Answered step by step

Verified Expert Solution

Question

1 Approved Answer

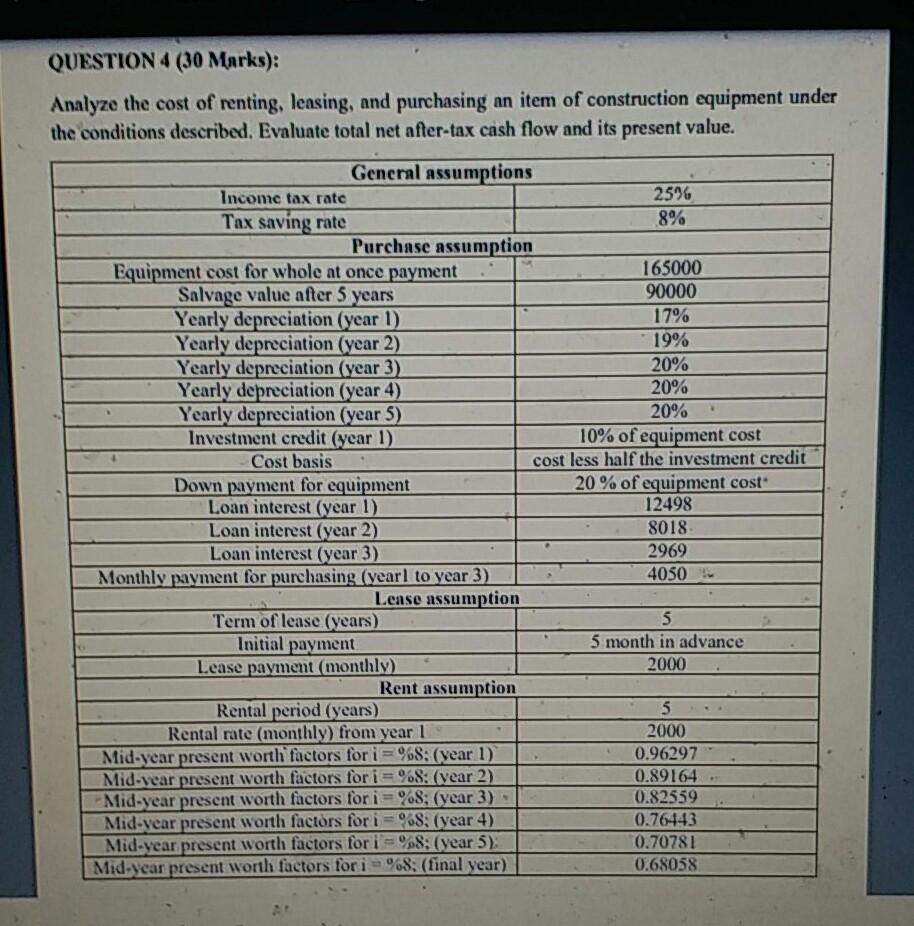

QUESTION 4 (30 Marks): Analyze the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate total net after-tax

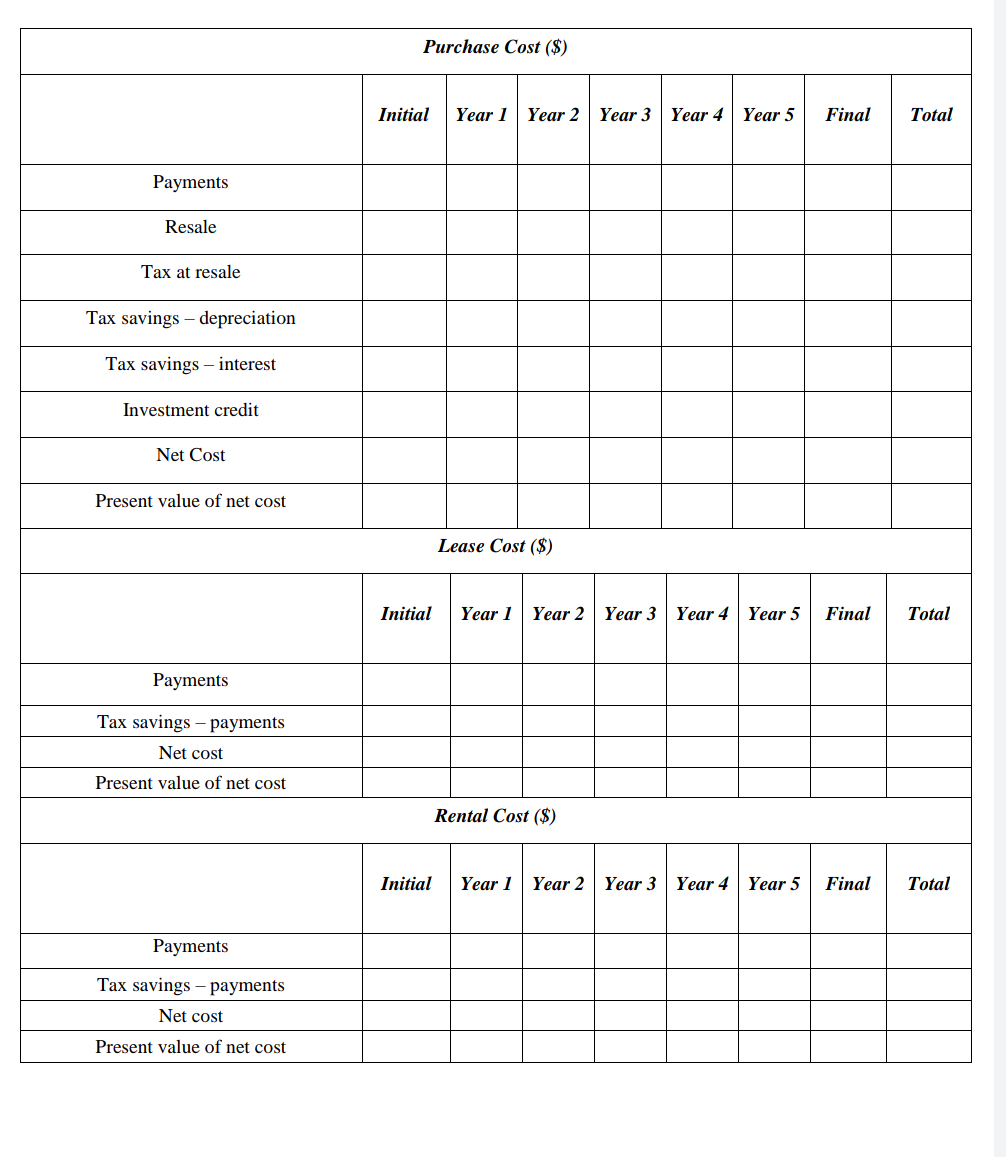

QUESTION 4 (30 Marks): Analyze the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate total net after-tax cash flow and its present value. Gencral assumptions Income tax rate 2576 Tax saving rate 8% Purchase assumption Equipment cost for whole at once payment 165000 Salvage value after 5 years 90000 Yearly depreciation (year 1) 17% Yearly depreciation (year 2) 19% Yearly depreciation (year 3) 20% Yearly depreciation (year 4) 20% Yearly depreciation (year 5) 20% Investment (year 1) 10% of equipment cost Cost basis cost less half the investment credit Down payment for equipment 20 % of equipment cost Loan interest (year 1) 12498 Loan interest (year 2) 8018 Loan interest (year 3) 2969 Monthly payment for purchasing (vearl to year 3) 4050 Lease assumption Term of lease (years) 5 Initial payment 5 month in advance Lease payment (monthly) 2000 Rent assumption Rental period (years) 5 Rental rate (monthly) from year 1 2000 Mid-year present worth factors for i=%8: (vear 1) 0.96297 Mid-vear present worth factors for it%8: (vear 2) 0.89164 Mid-year present worth factors for i=%8: (year 3) 0.82559 Mid vear present worth factors for i = %8: (year 4) 0.76443 Mid-year present worth factors for i=%8: (year 5) 0.70781 Mid-year present worth factors for i =%8: (final year) 0.68058 Purchase Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Resale Tax at resale Tax savings - depreciation Tax savings interest Investment credit Net Cost Present value of net cost Lease Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Tax savings - payments Net cost Present value of net cost Rental Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Tax savings - payments Net cost Present value of net cost QUESTION 4 (30 Marks): Analyze the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate total net after-tax cash flow and its present value. Gencral assumptions Income tax rate 2576 Tax saving rate 8% Purchase assumption Equipment cost for whole at once payment 165000 Salvage value after 5 years 90000 Yearly depreciation (year 1) 17% Yearly depreciation (year 2) 19% Yearly depreciation (year 3) 20% Yearly depreciation (year 4) 20% Yearly depreciation (year 5) 20% Investment (year 1) 10% of equipment cost Cost basis cost less half the investment credit Down payment for equipment 20 % of equipment cost Loan interest (year 1) 12498 Loan interest (year 2) 8018 Loan interest (year 3) 2969 Monthly payment for purchasing (vearl to year 3) 4050 Lease assumption Term of lease (years) 5 Initial payment 5 month in advance Lease payment (monthly) 2000 Rent assumption Rental period (years) 5 Rental rate (monthly) from year 1 2000 Mid-year present worth factors for i=%8: (vear 1) 0.96297 Mid-vear present worth factors for it%8: (vear 2) 0.89164 Mid-year present worth factors for i=%8: (year 3) 0.82559 Mid vear present worth factors for i = %8: (year 4) 0.76443 Mid-year present worth factors for i=%8: (year 5) 0.70781 Mid-year present worth factors for i =%8: (final year) 0.68058 Purchase Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Resale Tax at resale Tax savings - depreciation Tax savings interest Investment credit Net Cost Present value of net cost Lease Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Tax savings - payments Net cost Present value of net cost Rental Cost ($) Initial Year 1 Year 2 Year 3 Year 4 Year 5 Final Total Payments Tax savings - payments Net cost Present value of net cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started