Answered step by step

Verified Expert Solution

Question

1 Approved Answer

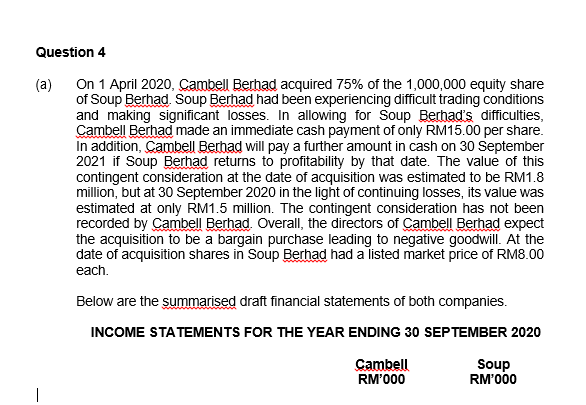

Question 4 (a) On 1 April 2020, Cambell Berhad acquired 75% of the 1,000,000 equity share of Soup Berhad. Soup Berhad had been experiencing

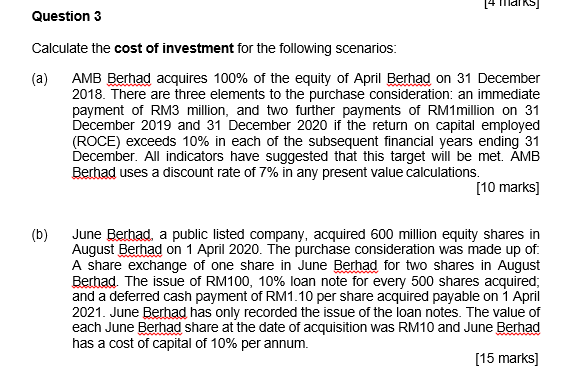

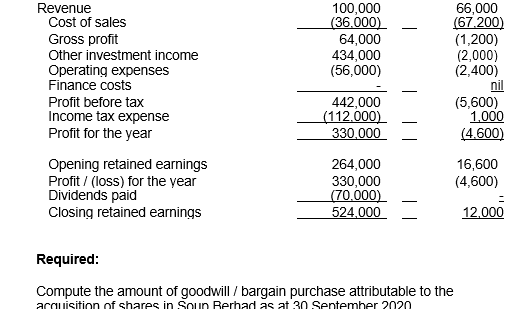

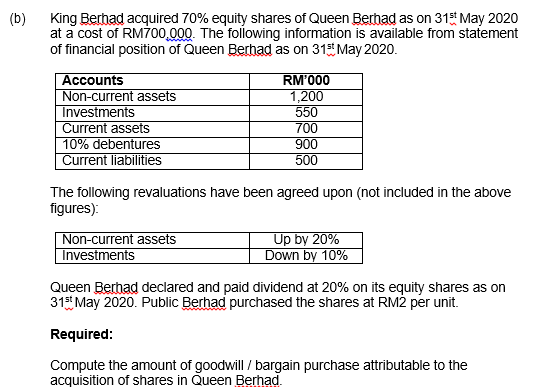

Question 4 (a) On 1 April 2020, Cambell Berhad acquired 75% of the 1,000,000 equity share of Soup Berhad. Soup Berhad had been experiencing difficult trading conditions and making significant losses. In allowing for Soup Berhad's difficulties, Cambell Berhad made an immediate cash payment of only RM15.00 per share. In addition, Cambell Berhad will pay a further amount in cash on 30 September 2021 if Soup Berhad returns to profitability by that date. The value of this contingent consideration at the date of acquisition was estimated to be RM1.8 million, but at 30 September 2020 in the light of continuing losses, its value was estimated at only RM1.5 million. The contingent consideration has not been recorded by Cambell Berhad. Overall, the directors of Cambell Berhad expect the acquisition to be a bargain purchase leading to negative goodwill. At the date of acquisition shares in Soup Berhad had a listed market price of RM8.00 each. Below are the summarised draft financial statements of both companies. INCOME STATEMENTS FOR THE YEAR ENDING 30 SEPTEMBER 2020 Cambell RM'000 Soup RM'000 [4 mar Question 3 Calculate the cost of investment for the following scenarios: (a) AMB Berhad acquires 100% of the equity of April Berhad on 31 December 2018. There are three elements to the purchase consideration: an immediate payment of RM3 million, and two further payments of RM1million on 31 December 2019 and 31 December 2020 if the return on capital employed (ROCE) exceeds 10% in each of the subsequent financial years ending 31 December. All indicators have suggested that this target will be met. AMB Berhad uses a discount rate of 7% in any present value calculations. (b) [10 marks] June Berhad, a public listed company, acquired 600 million equity shares in August Berhad on 1 April 2020. The purchase consideration was made up of. A share exchange of one share in June Berhad for two shares in August Berhad. The issue of RM100, 10% loan note for every 500 shares acquired; and a deferred cash payment of RM1.10 per share acquired payable on 1 April 2021. June Berhad has only recorded the issue of the loan notes. The value of each June Berhad share at the date of acquisition was RM10 and June Berhad has a cost of capital of 10% per annum. [15 marks] Revenue Cost of sales 100,000 66,000 (36.000) (67.200) Gross profit 64,000 (1,200) Other investment income 434,000 (2,000) Operating expenses (56,000) (2,400) Finance costs nil Profit before tax 442,000 (5,600) Income tax expense (112.000) 1,000 Profit for the year 330,000 (4.600) Opening retained earnings 264,000 16,600 Profit/(loss) for the year 330,000 (4,600) Dividends paid (70.000) Closing retained earnings 524,000 12,000 Required: Compute the amount of goodwill/bargain purchase attributable to the acquisition of shares in Soun Berhad as at 30 September 2020 (b) King Berhad acquired 70% equity shares of Queen Berhad as on 31st May 2020 at a cost of RM700,000. The following information is available from statement of financial position of Queen Berhad as on 31st May 2020. Accounts Non-current assets Investments Current assets 10% debentures Current liabilities RM'000 1,200 550 700 900 500 The following revaluations have been agreed upon (not included in the above figures): Non-current assets Investments Up by 20% Down by 10% Queen Berhad declared and paid dividend at 20% on its equity shares as on 31st May 2020. Public Berhad purchased the shares at RM2 per unit. Required: Compute the amount of goodwill/bargain purchase attributable to the acquisition of shares in Queen Berhad.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started