Answered step by step

Verified Expert Solution

Question

1 Approved Answer

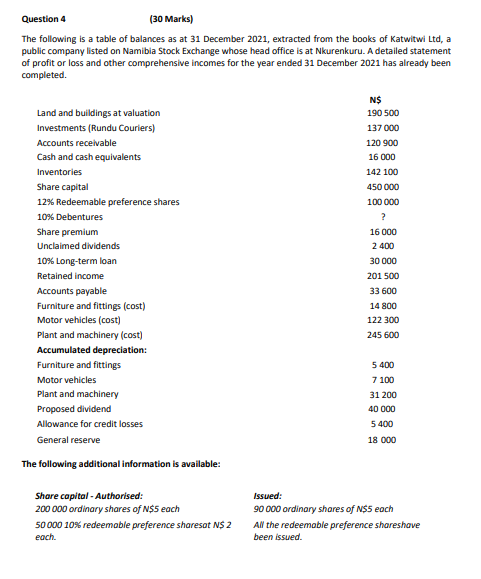

Question 4 (30 Marks) The following is a table of balances as at 31 December 2021, extracted from the books of Katwitwi Ltd, a public

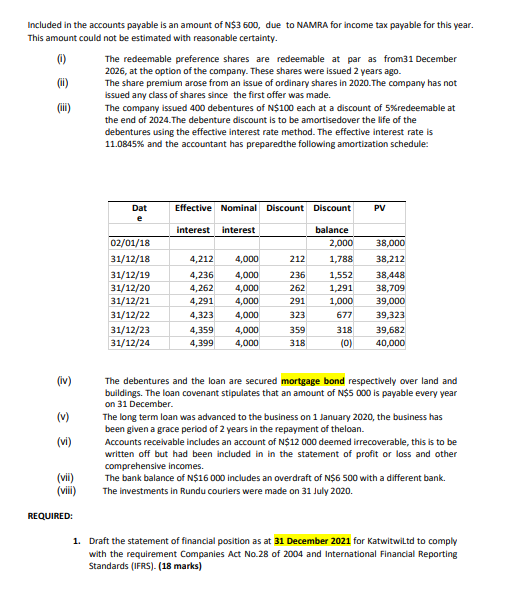

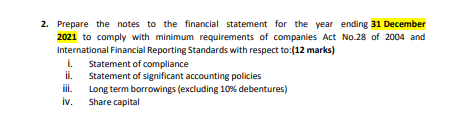

Question 4 (30 Marks) The following is a table of balances as at 31 December 2021, extracted from the books of Katwitwi Ltd, a public company listed on Namibia Stock Exchange whose head office is at Nkurenkuru. A detailed statement of profit or loss and other comprehensive incomes for the year ended 31 December 2021 has already been completed. Included in the accounts payable is an amount of N\$3 600, due to NAMRA for income tax payable for this year. This amount could not be estimated with reasonable certainty. (i) The redeemable preference shares are redeemable at par as from31 December 2026 , at the option of the company. These shares were issued 2 years ago. (ii) The share premium arose from an issue of ordinary shares in 2020.The company has not issued any class of shares since the first offer was made. (iii) The company issued 400 debentures of N$100 each at a discount of 5% redeemable at the end of 2024.The debenture discount is to be amortisedover the life of the debentures using the effective interest rate method. The effective interest rate is 11.0845% and the accountant has preparedthe following amortization schedule: (iv) The debentures and the loan are secured mortgage bond respectively over land and buildings. The loan covenant stipulates that an amount of N$5000 is payable every year on 31 December. (v) The long term loan was advanced to the business on 1 January 2020, the business has been given a grace period of 2 years in the repayment of theloan. (vi) Accounts receivable includes an account of N$12000 deemed irrecoverable, this is to be written off but had been included in in the statement of profit or loss and other comprehensive incomes. (vii) The bank balance of N$16000 includes an overdraft of N$6500 with a different bank. (viii) The investments in Rundu couriers were made on 31 July 2020. REQUIRED: 1. Draft the statement of financial position as at 31 December 2021 for Katwitwiltd to comply with the requirement Companies Act No.28 of 2004 and International Financial Reporting Standards (IFRS). (18 marks) 2. Prepare the notes to the financial statement for the year ending 31 December 2021 to comply with minimum requirements of companies Act No.28 of 2004 and International Financial Reporting Standards with respect to:(12 marks) i. Statement of compliance ii. Statement of significant accounting policies iii. Long term borrowings (excluding 10% debentures) iv. Share capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started