Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4+ Answer the following unrelated items. < a) Suppose you live in a Modigliani-Miller world with just one imperfection: taxes. You are the

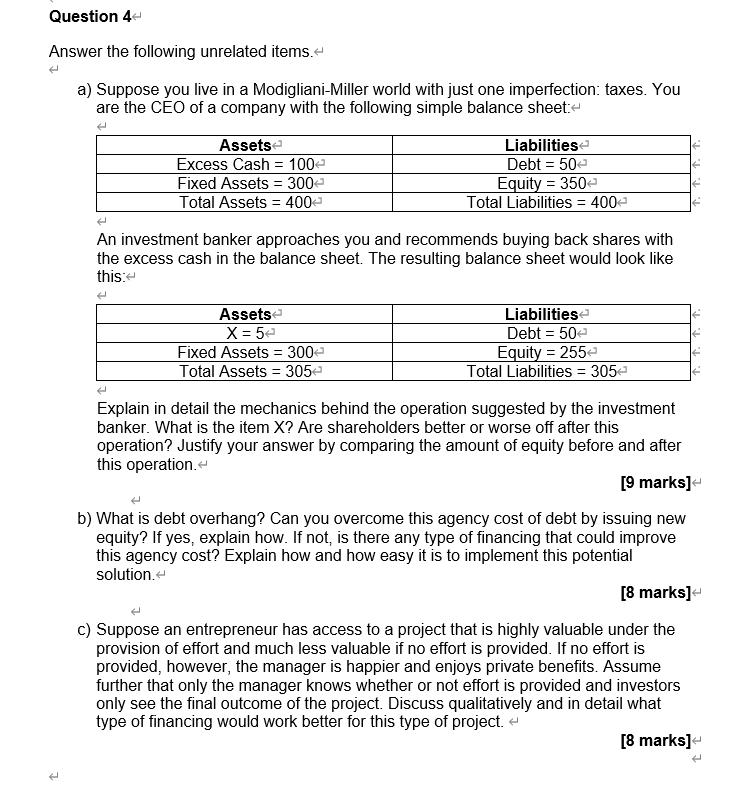

Question 4+ Answer the following unrelated items. < a) Suppose you live in a Modigliani-Miller world with just one imperfection: taxes. You are the CEO of a company with the following simple balance sheet: < ( t Assets Excess Cash = 100 Fixed Assets = 300 Total Assets = 400 E An investment banker approaches you and recommends buying back shares with the excess cash in the balance sheet. The resulting balance sheet would look like this: 4 Assets X = 54 Liabilities Debt = 50 Equity = 350 Total Liabilities = 400 < Fixed Assets = 300 < Total Assets = 305 Liabilities Debt = 50 Equity = 255 Total Liabilities = 305 < Explain in detail the mechanics behind the operation suggested by the investment banker. What is the item X? Are shareholders better or worse off after this operation? Justify your answer by comparing the amount of equity before and after this operation. < [9 marks] b) What is debt overhang? Can you overcome this agency cost of debt by issuing new equity? If yes, explain how. If not, is there any type of financing that could improve this agency cost? Explain how and how easy it is to implement this potential solution. < [8 marks] c) Suppose an entrepreneur has access to a project that is highly valuable under the provision of effort and much less valuable if no effort is provided. If no effort is provided, however, the manager is happier and enjoys private benefits. Assume further that only the manager knows whether or not effort is provided and investors only see the final outcome of the project. Discuss qualitatively and in detail what type of financing would work better for this type of project. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In the ModiglianiMiller world with taxes the operation suggested by the investment banker is a share buyback using excess cash from the balance sheet This involves the company repurchasing its own s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started