Answered step by step

Verified Expert Solution

Question

1 Approved Answer

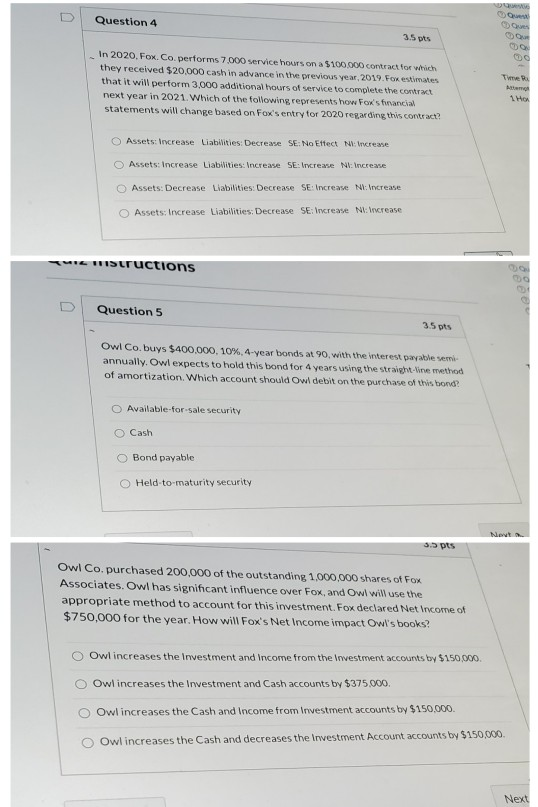

Question 4 35 pts In 2020, Fox. Co performs 7.000 service hours on a $100.000 contract for which they received $20,000 cash in advance in

Question 4 35 pts In 2020, Fox. Co performs 7.000 service hours on a $100.000 contract for which they received $20,000 cash in advance in the previous year, 2019. Fox estimates that it will perform 3,000 additional hours of service to complete the contract next year in 2021. Which of the following represents how Fox's fancial statements will change based on Fox's entry for 2020 regarding this contract? Am 1 Hon Assets: Increase Liabilities: Decrease SE: No Ettect Newcrease Assets: Increase Liabilities: Increase SE:Vrcrease Nr: Increase Assets: Decrease Llabilities: Decrease SE: Increase Nincrease O Assets: Increase Liabilities: Decrease SE:Inxrease N:Increase FRISuructions Question 5 35 pts Owl Co. buys $400.000, 10%, 4-year bonds at 90, with the interest payable semi annually. Owl expects to hold this bond for 4 years using the straight-line method of amortization. Which account should Owl debit on the purchase of this bond? O Available for sale security O Cash O Bond payable Held-to-maturity security Net 3.3 pts Owl Co. purchased 200,000 of the outstanding 1,000,000 shares of Fox Associates. Owl has significant influence over Fox, and Owl will use the appropriate method to account for this investment. Fox declared Net Income of $750,000 for the year. How will Fox's Net Income impact Owl's books? Owl increases the Investment and income from the Investment accounts by $150.00 Owl increases the Investment and Cash accounts by $375.000 Owl increases the Cash and Income from Investment accounts by $150,000 0 O Owl increases the Cash and decreases the Investment Account accounts by $150.000 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started