Answered step by step

Verified Expert Solution

Question

1 Approved Answer

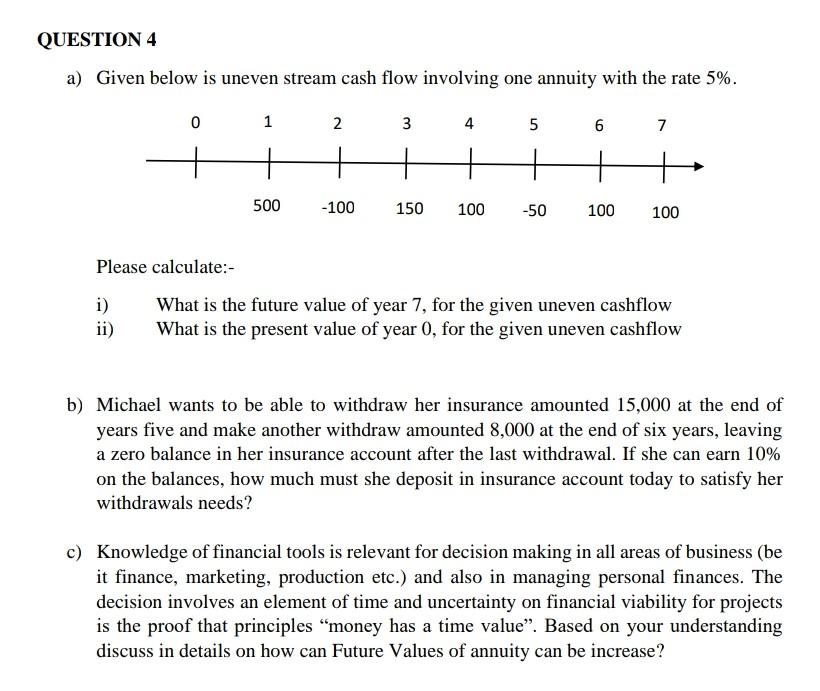

. QUESTION 4 a) Given below is uneven stream cash flow involving one annuity with the rate 5%. 0 1 2 3 4 5 6

.

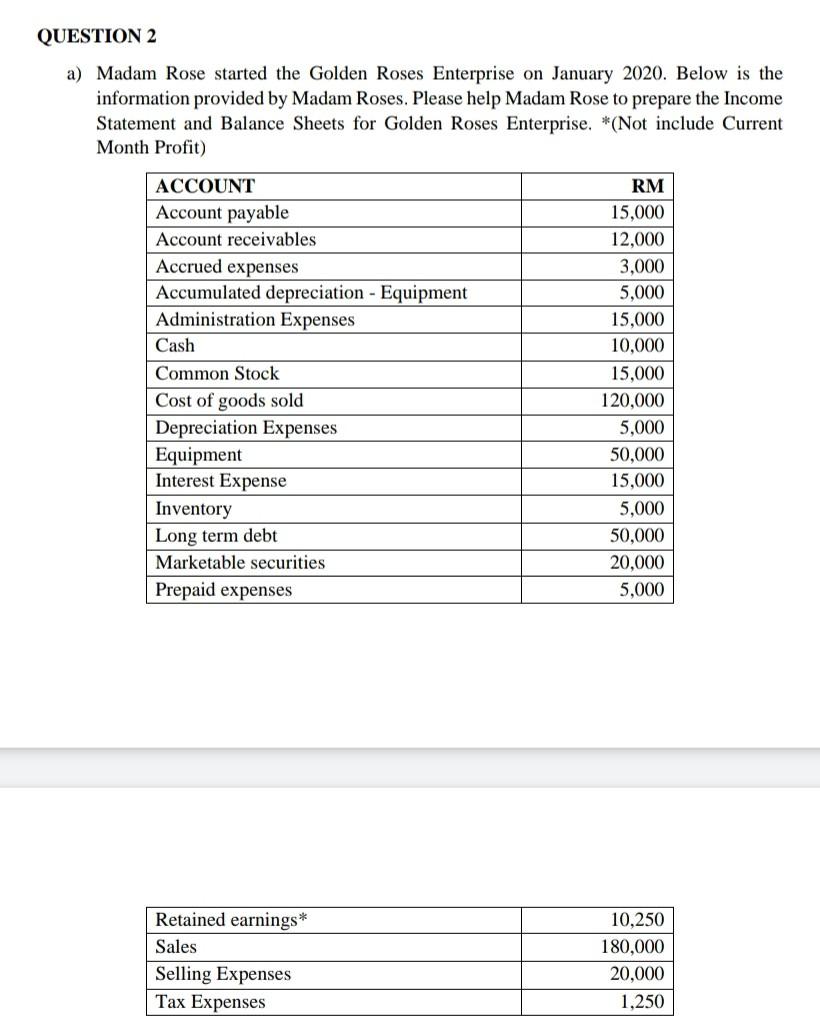

QUESTION 4 a) Given below is uneven stream cash flow involving one annuity with the rate 5%. 0 1 2 3 4 5 6 7 + 500 -100 150 100 -50 100 100 Please calculate:- i) What is the future value of year 7, for the given uneven cashflow ii) What is the present value of year 0, for the given uneven cashflow b) Michael wants to be able to withdraw her insurance amounted 15,000 at the end of years five and make another withdraw amounted 8,000 at the end of six years, leaving a zero balance in her insurance account after the last withdrawal. If she can earn 10% on the balances, how much must she deposit in insurance account today to satisfy her withdrawals needs? c) Knowledge of financial tools is relevant for decision making in all areas of business (be it finance, marketing, production etc.) and also in managing personal finances. The decision involves an element of time and uncertainty on financial viability for projects is the proof that principles money has a time value. Based on your understanding discuss in details on how can Future Values of annuity can be increase? QUESTION 2 a) Madam Rose started the Golden Roses Enterprise on January 2020. Below is the information provided by Madam Roses. Please help Madam Rose to prepare the Income Statement and Balance Sheets for Golden Roses Enterprise. *(Not include Current Month Profit) ACCOUNT Account payable Account receivables Accrued expenses Accumulated depreciation - Equipment Administration Expenses Cash Common Stock Cost of goods sold Depreciation Expenses Equipment Interest Expense Inventory Long term debt Marketable securities Prepaid expenses RM 15,000 12,000 3,000 5,000 15,000 10,000 15,000 120,000 5,000 50,000 15,000 5,000 50.000 20.000 5,000 Retained earnings* Sales Selling Expenses Tax Expenses 10,250 180,000 20,000 1,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started