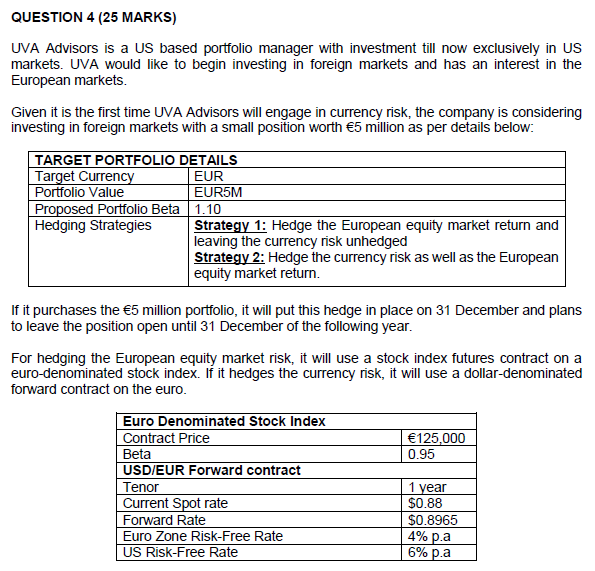

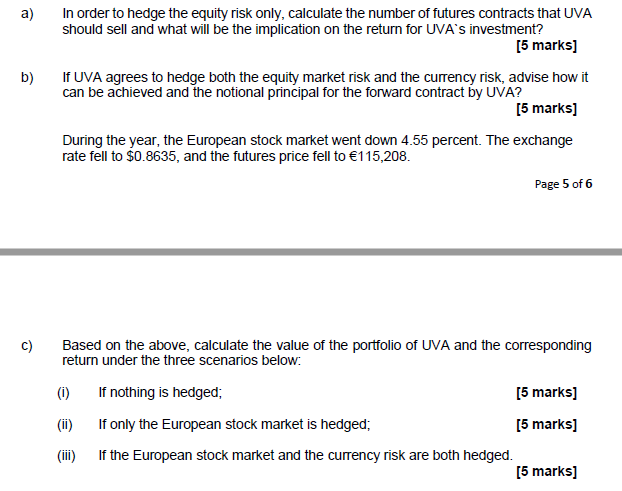

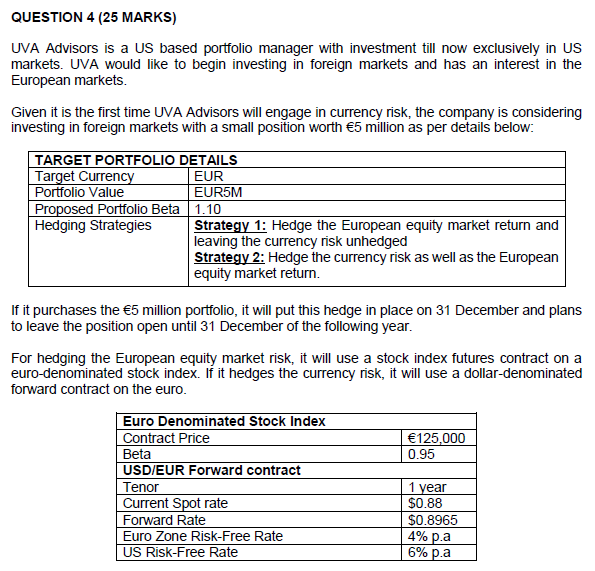

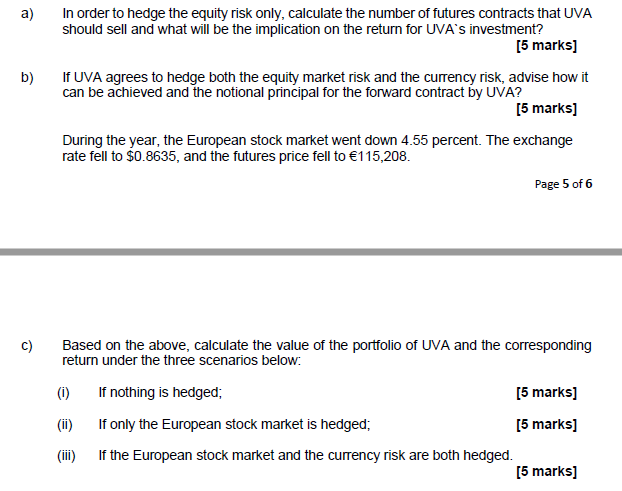

QUESTION 4 (25 MARKS) UVA Advisors is a US based portfolio manager with investment till now exclusively in US markets. UVA would like to begin investing in foreign markets and has an interest in the European markets. Given it is the first time UVA Advisors will engage in currency risk, the company is considering investing in foreign markets with a small position worth 5 million as per details below: TARGET PORTFOLIO DETAILS Target Currency EUR Portfolio Value EUR5M Proposed Portfolio Beta 1.10 Hedging Strategies Strategy 1: Hedge the European equity market return and leaving the currency risk unhedged Strategy 2: Hedge the currency risk as well as the European equity market return. If it purchases the 5 million portfolio, it will put this hedge in place on 31 December and plans to leave the position open until 31 December of the following year. For hedging the European equity market risk, it will use a stock index futures contract on a euro-denominated stock index. If it hedges the currency risk, it will use a dollar-denominated forward contract on the euro. Euro Denominated Stock Index Contract Price 125,000 Beta 0.95 USD/EUR Forward contract Tenor 1 year Current Spot rate $0.88 Forward Rate $0.8965 Euro Zone Risk-Free Rate US Risk-Free Rate 4% p.a 6% p.a a) b) In order to hedge the equity risk only, calculate the number of futures contracts that UVA should sell and what will be the implication on the return for UVA's investment? [5 marks] If UVA agrees to hedge both the equity market risk and the currency risk, advise how it can be achieved and the notional principal for the forward contract by UVA? [5 marks] During the year, the European stock market went down 4.55 percent. The exchange rate fell to $0.8635, and the futures price fell to 115,208. Page 5 of 6 c) Based on the above, calculate the value of the portfolio of UVA and the corresponding return under the three scenarios below: (1) If nothing is hedged; [5 marks] (ii) If only the European stock market is hedged; [5 marks] If the European stock market and the currency risk are both hedged. [5 marks] (iii) QUESTION 4 (25 MARKS) UVA Advisors is a US based portfolio manager with investment till now exclusively in US markets. UVA would like to begin investing in foreign markets and has an interest in the European markets. Given it is the first time UVA Advisors will engage in currency risk, the company is considering investing in foreign markets with a small position worth 5 million as per details below: TARGET PORTFOLIO DETAILS Target Currency EUR Portfolio Value EUR5M Proposed Portfolio Beta 1.10 Hedging Strategies Strategy 1: Hedge the European equity market return and leaving the currency risk unhedged Strategy 2: Hedge the currency risk as well as the European equity market return. If it purchases the 5 million portfolio, it will put this hedge in place on 31 December and plans to leave the position open until 31 December of the following year. For hedging the European equity market risk, it will use a stock index futures contract on a euro-denominated stock index. If it hedges the currency risk, it will use a dollar-denominated forward contract on the euro. Euro Denominated Stock Index Contract Price 125,000 Beta 0.95 USD/EUR Forward contract Tenor 1 year Current Spot rate $0.88 Forward Rate $0.8965 Euro Zone Risk-Free Rate US Risk-Free Rate 4% p.a 6% p.a a) b) In order to hedge the equity risk only, calculate the number of futures contracts that UVA should sell and what will be the implication on the return for UVA's investment? [5 marks] If UVA agrees to hedge both the equity market risk and the currency risk, advise how it can be achieved and the notional principal for the forward contract by UVA? [5 marks] During the year, the European stock market went down 4.55 percent. The exchange rate fell to $0.8635, and the futures price fell to 115,208. Page 5 of 6 c) Based on the above, calculate the value of the portfolio of UVA and the corresponding return under the three scenarios below: (1) If nothing is hedged; [5 marks] (ii) If only the European stock market is hedged; [5 marks] If the European stock market and the currency risk are both hedged. [5 marks] (iii)