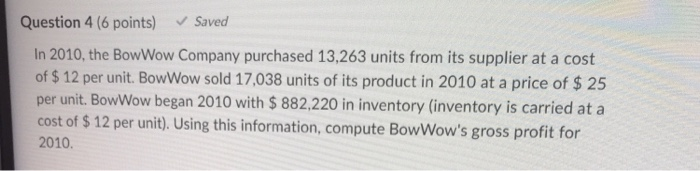

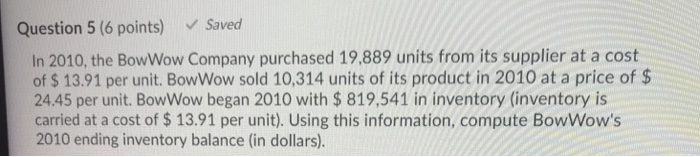

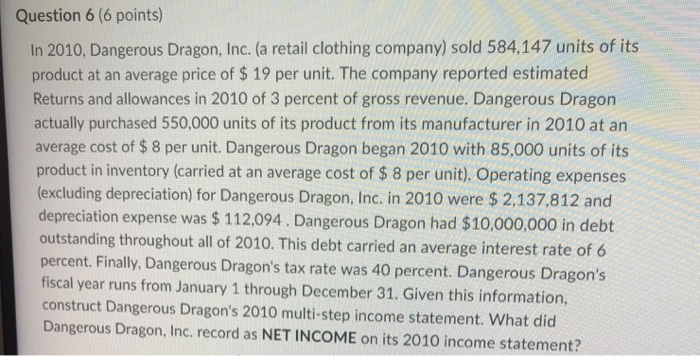

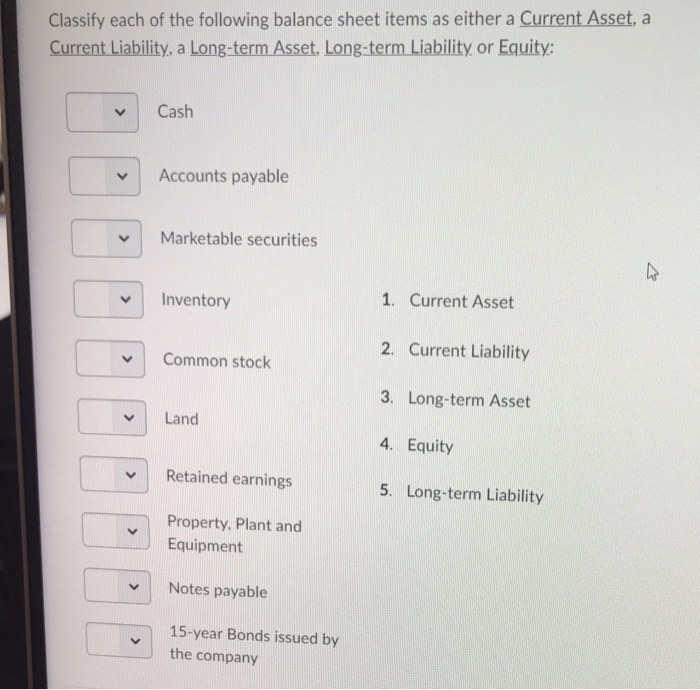

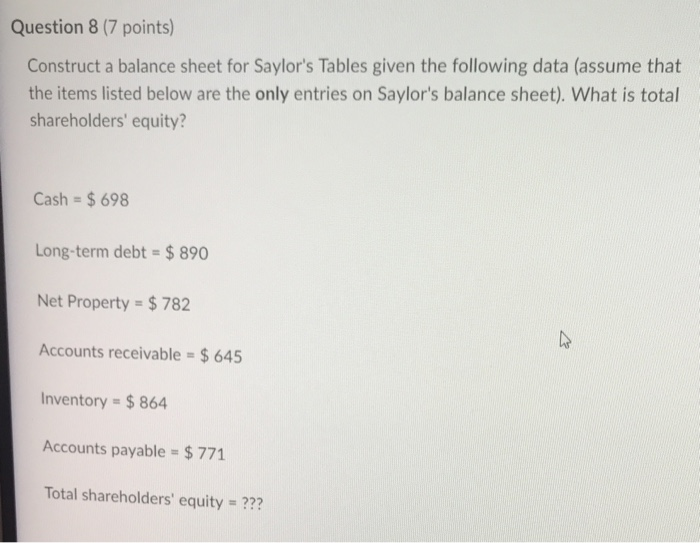

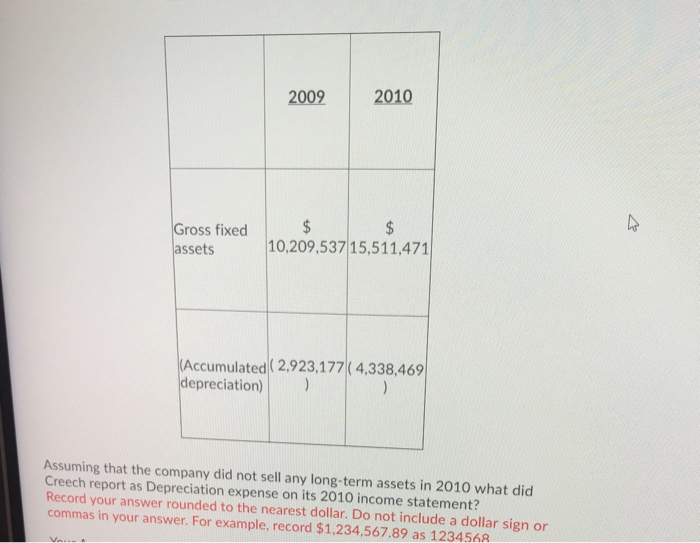

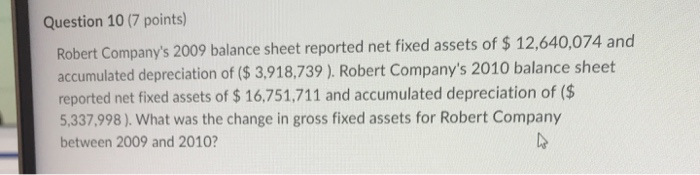

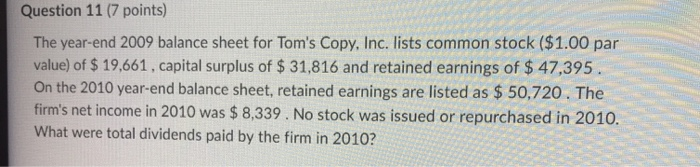

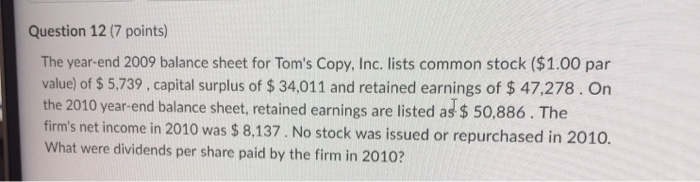

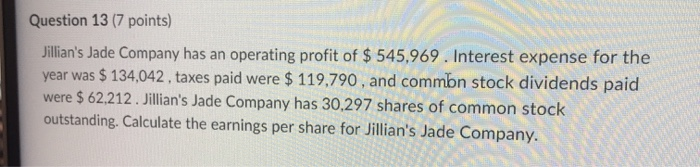

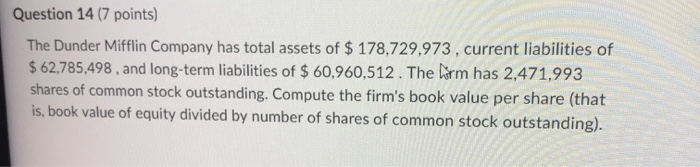

Question 4 (6 points) Saved In 2010, the Bow Wow Company purchased 13,263 units from its supplier at a cost of $ 12 per unit. BowWow sold 17,038 units of its product in 2010 at a price of $ 25 per unit. BowWow began 2010 with $ 882.220 in inventory (inventory is carried at a cost of $ 12 per unit). Using this information, compute Bow Wow's gross profit for 2010. Question 5 (6 points) Saved In 2010, the Bow Wow Company purchased 19,889 units from its supplier at a cost of $13.91 per unit. Bow Wow sold 10,314 units of its product in 2010 at a price of $ 24.45 per unit. Bow Wow began 2010 with $ 819,541 in inventory (inventory is carried at a cost of $ 13.91 per unit). Using this information, compute Bow Wow's 2010 ending inventory balance (in dollars). Question 6 (6 points) In 2010, Dangerous Dragon, Inc. (a retail clothing company) sold 584,147 units of its product at an average price of $ 19 per unit. The company reported estimated Returns and allowances in 2010 of 3 percent of gross revenue. Dangerous Dragon actually purchased 550,000 units of its product from its manufacturer in 2010 at an average cost of $ 8 per unit. Dangerous Dragon began 2010 with 85,000 units of its product in inventory (carried at an average cost of $ 8 per unit). Operating expenses (excluding depreciation) for Dangerous Dragon, Inc. in 2010 were $ 2,137,812 and depreciation expense was $ 112,094. Dangerous Dragon had $10,000,000 in debt outstanding throughout all of 2010. This debt carried an average interest rate of 6 percent. Finally, Dangerous Dragon's tax rate was 40 percent. Dangerous Dragon's fiscal year runs from January 1 through December 31. Given this information, construct Dangerous Dragon's 2010 multi-step income statement. What did Dangerous Dragon, Inc. record as NET INCOME on its 2010 income statement? Classify each of the following balance sheet items as either a Current Asset, a Current Liability, a Long-term Asset. Long-term Liability or Equity: Cash Accounts payable Marketable securities Inventory 1. Current Asset 2. Current Liability Common stock 3. Long-term Asset Land 4. Equity Retained earnings 5. Long-term Liability Property, Plant and Equipment Notes payable 15-year Bonds issued by the company Question 8 (7 points) Construct a balance sheet for Saylor's Tables given the following data (assume that the items listed below are the only entries on Saylor's balance sheet). What is total shareholders' equity? Cash = $ 698 Long-term debt = $ 890 Net Property = $ 782 Accounts receivable - $ 645 Inventory = $ 864 Accounts payable = $ 771 Total shareholders' equity = ??? 2009 2010 Gross fixed assets $ 10,209,537 15,511,471 (Accumulated ( 2,923,177 ( 4,338,469 depreciation) ) Assuming that the company did not sell any long-term assets in 2010 what did Creech report as Depreciation expense on its 2010 income statement? Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568 Question 10 (7 points) Robert Company's 2009 balance sheet reported net fixed assets of $ 12,640,074 and accumulated depreciation of ($ 3,918,739 ). Robert Company's 2010 balance sheet reported net fixed assets of $ 16,751,711 and accumulated depreciation of ($ 5,337,998). What was the change in gross fixed assets for Robert Company between 2009 and 2010? Question 11 (7 points) The year-end 2009 balance sheet for Tom's Copy, Inc. lists common stock ($1.00 par value) of $ 19,661, capital surplus of $ 31,816 and retained earnings of $ 47,395. On the 2010 year-end balance sheet, retained earnings are listed as $ 50,720. The firm's net income in 2010 was $ 8,339. No stock was issued or repurchased in 2010. What were total dividends paid by the firm in 2010? Question 12 (7 points) The year-end 2009 balance sheet for Tom's Copy, Inc. lists common stock ($1.00 par value) of $ 5,739, capital surplus of $ 34,011 and retained earnings of $ 47,278. On the 2010 year-end balance sheet, retained earnings are listed as $ 50,886. The firm's net income in 2010 was $ 8,137. No stock was issued or repurchased in 2010. What were dividends per share paid by the firm in 2010? Question 13(7 points) Jillian's Jade Company has an operating profit of $ 545,969. Interest expense for the year was $ 134,042, taxes paid were $ 119,790, and common stock dividends paid were $ 62,212. Jillian's Jade Company has 30,297 shares of common stock outstanding. Calculate the earnings per share for Jillian's Jade Company. Question 14 (7 points) The Dunder Mifflin Company has total assets of $ 178,729,973, current liabilities of $ 62,785,498, and long-term liabilities of $ 60,960,512. The Crm has 2,471,993 shares of common stock outstanding. Compute the firm's book value per share (that is, book value of equity divided by number of shares of common stock outstanding)