Answered step by step

Verified Expert Solution

Question

1 Approved Answer

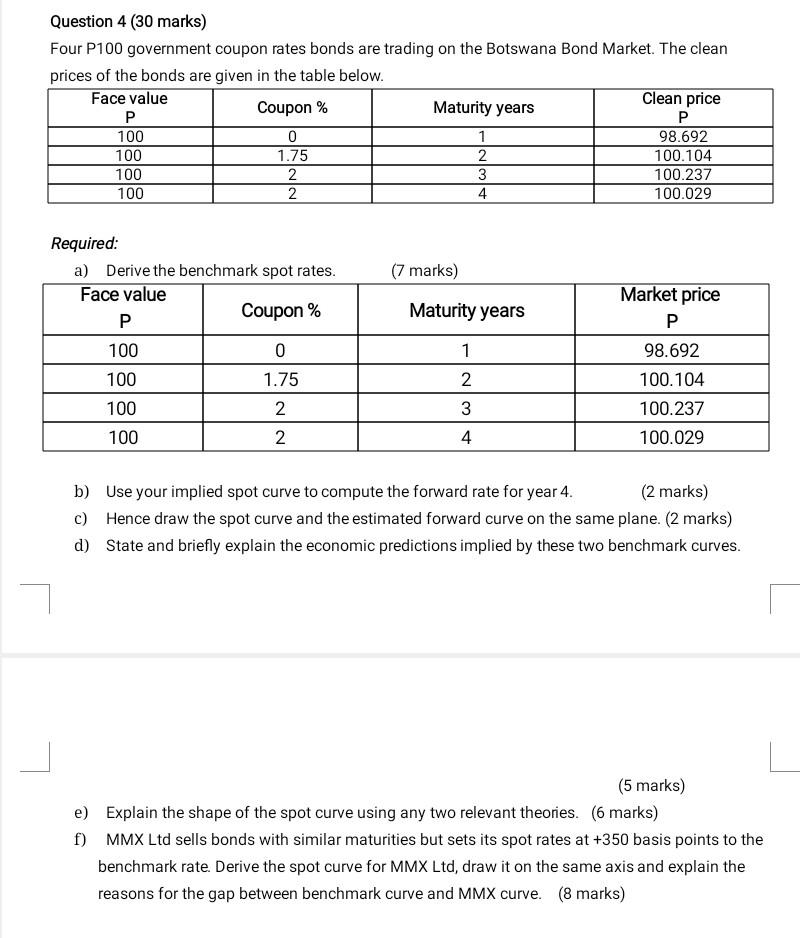

Question 4 (30 marks) Four P100 government coupon rates bonds are trading on the Botswana Bond Market. The clean prices of the bonds are given

Question 4 (30 marks) Four P100 government coupon rates bonds are trading on the Botswana Bond Market. The clean prices of the bonds are given in the table below. Required: a) Narivethe hannhmark ennt ratoe 17marle) b) Use your implied spot curve to compute the forward rate for year 4 . (2 marks) c) Hence draw the spot curve and the estimated forward curve on the same plane. (2 marks) d) State and briefly explain the economic predictions implied by these two benchmark curves. (5 marks) e) Explain the shape of the spot curve using any two relevant theories. (6 marks) f) MMX Ltd sells bonds with similar maturities but sets its spot rates at +350 basis points to the benchmark rate. Derive the spot curve for MMX Ltd, draw it on the same axis and explain the reasons for the gap between benchmark curve and MMX curve. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started