Question #4 ammoritization table

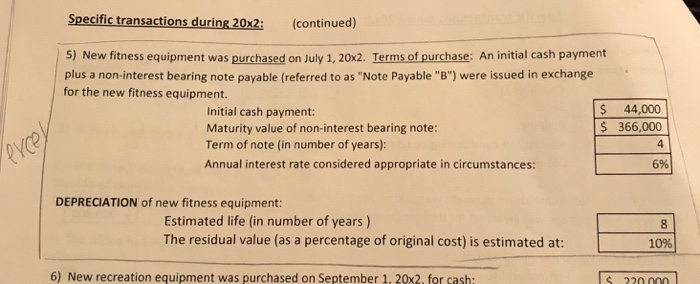

Question #5 is a continuation, also ammoritization table needed

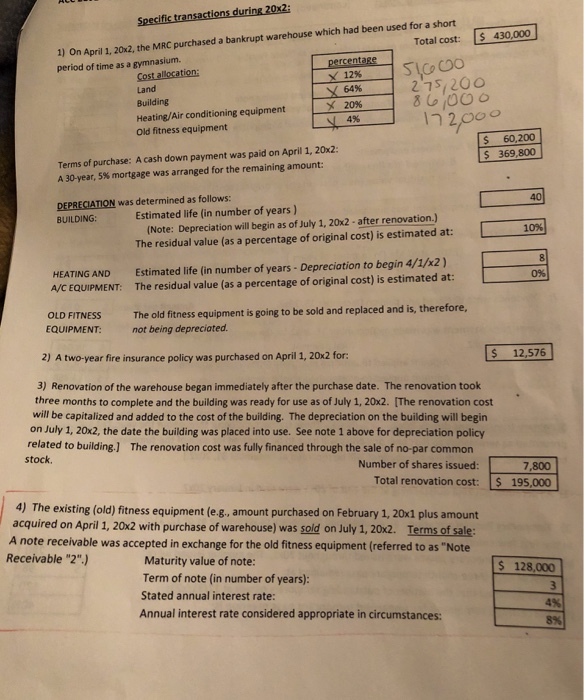

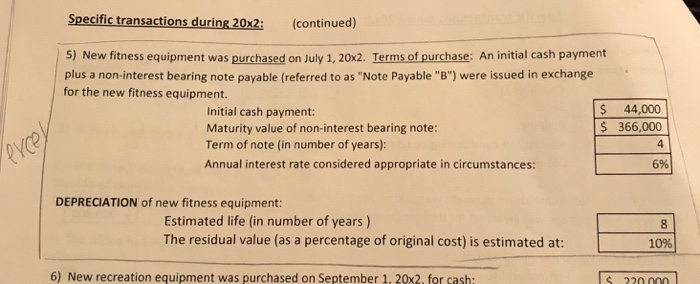

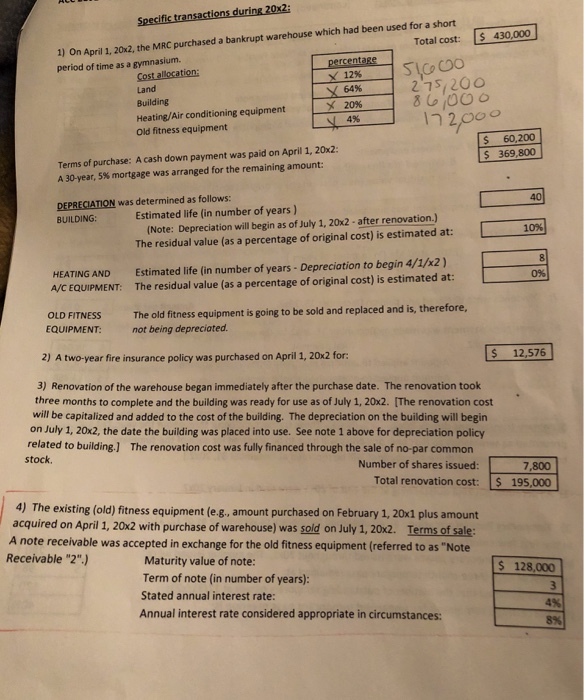

1) On April 1, 20x2, the MRC purchased a bankrupt warehouse which had been used for a short period of time as a gymnasium. Total cost: $ 430,000 12% 64% x Land Building Heating/Air conditioning equipment Old fitness equipment 2096 4% 2000 Terms of purchase: A cash down payment was paid on April 1, 20x2: A 30-year, 5% mortgage was arranged for the remaining amount: $ 60,200 $ 369,800 DEPRECIATION was determined as follows: BUILDING 40 Estimated life (in number of years ) (Note: Depreciation will begin as of July 1, 20x2-after renovation.) The residual value (as a percentage of original cost) is estimated at: 10% HEATING AND AVC EQUIPMENT: Estimated life (in number of years- Depreciation to begin 4/1/x2) The residual value (as a percentage of original cost) is estimated at: 0% TNESS EQUIPMENT: The old fitness equipment is going to be sold and replaced and is, therefore not being depreciated 2) A two-year fire insurance policy was purchased on April 1, 20x2 for: $ 12,576 3) Renovation of the warehouse began immediately after the purchase date. The renovation took three months to complete and the building was ready for use as of July 1, 20x2. [The renovation cost will be capitalized and added to the cost of the building. The depreciation on the building will begin on July 1, 20x2, the date the building was placed into use. See note 1 above for depreciation policy related to building.] stock The renovation cost was fully financed through the sale of no-par common Number of shares issued: 7,800 Total renovation cost: S 195,000 4) The existing (old) fitness equipment (e g, amount purchased on February 1, 20x1 plus amount acquired on April 1, 20x2 with purchase of warehouse) was sold on July 1, 20x2. Terms of sale: A note receivable was accepted in exchange for the old fitness equipment (referred to as "Note Receivable "2".) Maturity value of note: Term of note (in number of years): Stated annual interest rate: Annual interest rate considered appropriate in circumstances: 128, 4% 8% 1) On April 1, 20x2, the MRC purchased a bankrupt warehouse which had been used for a short period of time as a gymnasium. Total cost: $ 430,000 12% 64% x Land Building Heating/Air conditioning equipment Old fitness equipment 2096 4% 2000 Terms of purchase: A cash down payment was paid on April 1, 20x2: A 30-year, 5% mortgage was arranged for the remaining amount: $ 60,200 $ 369,800 DEPRECIATION was determined as follows: BUILDING 40 Estimated life (in number of years ) (Note: Depreciation will begin as of July 1, 20x2-after renovation.) The residual value (as a percentage of original cost) is estimated at: 10% HEATING AND AVC EQUIPMENT: Estimated life (in number of years- Depreciation to begin 4/1/x2) The residual value (as a percentage of original cost) is estimated at: 0% TNESS EQUIPMENT: The old fitness equipment is going to be sold and replaced and is, therefore not being depreciated 2) A two-year fire insurance policy was purchased on April 1, 20x2 for: $ 12,576 3) Renovation of the warehouse began immediately after the purchase date. The renovation took three months to complete and the building was ready for use as of July 1, 20x2. [The renovation cost will be capitalized and added to the cost of the building. The depreciation on the building will begin on July 1, 20x2, the date the building was placed into use. See note 1 above for depreciation policy related to building.] stock The renovation cost was fully financed through the sale of no-par common Number of shares issued: 7,800 Total renovation cost: S 195,000 4) The existing (old) fitness equipment (e g, amount purchased on February 1, 20x1 plus amount acquired on April 1, 20x2 with purchase of warehouse) was sold on July 1, 20x2. Terms of sale: A note receivable was accepted in exchange for the old fitness equipment (referred to as "Note Receivable "2".) Maturity value of note: Term of note (in number of years): Stated annual interest rate: Annual interest rate considered appropriate in circumstances: 128, 4% 8%

Question #4 ammoritization table

Question #4 ammoritization table  Question #5 is a continuation, also ammoritization table needed

Question #5 is a continuation, also ammoritization table needed