Answered step by step

Verified Expert Solution

Question

1 Approved Answer

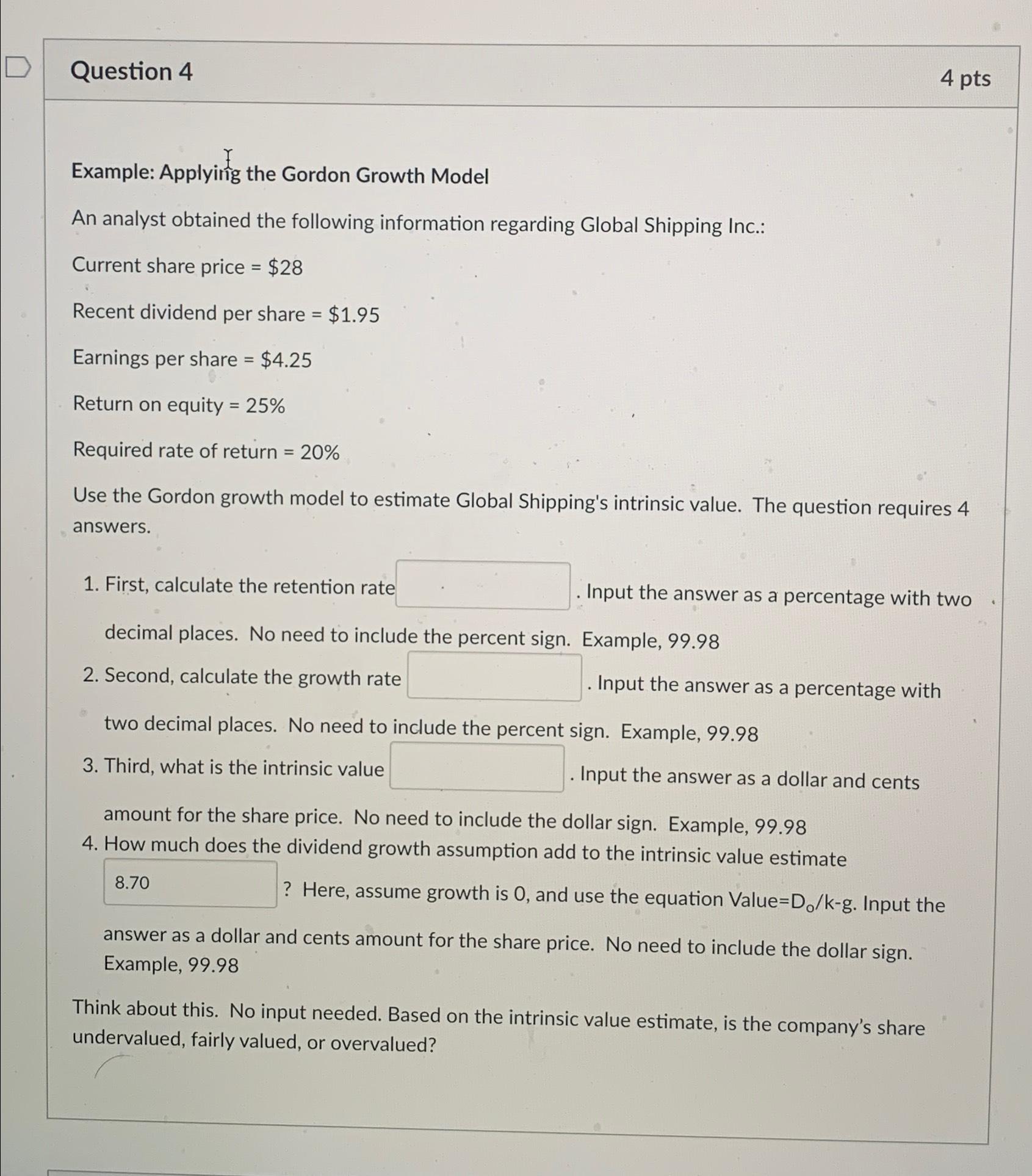

Question 4 4 pts Example: Applyinig the Gordon Growth Model An analyst obtained the following information regarding Global Shipping Inc.: Current share price = $

Question

pts

Example: Applyinig the Gordon Growth Model

An analyst obtained the following information regarding Global Shipping Inc.:

Current share price $

Recent dividend per share $

Earnings per share $

Return on equity

Required rate of return

Use the Gordon growth model to estimate Global Shipping's intrinsic value. The question requires answers.

First, calculate the retention rat Input the answer as a percentage with two decimal places. No need to include the percent sign. Example,

Second, calculate the growth rate Input the answer as a percentage with two decimal places. No need to include the percent sign. Example,

Third, what is the intrinsic value Input the answer as a dollar and cents amount for the share price. No need to include the dollar sign. Example,

How much does the dividend growth assumption add to the intrinsic value estimate

Here, assume growth is and use the equation Value Input the answer as a dollar and cents amount for the share price. No need to include the dollar sign. Example,

Think about this. No input needed. Based on the intrinsic value estimate, is the company's share undervalued, fairly valued, or overvalued?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started