Answered step by step

Verified Expert Solution

Question

1 Approved Answer

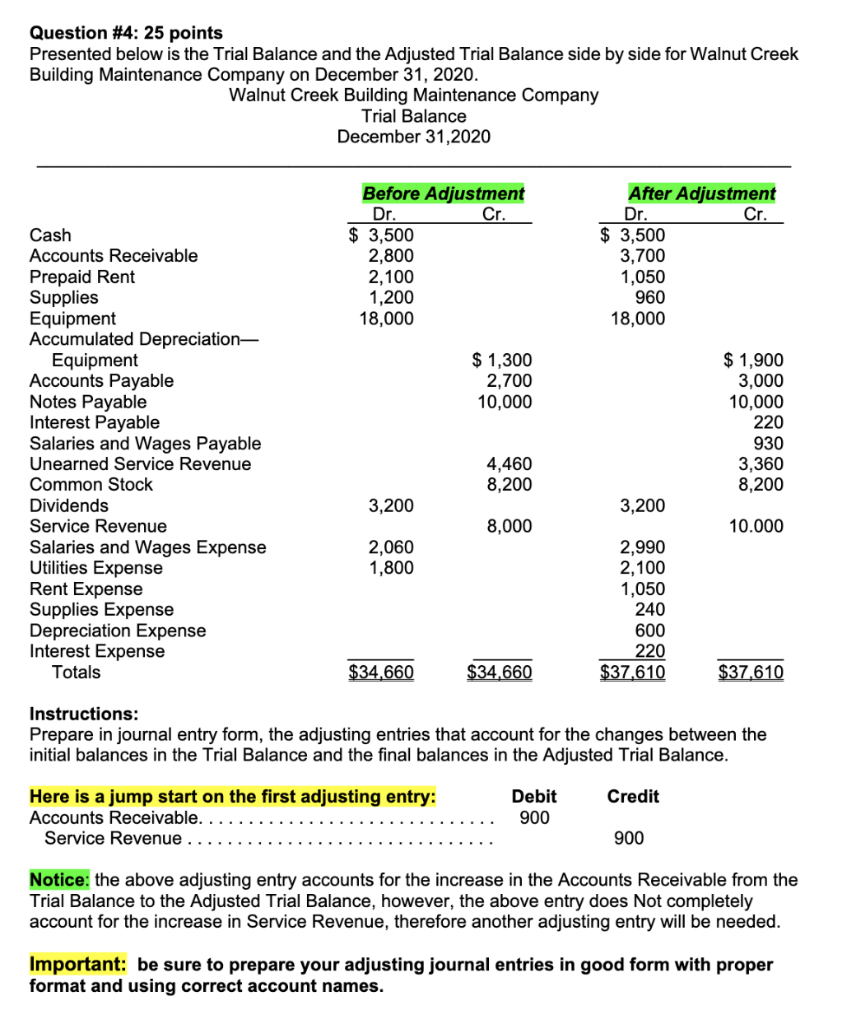

Question #4: 25 points Presented below is the Trial Balance and the Adjusted Trial Balance side by side for Walnut Creek Building Maintenance Company

Question #4: 25 points Presented below is the Trial Balance and the Adjusted Trial Balance side by side for Walnut Creek Building Maintenance Company on December 31, 2020. Walnut Creek Building Maintenance Company Trial Balance December 31,2020 Before Adjustment Dr. Cr. Cash $ 3,500 After Adjustment Dr. $ 3,500 Cr. Accounts Receivable 2,800 3,700 Prepaid Rent 2,100 1,050 Supplies 1,200 960 Equipment 18,000 18,000 Accumulated Depreciation- Equipment Accounts Payable $ 1,300 $1,900 2,700 3,000 Notes Payable 10,000 10,000 Interest Payable 220 Salaries and Wages Payable 930 Unearned Service Revenue 4,460 3,360 Common Stock 8,200 8,200 Dividends 3,200 3,200 Service Revenue 8,000 10.000 Salaries and Wages Expense 2,060 2,990 Utilities Expense 1,800 2,100 Rent Expense 1,050 Supplies Expense 240 Depreciation Expense 600 Interest Expense 220 Totals $34,660 $34,660 $37,610 $37,610 Instructions: Prepare in journal entry form, the adjusting entries that account for the changes between the initial balances in the Trial Balance and the final balances in the Adjusted Trial Balance. Here is a jump start on the first adjusting entry: Accounts Receivable. Service Revenue. Debit 900 Credit 900 Notice: the above adjusting entry accounts for the increase in the Accounts Receivable from the Trial Balance to the Adjusted Trial Balance, however, the above entry does Not completely account for the increase in Service Revenue, therefore another adjusting entry will be needed. Important: be sure to prepare your adjusting journal entries in good form with proper format and using correct account names.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started