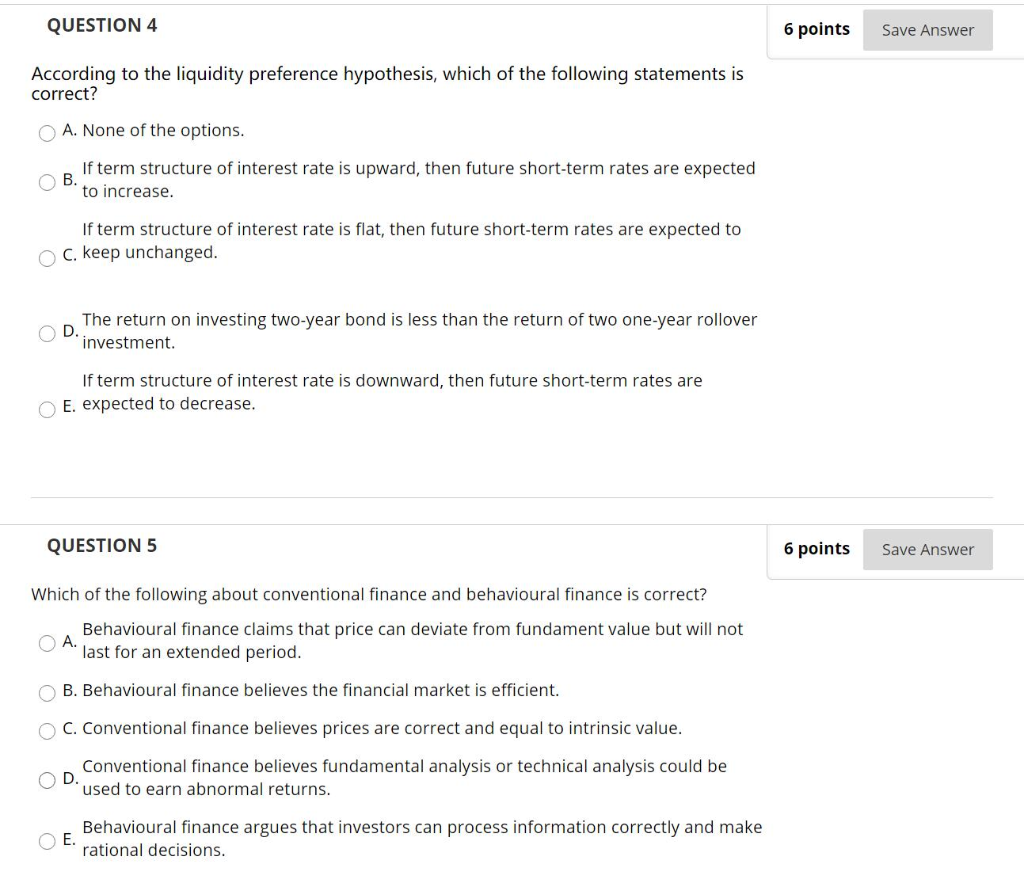

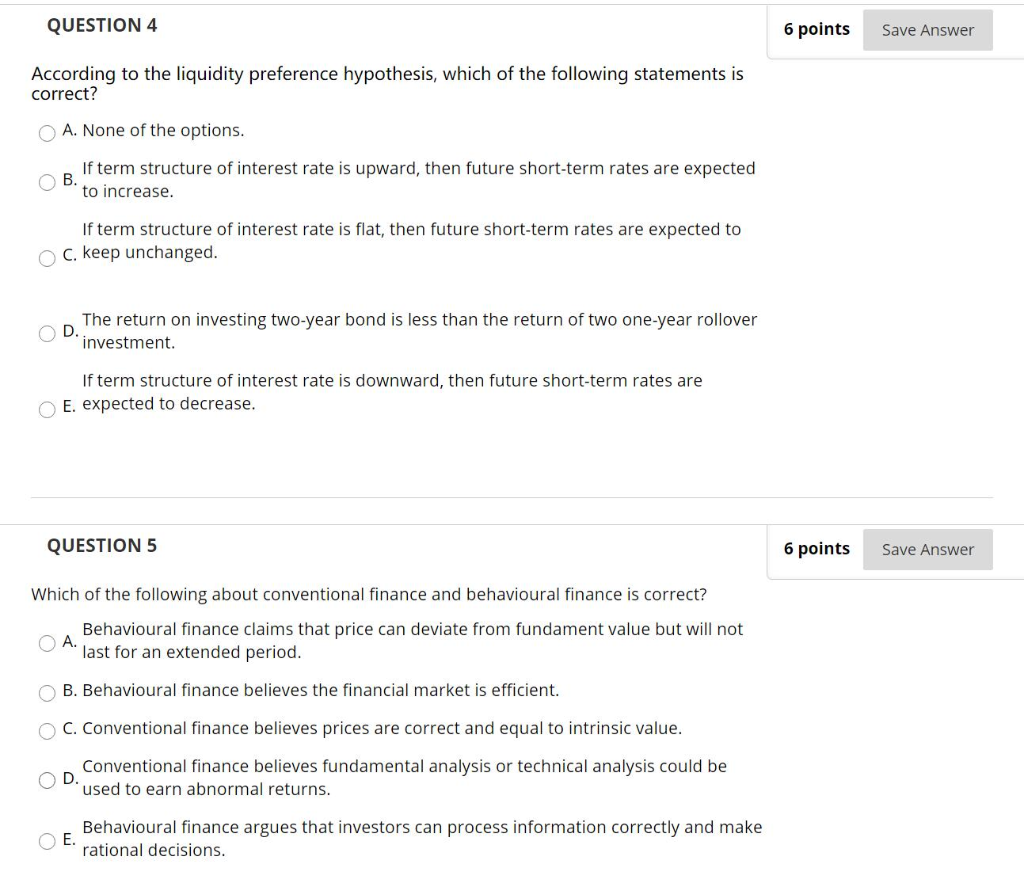

QUESTION 4 6 points Save Answer According to the liquidity preference hypothesis, which of the following statements is correct? A. None of the options. If term structure of interest rate is upward, then future short-term rates are expected OB. to increase. If term structure of interest rate is flat, then future short-term rates are expected to C. keep unchanged. D The return on investing two-year bond is less than the return of two one-year rollover investment. If term structure of interest rate is downward, then future short-term rates are E. expected to decrease. QUESTION 5 6 points Save Answer Which of the following about conventional finance and behavioural finance is correct? Behavioural finance claims that price can deviate from fundament value but will not A. last for an extended period. B. Behavioural finance believes the financial market is efficient. C. Conventional finance believes prices are correct and equal to intrinsic value. D Conventional finance believes fundamental analysis or technical analysis could be used to earn abnormal returns. E. Behavioural finance argues that investors can process information correctly and make rational decisions. QUESTION 4 6 points Save Answer According to the liquidity preference hypothesis, which of the following statements is correct? A. None of the options. If term structure of interest rate is upward, then future short-term rates are expected OB. to increase. If term structure of interest rate is flat, then future short-term rates are expected to C. keep unchanged. D The return on investing two-year bond is less than the return of two one-year rollover investment. If term structure of interest rate is downward, then future short-term rates are E. expected to decrease. QUESTION 5 6 points Save Answer Which of the following about conventional finance and behavioural finance is correct? Behavioural finance claims that price can deviate from fundament value but will not A. last for an extended period. B. Behavioural finance believes the financial market is efficient. C. Conventional finance believes prices are correct and equal to intrinsic value. D Conventional finance believes fundamental analysis or technical analysis could be used to earn abnormal returns. E. Behavioural finance argues that investors can process information correctly and make rational decisions