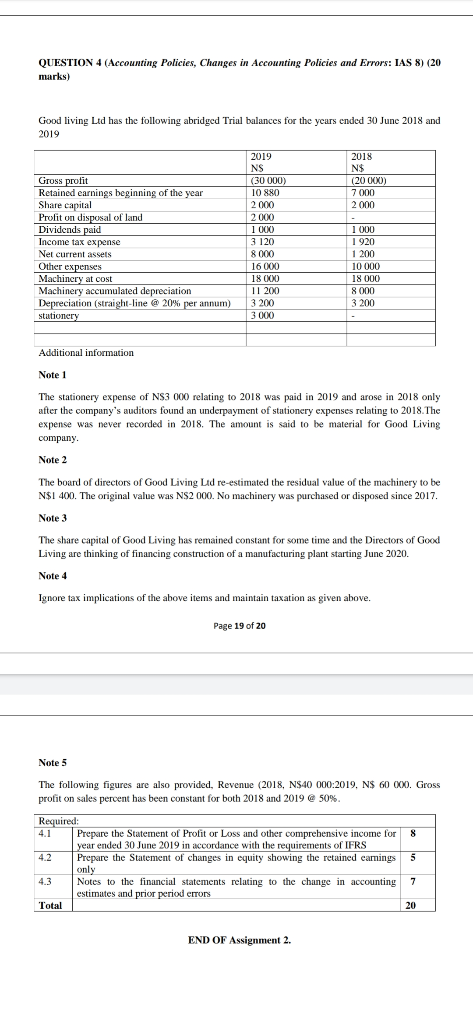

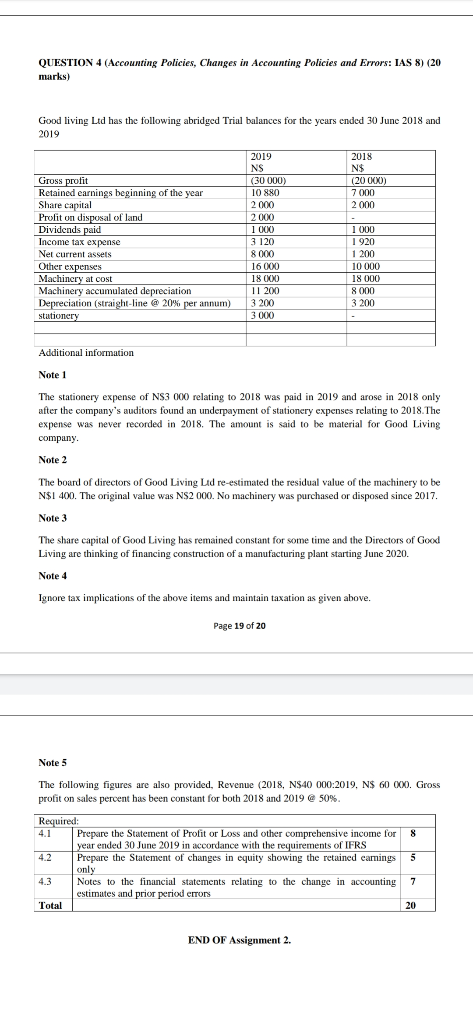

QUESTION 4 (Accounting Policies, Changes in Accounting Policies and Errors: IAS 8) (20 marks) Good living Ltd has the following abridged Trial balances for the years ended 30 June 2018 and 2019 2018 N$ (20 0XX) 7 000 2000 Gross profit Retained earnings beginning of the year Share capital Profit on disposal of land Dividends paid Income tax expense Net current assets Other expenses Machinery at cost Machinery accumulated depreciation Depreciation (straight-line @ 20% per annum) stationery 2019 NS (30 000) 10 880 2000 2000 1 000 3 120 8000 16 000 18 000 11 200 3 200 3000 1 000 1920 1 200 10 000 18 000 8000 3 200 Additional information Note 1 The stationery expense of NS3 000 relating to 2018 was paid in 2019 and arose in 2018 only after the company's auditors found an underpayment of stationery expenses relating to 2018. The expense was never recorded in 2018. The amount is said to be material for Good Living company. Note 2 The board of directors of Good Living Lid re-estimated the residual value of the machinery to be N$I 400. The original value was NS2 000. No machinery was purchased or disposed since 2017. Note 3 The share capital of Good Living has remained constant for some time and the Directors of Good Living are thinking of financing construction of a manufacturing plant starting June 2020. Note 4 Ignore tax implications of the above items and maintain taxation as given above. Page 19 of 20 Note 5 The following figures are also provided, Revenue (2018, N$40 000:2019, N$ 60 000. Gross profit on sales percent has been constant for both 2018 and 2019 @ 50% Required: Prepare the Statement of Profit or Loss and other comprehensive income for 8 year ended 30 June 2019 in accordance with the requirements of IFRS 42 Prepare the Statement of changes in equity showing the retained earnings 5 only 4.3 Notes to the financial statements relating to the change in accounting 7 estimates and prior period errors Total 20 END OF Assignment 2. QUESTION 4 (Accounting Policies, Changes in Accounting Policies and Errors: IAS 8) (20 marks) Good living Ltd has the following abridged Trial balances for the years ended 30 June 2018 and 2019 2018 N$ (20 0XX) 7 000 2000 Gross profit Retained earnings beginning of the year Share capital Profit on disposal of land Dividends paid Income tax expense Net current assets Other expenses Machinery at cost Machinery accumulated depreciation Depreciation (straight-line @ 20% per annum) stationery 2019 NS (30 000) 10 880 2000 2000 1 000 3 120 8000 16 000 18 000 11 200 3 200 3000 1 000 1920 1 200 10 000 18 000 8000 3 200 Additional information Note 1 The stationery expense of NS3 000 relating to 2018 was paid in 2019 and arose in 2018 only after the company's auditors found an underpayment of stationery expenses relating to 2018. The expense was never recorded in 2018. The amount is said to be material for Good Living company. Note 2 The board of directors of Good Living Lid re-estimated the residual value of the machinery to be N$I 400. The original value was NS2 000. No machinery was purchased or disposed since 2017. Note 3 The share capital of Good Living has remained constant for some time and the Directors of Good Living are thinking of financing construction of a manufacturing plant starting June 2020. Note 4 Ignore tax implications of the above items and maintain taxation as given above. Page 19 of 20 Note 5 The following figures are also provided, Revenue (2018, N$40 000:2019, N$ 60 000. Gross profit on sales percent has been constant for both 2018 and 2019 @ 50% Required: Prepare the Statement of Profit or Loss and other comprehensive income for 8 year ended 30 June 2019 in accordance with the requirements of IFRS 42 Prepare the Statement of changes in equity showing the retained earnings 5 only 4.3 Notes to the financial statements relating to the change in accounting 7 estimates and prior period errors Total 20 END OF Assignment 2