Answered step by step

Verified Expert Solution

Question

1 Approved Answer

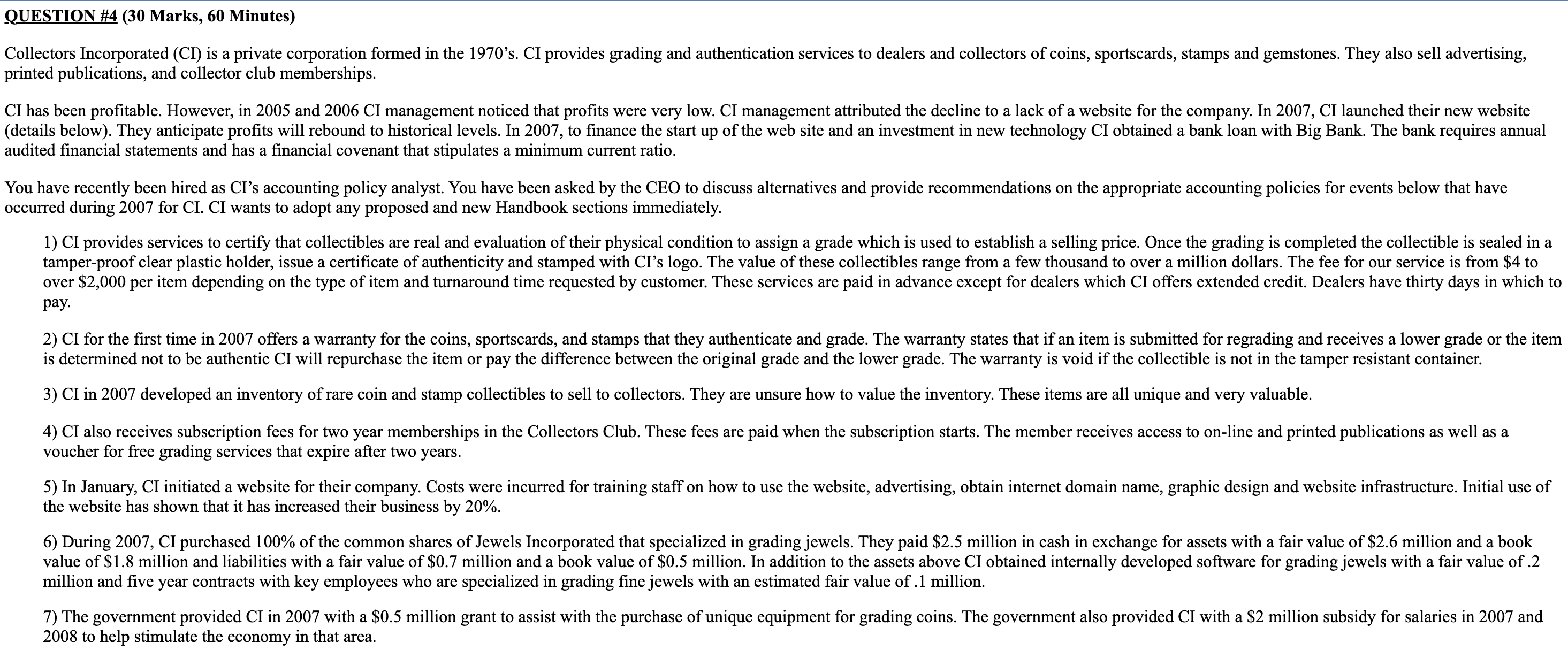

QUESTION # 4 ( 3 0 Marks, 6 0 Minutes ) Collectors Incorporated ( CI ) is a private corporation formed in the 1 9

QUESTION # Marks, Minutes

Collectors Incorporated CI is a private corporation formed in the s CI provides grading and authentication services to dealers and collectors of coins, sportscards, stamps and gemstones. They also sell advertising,

printed publications, and collector club memberships.

CI has been profitable. However, in and CI management noticed that profits were very low. CI management attributed the decline to a lack of a website for the company. In CI launched their new website

details below They anticipate profits will rebound to historical levels. In to finance the start up of the web site and an investment in new technology CI obtained a bank loan with Big Bank. The bank requires annual

audited financial statements and has a financial covenant that stipulates a minimum current ratio.

You have recently been hired as CI's accounting policy analyst. You have been asked by the CEO to discuss alternatives and provide recommendations on the appropriate accounting policies for events below that have

occurred during for CI CI wants to adopt any proposed and new Handbook sections immediately.

CI provides services to certify that collectibles are real and evaluation of their physical condition to assign a grade which is used to establish a selling price. Once the grading is completed the collectible is sealed in a

tamperproof clear plastic holder, issue a certificate of authenticity and stamped with Cls logo The value of these collectibles range from a few thousand to over a million dollars. The fee for our service is from $ to

over $ per item depending on the type of item and turnaround time requested by customer. These services are paid in advance except for dealers which CI offers extended credit. Dealers have thirty days in which to

pay.

CI for the first time in offers a warranty for the coins, sportscards, and stamps that they authenticate and grade. The warranty states that if an item is submitted for regrading and receives a lower grade or the item

is determined not to be authentic CI will repurchase the item or pay the difference between the original grade and the lower grade. The warranty is void if the collectible is not in the tamper resistant container.

CI in developed an inventory of rare coin and stamp collectibles to sell to collectors. They are unsure how to value the inventory. These items are all unique and very valuable.

CI also receives subscription fees for two year memberships in the Collectors Club. These fees are paid when the subscription starts. The member receives access to online and printed publications as well as a

voucher for free grading services that expire after two years.

In January, CI initiated a website for their company. Costs were incurred for training staff on how to use the website, advertising, obtain internet domain name, graphic design and website infrastructure. Initial use of

the website has shown that it has increased their business by

During CI purchased of the common shares of Jewels Incorporated that specialized in grading jewels. They paid $ million in cash in exchange for assets with a fair value of $ million and a book

value of $ million and liabilities with a fair value of $ million and a book value of $ million. In addition to the assets above CI obtained internally developed software for grading jewels with a fair value of

million and five year contracts with key employees who are specialized in grading fine jewels with an estimated fair value of million.

The government provided CI in with a $ million grant to assist with the purchase of unique equipment for grading coins. The government also provided CI with a $ million subsidy for salaries in and

to help stimulate the economy in that area.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started