Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (30 p) Zoya&Maggie Investment has been given the task to present a recommendation whether a firm should lease or own additional space they

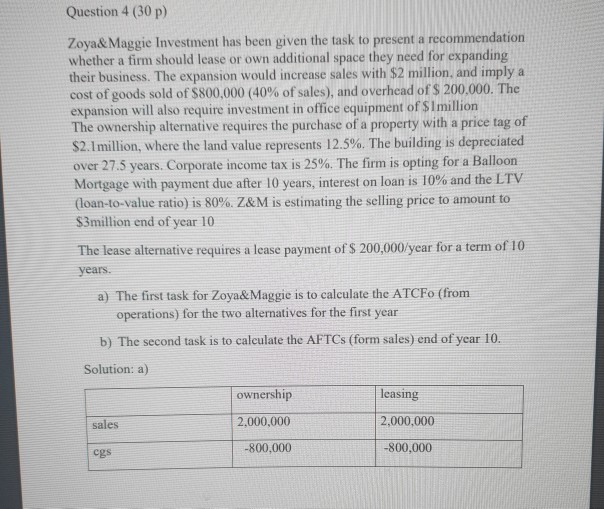

Question 4 (30 p) Zoya&Maggie Investment has been given the task to present a recommendation whether a firm should lease or own additional space they need for expanding their business. The expansion would increase sales with $2 million, and imply a cost of goods sold of $800,000 (40% of sales), and overhead of $ 200,000. The expansion will also require investment in office equipment of $1million The ownership alternative requires the purchase of a property with a price tag of $2.1million, where the land value represents 12.5%. The building is depreciated over 27.5 years. Corporate income tax is 25%. The firm is opting for a Balloon Mortgage with payment due after 10 years, interest on loan is 10% and the LTV (loan-to-value ratio) is 80%. Z&M is estimating the selling price to amount to $3million end of year 10 The lease alternative requires a lease payment of $ 200,000/year for a term of 10 years. a) The first task for Zoya&Maggie is to calculate the ATCF0 (from operations) for the two alternatives for the first year b) The second task is to calculate the AFTCS (form sales) end of year 10. Solution: a) leasing ownership 2,000,000 2,000,000 sales -800,000 -800,000 egs Question 4 (30 p) Zoya&Maggie Investment has been given the task to present a recommendation whether a firm should lease or own additional space they need for expanding their business. The expansion would increase sales with $2 million, and imply a cost of goods sold of $800,000 (40% of sales), and overhead of $ 200,000. The expansion will also require investment in office equipment of $1million The ownership alternative requires the purchase of a property with a price tag of $2.1million, where the land value represents 12.5%. The building is depreciated over 27.5 years. Corporate income tax is 25%. The firm is opting for a Balloon Mortgage with payment due after 10 years, interest on loan is 10% and the LTV (loan-to-value ratio) is 80%. Z&M is estimating the selling price to amount to $3million end of year 10 The lease alternative requires a lease payment of $ 200,000/year for a term of 10 years. a) The first task for Zoya&Maggie is to calculate the ATCF0 (from operations) for the two alternatives for the first year b) The second task is to calculate the AFTCS (form sales) end of year 10. Solution: a) leasing ownership 2,000,000 2,000,000 sales -800,000 -800,000 egs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started