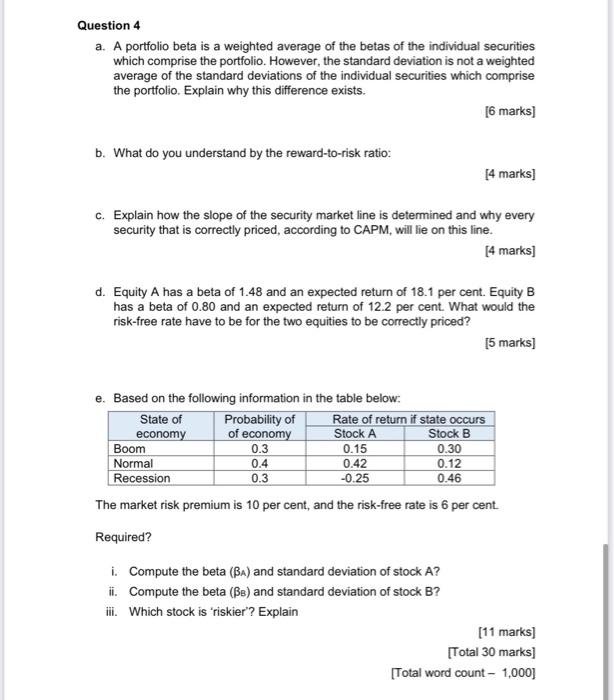

Question 4 a. A portfolio beta is a weighted average of the betas of the individual securities which comprise the portfolio. However, the standard deviation is not a weighted average of the standard deviations of the individual securities which comprise the portfolio. Explain why this difference exists. [6 marks] b. What do you understand by the reward-to-risk ratio: [4 marks) c. Explain how the slope of the security market line is determined and why every security that is correctly priced, according to CAPM, will lie on this line. [4 marks] d. Equity A has a beta of 1.48 and an expected return of 18.1 per cent. Equity B has a beta of 0.80 and an expected return of 12.2 per cent. What would the risk-free rate have to be for the two equities to be correctly priced? [5 marks] e. Based on the following information in the table below: State of Probability of Rate of return if state occurs economy of economy Stock A Stock B Boom 0.3 0.15 0.30 Normal 0.4 0.42 0.12 Recession 0.3 -0.25 0.46 The market risk premium is 10 per cent, and the risk-free rate is 6 per cent Required? i. Compute the beta (BA) and standard deviation of stock A? ii. Compute the beta (Be) and standard deviation of stock B? ii. Which stock is "riskier'? Explain [11 marks] [Total 30 marks] [Total word count - 1,000] Question 4 a. A portfolio beta is a weighted average of the betas of the individual securities which comprise the portfolio. However, the standard deviation is not a weighted average of the standard deviations of the individual securities which comprise the portfolio. Explain why this difference exists. [6 marks] b. What do you understand by the reward-to-risk ratio: [4 marks) c. Explain how the slope of the security market line is determined and why every security that is correctly priced, according to CAPM, will lie on this line. [4 marks] d. Equity A has a beta of 1.48 and an expected return of 18.1 per cent. Equity B has a beta of 0.80 and an expected return of 12.2 per cent. What would the risk-free rate have to be for the two equities to be correctly priced? [5 marks] e. Based on the following information in the table below: State of Probability of Rate of return if state occurs economy of economy Stock A Stock B Boom 0.3 0.15 0.30 Normal 0.4 0.42 0.12 Recession 0.3 -0.25 0.46 The market risk premium is 10 per cent, and the risk-free rate is 6 per cent Required? i. Compute the beta (BA) and standard deviation of stock A? ii. Compute the beta (Be) and standard deviation of stock B? ii. Which stock is "riskier'? Explain [11 marks] [Total 30 marks] [Total word count - 1,000]