Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 a) Define non-diversifiable risk. Explain why, in theory, non-diversifiable risk is considered the only relevant risk for determination of an investor's required

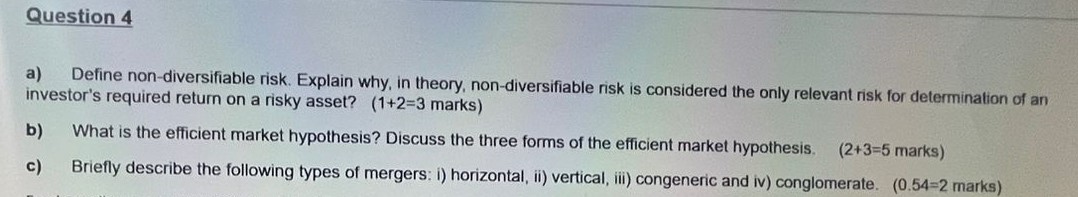

Question 4 a) Define non-diversifiable risk. Explain why, in theory, non-diversifiable risk is considered the only relevant risk for determination of an investor's required return on a risky asset? (1+2-3 marks) b) What is the efficient market hypothesis? Discuss the three forms of the efficient market hypothesis. (2+3=5 marks) c) Briefly describe the following types of mergers: i) horizontal, ii) vertical, iii) congeneric and iv) conglomerate. (0.54-2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Nondiversifiable risk also known as systematic risk or market risk refers to the risk that is inherent in the overall market or economy and cannot be eliminated through diversification This type of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started