Answered step by step

Verified Expert Solution

Question

1 Approved Answer

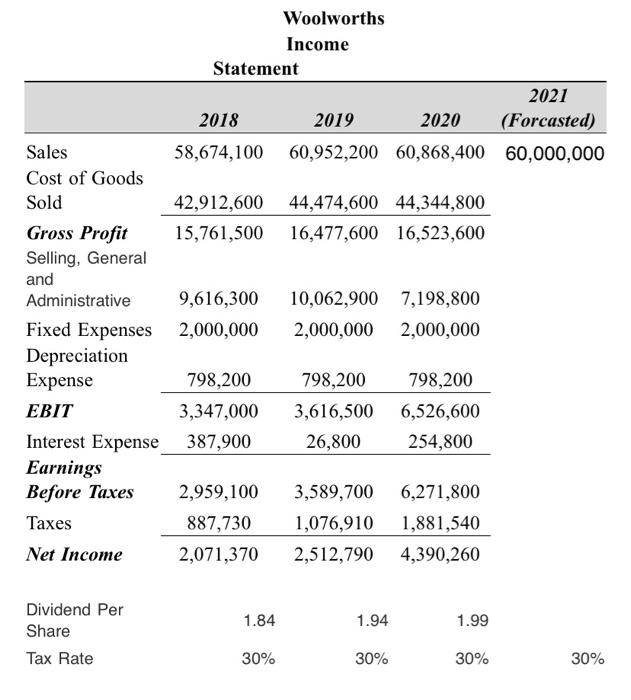

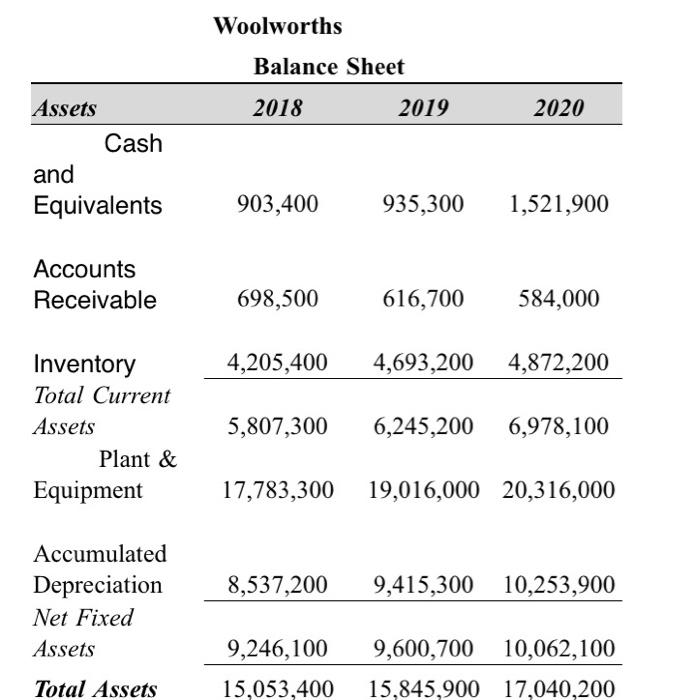

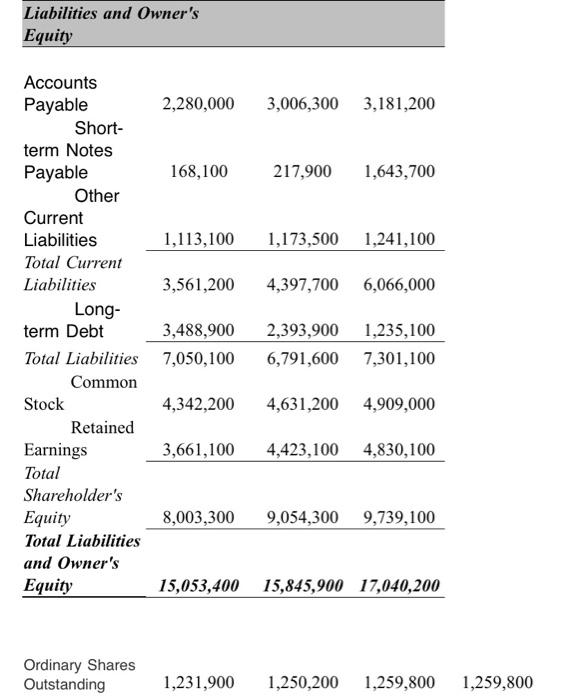

QUESTION 4: Analyse your companys leverage ratio in 2020 compared to 2019 and 2018. Use two leverage ratios to support your answer which are total

QUESTION 4:

Analyse your companys leverage ratio in 2020 compared to 2019 and 2018. Use two leverage ratios to support your answer which are total debt ratio and long-term debt ratio. Ensure that you analyse in this question, not just describe the ratio values. Create a X Y Scatter chart with straight lines and markers in Excel for your results with clear indication on axis titles.

QUESTION 5:

Analyse your companys profitability in 2020 compared to 2019 and 2018. Use two profitability ratios to support your answer which are gross profit margin and return on total assets. Ensure that you analyse in this question, not just describe the ratio values. Create a X Y Scatter chart with straight lines and markers in Excel for your results with clear indication on axis titles.

QUESTION 6:

Depending on the above questions results, using Excel application only, make a table summarizing all the financial ratios groups that you have calculated and create Sparkline charts next to each ratio, then put and show these tables and charts in the word file where you are writing your assignment. Write your final report about your company performance during these years. What do you think? Was it good or bad? Why?

QUESTION 7:

Now, using only 2020 and 2019 years of your company information, forecast the income statement for 2021. Is the EPS will increase or decrease for 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started