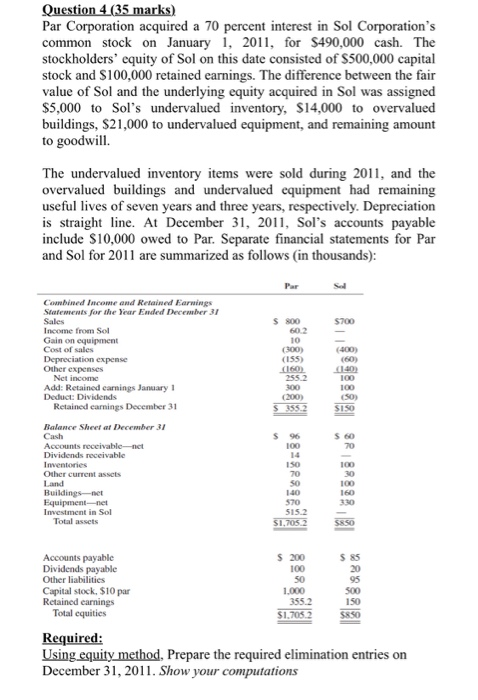

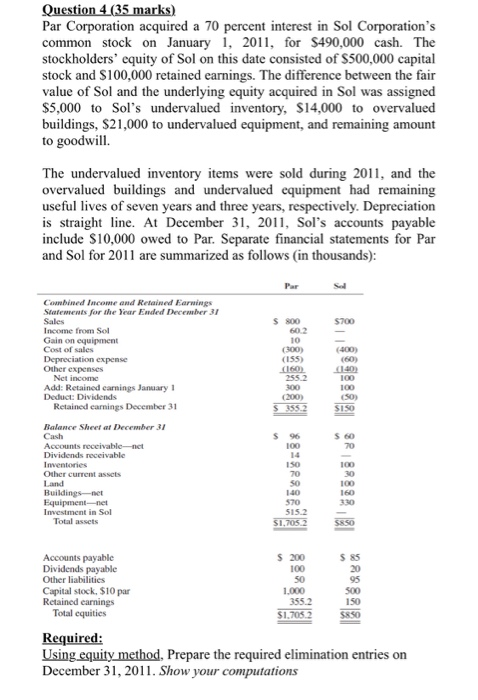

Question 4 (35 marks) Par Corporation acquired a 70 percent interest in Sol Corporation's common stock on January 1, 2011, for $490,000 cash. The stockholders' equity of Sol on this date consisted of $500,000 capital stock and $100,000 retained earnings. The difference between the fair value of Sol and the underlying equity acquired in Sol was assigned $5,000 to Sol's undervalued inventory, S14,000 to overvalued buildings, S21,000 to undervalued equipment, and remaining amount to goodwill. The undervalued inventory items were sold during 2011, and the overvalued buildings and undervalued equipment had remaining useful lives of seven years and three years, respectively. Depreciation is straight line. At December 31, 2011, Sol's accounts payable include $10,000 owed to Par. Separate financial statements for Par and Sol for 2011 are summarized as follows (in thousands): Combined lace and Retained Earnings Statements for the ear End December 31 S 800 602 $700 10 Income from Sol Gain on equipment Cost of sales Depreciation expense Other expenses Net income Add: Retained earnings January 1 Deduct: Dividends Retained earnings December 31 (200 (155) (160 (400) (60) (10) 100 SO SISO Balance Sheetal December 31 Cash Accounts receivable Dividends receivable Inventories Other current 160 Buildings at Equipment Investment in Sol Total assets S1705.2 Accounts payable Dividends payable Other liabilities Capital stock. SIO par Retained earnings Totalcquities $ 200 100 50 100 355.2 $1.705.2 150 Required: Using equity method, Prepare the required elimination entries on December 31, 2011. Show your computations

Question 4 (35 marks) Par Corporation acquired a 70 percent interest in Sol Corporation's common stock on January 1, 2011, for $490,000 cash. The stockholders' equity of Sol on this date consisted of $500,000 capital stock and $100,000 retained earnings. The difference between the fair value of Sol and the underlying equity acquired in Sol was assigned $5,000 to Sol's undervalued inventory, S14,000 to overvalued buildings, S21,000 to undervalued equipment, and remaining amount to goodwill. The undervalued inventory items were sold during 2011, and the overvalued buildings and undervalued equipment had remaining useful lives of seven years and three years, respectively. Depreciation is straight line. At December 31, 2011, Sol's accounts payable include $10,000 owed to Par. Separate financial statements for Par and Sol for 2011 are summarized as follows (in thousands): Combined lace and Retained Earnings Statements for the ear End December 31 S 800 602 $700 10 Income from Sol Gain on equipment Cost of sales Depreciation expense Other expenses Net income Add: Retained earnings January 1 Deduct: Dividends Retained earnings December 31 (200 (155) (160 (400) (60) (10) 100 SO SISO Balance Sheetal December 31 Cash Accounts receivable Dividends receivable Inventories Other current 160 Buildings at Equipment Investment in Sol Total assets S1705.2 Accounts payable Dividends payable Other liabilities Capital stock. SIO par Retained earnings Totalcquities $ 200 100 50 100 355.2 $1.705.2 150 Required: Using equity method, Prepare the required elimination entries on December 31, 2011. Show your computations Question 4 (35 marks) Par Corporation acquired a 70 percent interest in Sol Corporation's common stock on January 1, 2011, for $490,000 cash. The stockholders' equity of Sol on this date consisted of $500,000 capital stock and $100,000 retained earnings. The difference between the fair value of Sol and the underlying equity acquired in Sol was assigned $5,000 to Sol's undervalued inventory, S14,000 to overvalued buildings, S21,000 to undervalued equipment, and remaining amount to goodwill. The undervalued inventory items were sold during 2011, and the overvalued buildings and undervalued equipment had remaining useful lives of seven years and three years, respectively. Depreciation is straight line. At December 31, 2011, Sol's accounts payable include $10,000 owed to Par. Separate financial statements for Par and Sol for 2011 are summarized as follows (in thousands): Combined lace and Retained Earnings Statements for the ear End December 31 S 800 602 $700 10 Income from Sol Gain on equipment Cost of sales Depreciation expense Other expenses Net income Add: Retained earnings January 1 Deduct: Dividends Retained earnings December 31 (200 (155) (160 (400) (60) (10) 100 SO SISO Balance Sheetal December 31 Cash Accounts receivable Dividends receivable Inventories Other current 160 Buildings at Equipment Investment in Sol Total assets S1705.2 Accounts payable Dividends payable Other liabilities Capital stock. SIO par Retained earnings Totalcquities $ 200 100 50 100 355.2 $1.705.2 150 Required: Using equity method, Prepare the required elimination entries on December 31, 2011. Show your computations