Question 4:

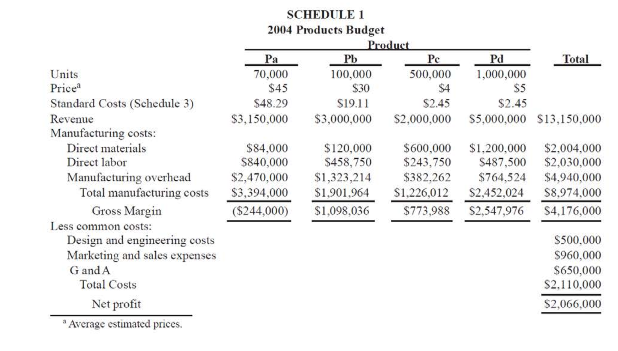

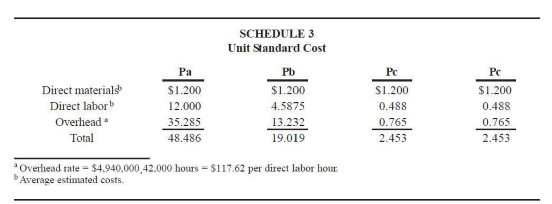

a.) Use an activity-based costing system to calculate new costs and profitability of each of the 4 products (Schedule 1) under the system.

To complete the design of the ABC system you have to make decisions on the following:

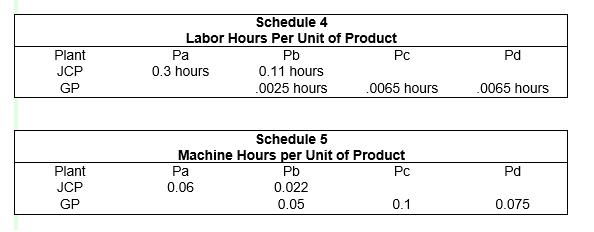

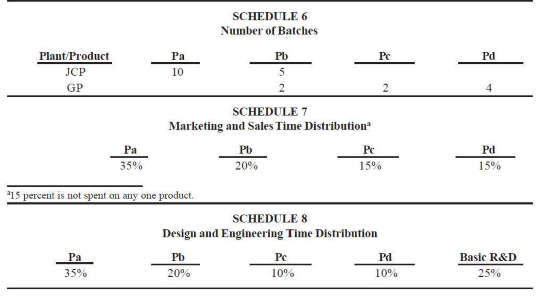

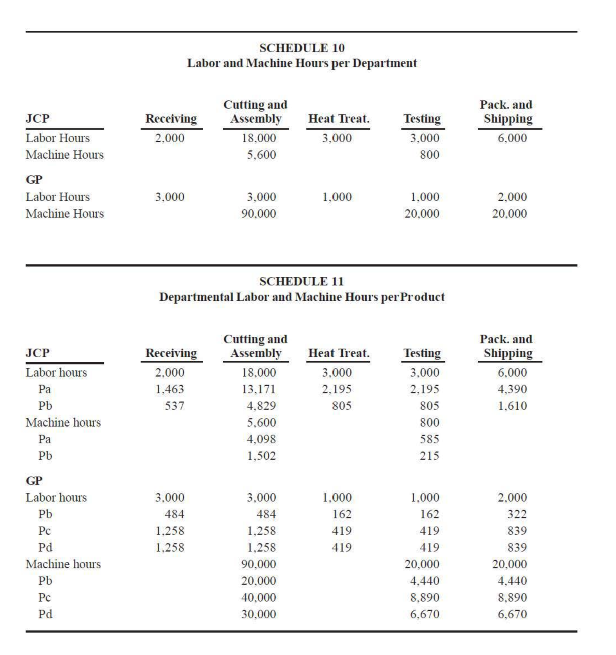

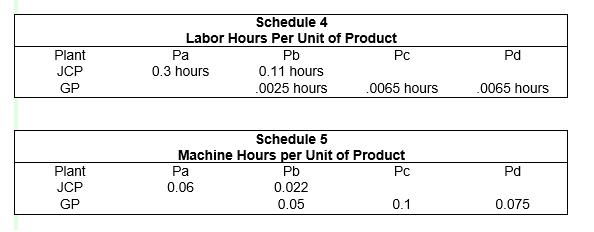

b.) Which cost driver should be used for allocating the costs of each activity to each of the products? Schedules 4 & 5 present labor hours and machine hours per unit for each product. Schedule 6 lists the number of batches for each product. Schedule 1 lists the number of units for each product.

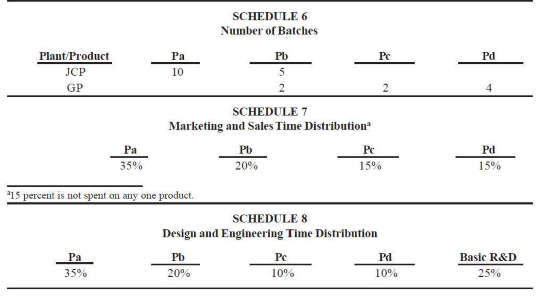

c.) Should you charge the design and engineering support and marketing expenses to products or treat them as firm-wide costs? Schedules 7 & 8 present sales personnel time distribution, and design and engineering support time distribution. If you decide to treat design and engineering and marketing as product costs, use the Allocation Menu to select the cost drivers and charge the cost to the products.

**Graphs and info located below

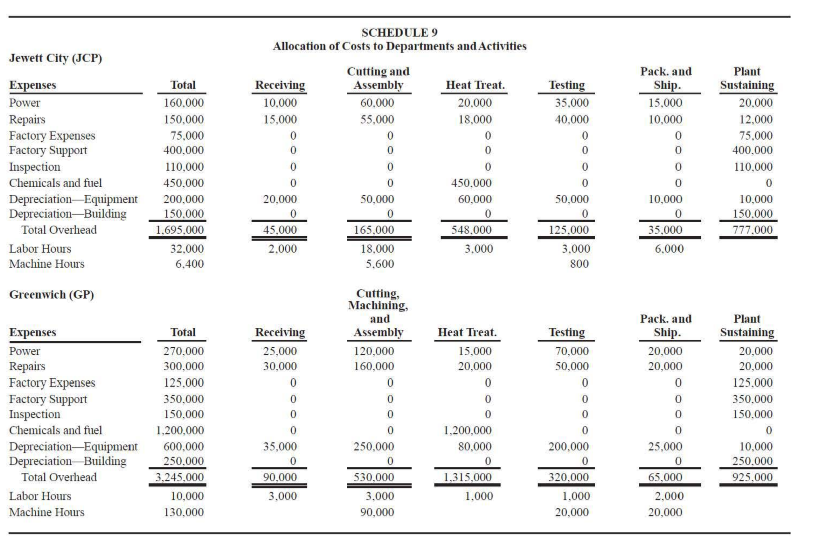

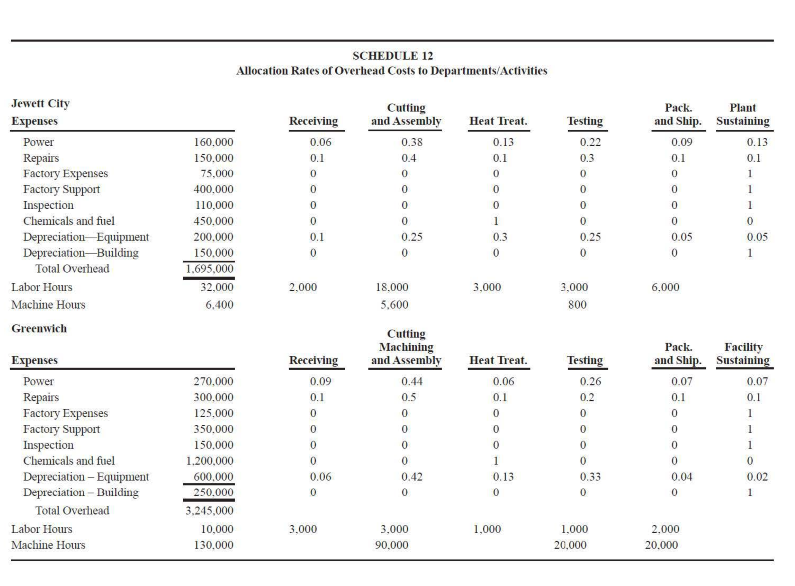

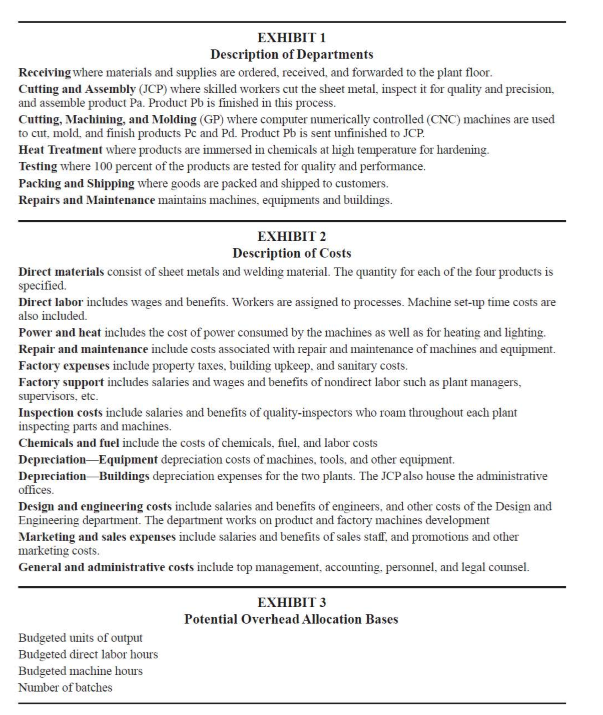

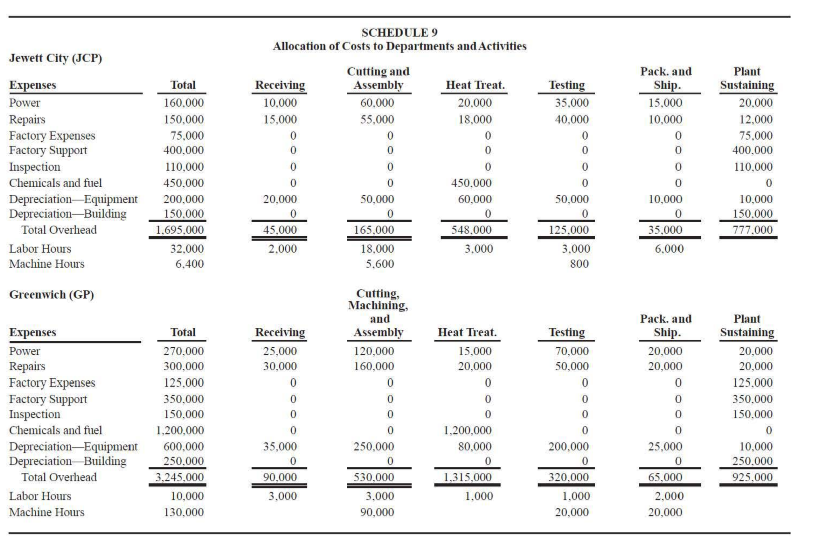

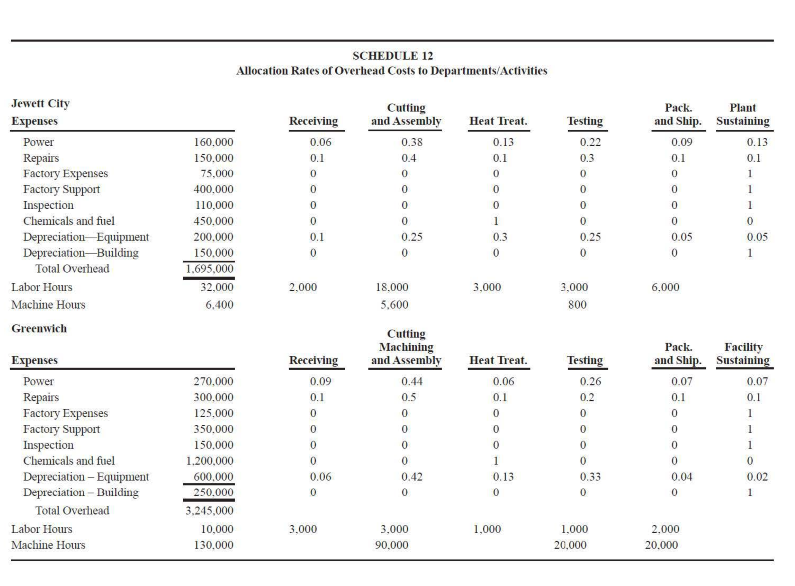

(Descriptions of activities within each of the departments in each plant given in Exhibit 1. You also decided to create plant-sustaining cost pool to allocate factory costs decided could not accurately be allocated to the other departments. Provided is an analysis and description of the costs in each cost pool (Exhibit 2) and allocated costs of the 8 cost pools (Schedule 9) to the different departments and to the plant sustaining cost pool.)

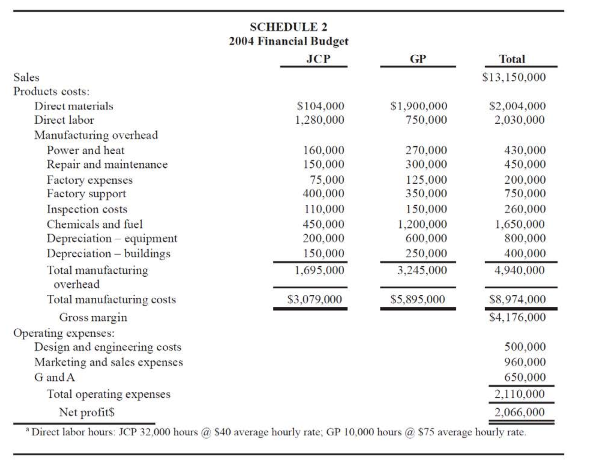

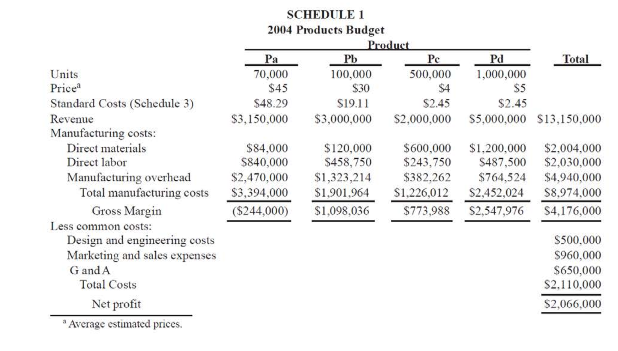

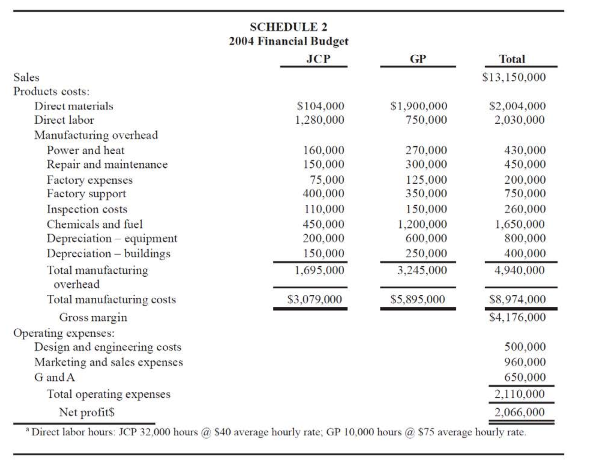

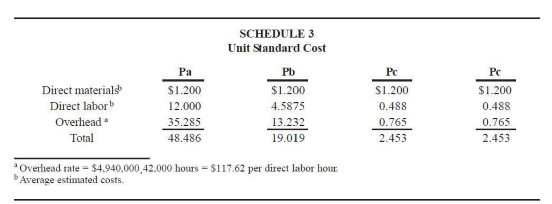

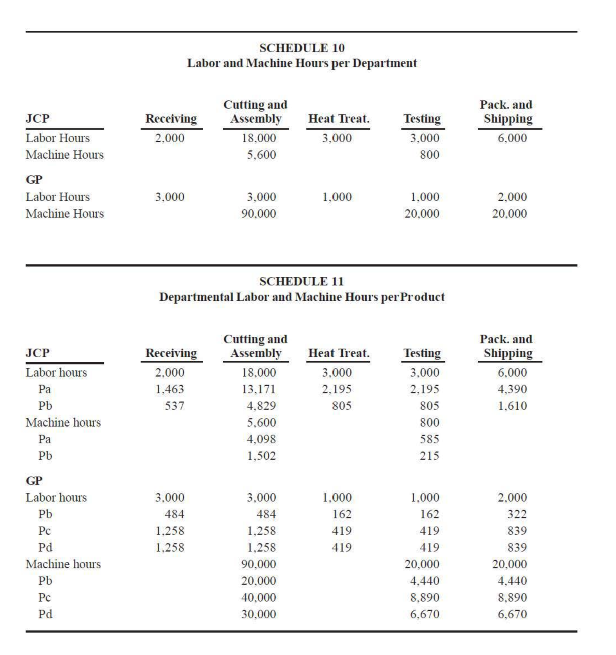

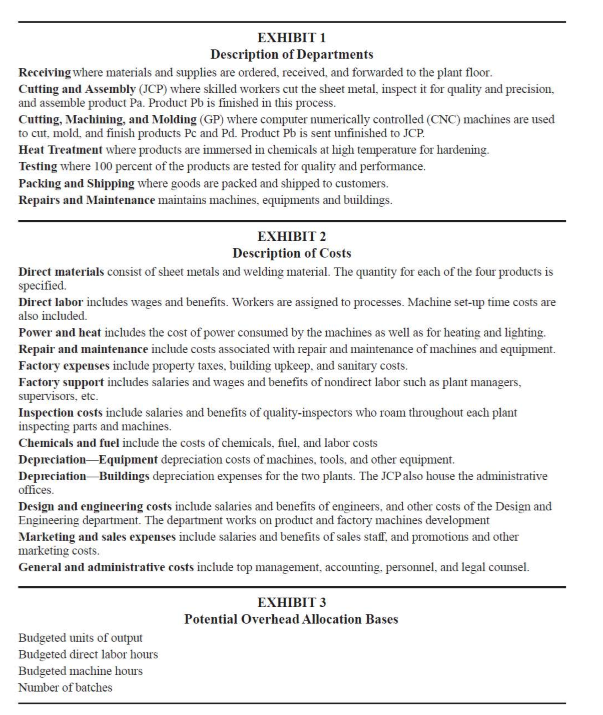

SCHEDULE 1 2004 Products Budget Pd Total Units Price Standard Costs (Schedule 3) Reveinue Manufacturing costs: 70,000 $45 $48.29 100,000 S30 S19.11 500,000 1,000,000 S5 $2.45 $4 $2.45 $3,150,000 $3,000,000 $2,000,000 S5,000,000 $13,150,000 Direct materials Direct labor Manufacturing overhead $84,000 $120,000 $600,000 $1,200,000 $2,004.000 $458,750 $243,750 $487,500 $2,030,000 $2,470,000 S1,323,214 S382,262 $764,524 $4,940,000 Total manufacturing costs $3,394,000 $1,901,964$1,226,012 S2,452,024 $8,974,000 $773,988 S2,547,976 $4,176,000 $840,000 Gross Margin ($244,000 $1,098,036 Less common costs: Design and engineering costs Marketing and sales expenses G and A $500.000 960,000 S650,000 S2,110,000 S2,066,000 Total Costs Net profit "Average estimated prices SCHEDULE 2 2004 Financial Budget JCP Total Sales Products costs $13,150,000 Direct materials Direct labor Manufacturing overhead 04.000 1,280,000 $1,900,000 750,000 S2,004,000 2.030,000 Power and heat Repair and maintenance Factory expenses Factory support Inspection costs Chemicals and fuel Depreciation equipment Depreciation buildings Total manufacturing 160,000 150,000 75,000 400,000 110,000 450,000 200,000 150,000 1,695,000 270,000 300,000 125,000 350,000 150,000 1,200,000 600,000 250,000 3,245,000 430,000 450,000 200,000 750,000 260,000 1,650,000 800,000 400,000 4,940,000 overhead Total manufacturing costs $3,079,000 $5,895,000 $8,974,000 Gross margin S4,1 76,000 Operating expenses Design and engineering costs Marketing and sales expenses G andA 500,000 960,000 650,000 2,110,000 2,066,000 Total operating expenses Net profits Direct labor hours: JCP 32,000 hours S40 average hourly rate; GP 10,000 hours $75 average hourly rate SCHEDULE 3 Unit Standard Cost Direct materials Direct laborb Overhead Total Pa $1.200 12.000 35.285 48.486 PD $1.200 4.5875 13.232 19.019 Pc $1.200 0.488 0.765 2.453 Pc $1.200 0.488 0.765 2.453 Overliead rate $4,940,000,42.000 hours $117.62 per direct labor hour Average estimated costs. Plant JCP GP Schedule 4 Labor Hours Per Unit of Product PD 0.11 hours 0025 hours Pa 0.3 hours Pc Pd 0065 hours 0065 hours Plant JCP GP Schedule 5 Machine Hours per Unit of Product PD 0.022 0.05 Pa 0.06 Pc Pd 0.1 0.075 SCHEDULE 6 Number of Batches Plant Product JCP GP Pa Pc Pd SCHEDULE 7 Marketing and Sales Time Distribution Pb 2090 Pc 15% Pd 15% 35% 15 percent is not spent on any one product SCHEDULE 8 Design and Engineering Time Distribution Pb 20% Pc Pd Basic R&D 35% 10% 10% 25% EXHIBIT 1 Description of Departments Receiving where materials and supplies are ordered, received, and forwarded to the plant floor Cutting and Assembly (JCP) where skilled workers cut the sheet metal, inspect it for quality and precision., and assemble product Pa. Product Pb is finished in this process. Cutting, Machining, and Molding (GP) where computer numerically controlled (CNC) machines are used to cut, mold, and finish products Pc and Pd. Product Pb is sent unfinished to JCP. Heat Treatment where products are immersed in chemicals at high temperature for hardening. Testing where 100 percent of the products are tested for quality and performance. Packing and Shipping where goods are packed and shipped to customers. Repairs and Maintenance maintains machines, equipments and buildings. EXHIBIT 2 Description of Costs Direct materials consist of sheet metals and welding material. The quantity for each of the four products is specified. Direct labor includes wages and benefits. Workers are assigned to processes. Machine set-up time costs are also included. Power and heat includes the cost of power consumed by the machines as well as for heating and lighting Repair and maintenance include costs associated with repair and maintenance of machines and equipment. Factory expenses include property taxes, building upkeep. and sanitary costs. Factory support includes salaries and wages and benefits of nondirect labor such as plant managers, suupervisors, etc. Inspection costs include salaries and benefits of quality-inspectors who roam throughout each plant inspecting parts and machines. Chemicals and fuel include the costs of chemicals, fuel, and labor costs Depreciation-Equipment depreciation costs of machines, tools, and other equipment. Depieciation Buildings depreciation expenses for the two plants. The JCPalso house the administrative offices. Design and engineering costs include salaries and benefits of engineers, and other costs of the Design and Engineering department. The department works on product and factory machines development Marketing and sales expenses include salaries and benefits of sales staff, and promotions and other marketing costs. General and administrative costs include top management, accounting, personnel, and legal counsel. EXHIBIT 3 Potential Overhead Allocation Bases Budgeted units of output Budgeted direct labor hours Budgeted machine hours Number of batches SCHEDULE 1 2004 Products Budget Pd Total Units Price Standard Costs (Schedule 3) Reveinue Manufacturing costs: 70,000 $45 $48.29 100,000 S30 S19.11 500,000 1,000,000 S5 $2.45 $4 $2.45 $3,150,000 $3,000,000 $2,000,000 S5,000,000 $13,150,000 Direct materials Direct labor Manufacturing overhead $84,000 $120,000 $600,000 $1,200,000 $2,004.000 $458,750 $243,750 $487,500 $2,030,000 $2,470,000 S1,323,214 S382,262 $764,524 $4,940,000 Total manufacturing costs $3,394,000 $1,901,964$1,226,012 S2,452,024 $8,974,000 $773,988 S2,547,976 $4,176,000 $840,000 Gross Margin ($244,000 $1,098,036 Less common costs: Design and engineering costs Marketing and sales expenses G and A $500.000 960,000 S650,000 S2,110,000 S2,066,000 Total Costs Net profit "Average estimated prices SCHEDULE 2 2004 Financial Budget JCP Total Sales Products costs $13,150,000 Direct materials Direct labor Manufacturing overhead 04.000 1,280,000 $1,900,000 750,000 S2,004,000 2.030,000 Power and heat Repair and maintenance Factory expenses Factory support Inspection costs Chemicals and fuel Depreciation equipment Depreciation buildings Total manufacturing 160,000 150,000 75,000 400,000 110,000 450,000 200,000 150,000 1,695,000 270,000 300,000 125,000 350,000 150,000 1,200,000 600,000 250,000 3,245,000 430,000 450,000 200,000 750,000 260,000 1,650,000 800,000 400,000 4,940,000 overhead Total manufacturing costs $3,079,000 $5,895,000 $8,974,000 Gross margin S4,1 76,000 Operating expenses Design and engineering costs Marketing and sales expenses G andA 500,000 960,000 650,000 2,110,000 2,066,000 Total operating expenses Net profits Direct labor hours: JCP 32,000 hours S40 average hourly rate; GP 10,000 hours $75 average hourly rate SCHEDULE 3 Unit Standard Cost Direct materials Direct laborb Overhead Total Pa $1.200 12.000 35.285 48.486 PD $1.200 4.5875 13.232 19.019 Pc $1.200 0.488 0.765 2.453 Pc $1.200 0.488 0.765 2.453 Overliead rate $4,940,000,42.000 hours $117.62 per direct labor hour Average estimated costs. Plant JCP GP Schedule 4 Labor Hours Per Unit of Product PD 0.11 hours 0025 hours Pa 0.3 hours Pc Pd 0065 hours 0065 hours Plant JCP GP Schedule 5 Machine Hours per Unit of Product PD 0.022 0.05 Pa 0.06 Pc Pd 0.1 0.075 SCHEDULE 6 Number of Batches Plant Product JCP GP Pa Pc Pd SCHEDULE 7 Marketing and Sales Time Distribution Pb 2090 Pc 15% Pd 15% 35% 15 percent is not spent on any one product SCHEDULE 8 Design and Engineering Time Distribution Pb 20% Pc Pd Basic R&D 35% 10% 10% 25% EXHIBIT 1 Description of Departments Receiving where materials and supplies are ordered, received, and forwarded to the plant floor Cutting and Assembly (JCP) where skilled workers cut the sheet metal, inspect it for quality and precision., and assemble product Pa. Product Pb is finished in this process. Cutting, Machining, and Molding (GP) where computer numerically controlled (CNC) machines are used to cut, mold, and finish products Pc and Pd. Product Pb is sent unfinished to JCP. Heat Treatment where products are immersed in chemicals at high temperature for hardening. Testing where 100 percent of the products are tested for quality and performance. Packing and Shipping where goods are packed and shipped to customers. Repairs and Maintenance maintains machines, equipments and buildings. EXHIBIT 2 Description of Costs Direct materials consist of sheet metals and welding material. The quantity for each of the four products is specified. Direct labor includes wages and benefits. Workers are assigned to processes. Machine set-up time costs are also included. Power and heat includes the cost of power consumed by the machines as well as for heating and lighting Repair and maintenance include costs associated with repair and maintenance of machines and equipment. Factory expenses include property taxes, building upkeep. and sanitary costs. Factory support includes salaries and wages and benefits of nondirect labor such as plant managers, suupervisors, etc. Inspection costs include salaries and benefits of quality-inspectors who roam throughout each plant inspecting parts and machines. Chemicals and fuel include the costs of chemicals, fuel, and labor costs Depreciation-Equipment depreciation costs of machines, tools, and other equipment. Depieciation Buildings depreciation expenses for the two plants. The JCPalso house the administrative offices. Design and engineering costs include salaries and benefits of engineers, and other costs of the Design and Engineering department. The department works on product and factory machines development Marketing and sales expenses include salaries and benefits of sales staff, and promotions and other marketing costs. General and administrative costs include top management, accounting, personnel, and legal counsel. EXHIBIT 3 Potential Overhead Allocation Bases Budgeted units of output Budgeted direct labor hours Budgeted machine hours Number of batches