Answered step by step

Verified Expert Solution

Question

1 Approved Answer

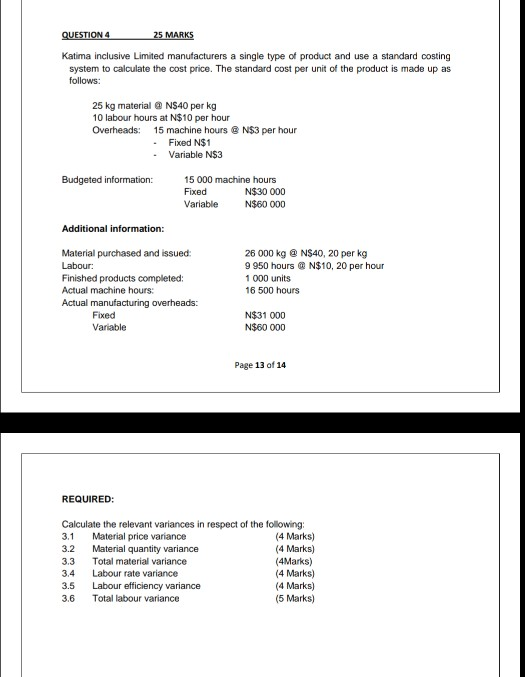

QUESTION 4 25 MARKS Katima inclusive Limited manufacturers a single type of product and use a standard costing system to calculate the cost price. The

QUESTION 4 25 MARKS Katima inclusive Limited manufacturers a single type of product and use a standard costing system to calculate the cost price. The standard cost per unit of the product is made up as follows: 25 kg material @N$40 per kg 10 labour hours at N$10 per hour Overheads: 15 machine hours @ N$3 per hour Fixed N$1 Variable N$3 Budgeted information: 15 000 machine hours Fixed N$30 000 Variable N$60 000 Additional information: Material purchased and issued: Labour: Finished products completed: Actual machine hours: Actual manufacturing overheads: Fixed Variable 26 000 kg @ N$40, 20 per kg 9 950 hours @ N$10, 20 per hour 1 000 units 16 500 hours N$31 000 N$60 000 Page 13 of 14 REQUIRED: Calculate the relevant variances in respect of the following: 3.1 Material price variance (4 Marks) 3.2 Material quantity variance (4 Marks) 3.3 Total material variance (4Marks) Labour rate variance (4 Marks) 3.5 Labour efficiency variance (4 Marks) 3.6 Total labour variance (5 Marks) 3.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started