Question: Question 4 A Bookmark this page Problem Set due Dec 8, 2021 23:00 +08 Question 4 4 points possible (graded) An airline company is considering

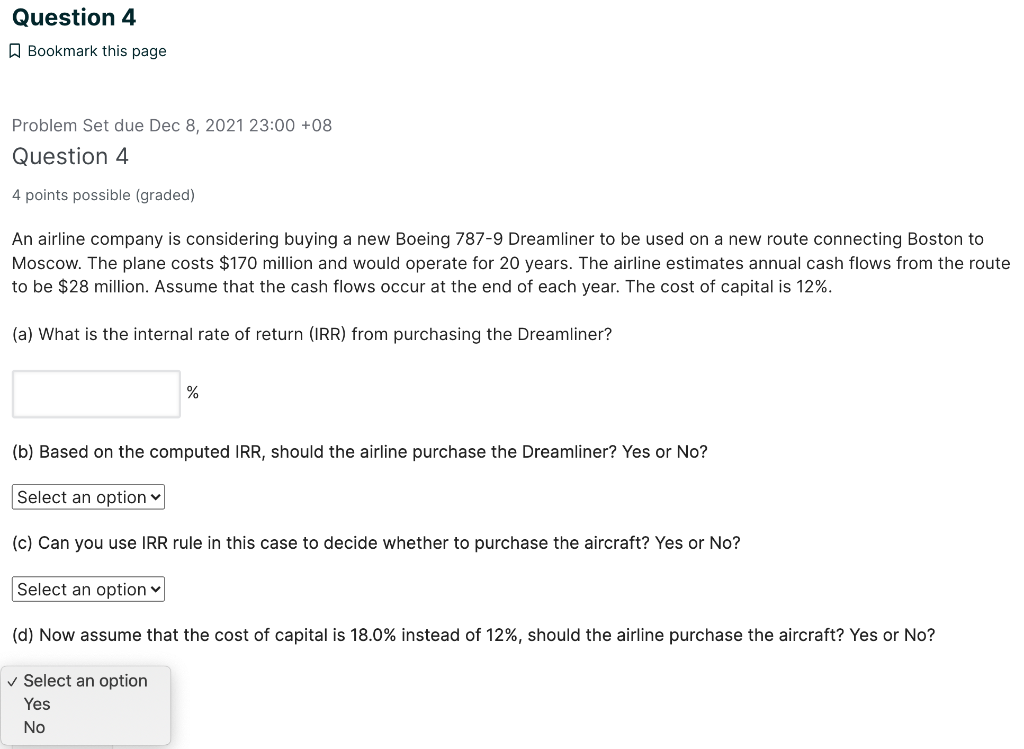

Question 4 A Bookmark this page Problem Set due Dec 8, 2021 23:00 +08 Question 4 4 points possible (graded) An airline company is considering buying a new Boeing 787-9 Dreamliner to be used on a new route connecting Boston to Moscow. The plane costs $170 million and would operate for 20 years. The airline estimates annual cash flows from the route to be $28 million. Assume that the cash flows occur at the end of each year. The cost of capital is 12%. (a) What is the internal rate of return (IRR) from purchasing the Dreamliner? % (b) Based on the computed IRR, should the airline purchase the Dreamliner? Yes or No? Select an option (c) Can you use IRR rule in this case to decide whether to purchase the aircraft? Yes or No? Select an option (d) Now assume that the cost of capital is 18.0% instead of 12%, should the airline purchase the aircraft? Yes or No? Select an option Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts