Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment. The following information pertains to Gerlamp Close

Question 4

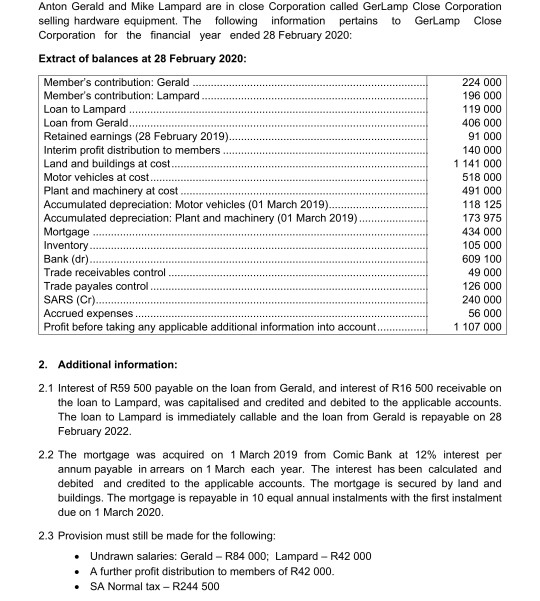

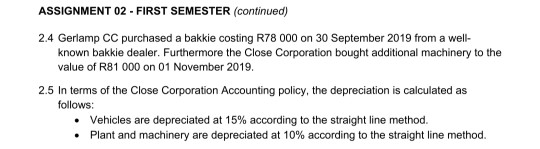

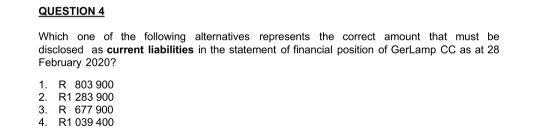

Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment. The following information pertains to Gerlamp Close Corporation for the financial year ended 28 February 2020: Extract of balances at 28 February 2020: Member's contribution: Gerald Member's contribution: Lampard ........ Loan to Lampard ....... Loan from Gerald.... Retained earnings (28 February 2019)...... Interim profit distribution to members Land and buildings at cost... Motor vehicles at cost.... Plant and machinery at cost ................. Accumulated depreciation: Motor vehicles (01 March 2019)......... Accumulated depreciation: Plant and machinery (01 March 2019) Mortgage Inventory Bank (dr).. Trade receivables control..... Trade payales control.. SARS (Cr).... .... Accrued expenses....... Profit before taking any applicable additional information into account.... 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 .. 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2022 2.2 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has been calculated and debited and credited to the applicable accounts. The mortgage is secured by land and buildings. The mortgage is repayable in 10 equal annual instalments with the first instalment due on 1 March 2020. 2.3 Provision must still be made for the following: Undrawn salaries: Gerald - R84 000; Lampard -R42 000 . A further profit distribution to members of R42 000. SA Normal tax-R244 500 ASSIGNMENT 02 - FIRST SEMESTER (continued) 2.4 Gerlamp CC purchased a bakkie costing R78 000 on 30 September 2019 from a well- known bakkie dealer. Furthermore the Close Corporation bought additional machinery to the value of R81 000 on 01 November 2019. 2.5 In terms of the Close Corporation Accounting policy, the depreciation is calculated as follows: Vehicles are depreciated at 15% according to the straight line method. Plant and machinery are depreciated at 10% according to the straight line method QUESTION 4 Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R 803 900 2. R1 283 900 3. R 677 900 4. R1 039 400 Anton Gerald and Mike Lampard are in close Corporation called Gerlamp Close Corporation selling hardware equipment. The following information pertains to Gerlamp Close Corporation for the financial year ended 28 February 2020: Extract of balances at 28 February 2020: Member's contribution: Gerald Member's contribution: Lampard ........ Loan to Lampard ....... Loan from Gerald.... Retained earnings (28 February 2019)...... Interim profit distribution to members Land and buildings at cost... Motor vehicles at cost.... Plant and machinery at cost ................. Accumulated depreciation: Motor vehicles (01 March 2019)......... Accumulated depreciation: Plant and machinery (01 March 2019) Mortgage Inventory Bank (dr).. Trade receivables control..... Trade payales control.. SARS (Cr).... .... Accrued expenses....... Profit before taking any applicable additional information into account.... 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 .. 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2022 2.2 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has been calculated and debited and credited to the applicable accounts. The mortgage is secured by land and buildings. The mortgage is repayable in 10 equal annual instalments with the first instalment due on 1 March 2020. 2.3 Provision must still be made for the following: Undrawn salaries: Gerald - R84 000; Lampard -R42 000 . A further profit distribution to members of R42 000. SA Normal tax-R244 500 ASSIGNMENT 02 - FIRST SEMESTER (continued) 2.4 Gerlamp CC purchased a bakkie costing R78 000 on 30 September 2019 from a well- known bakkie dealer. Furthermore the Close Corporation bought additional machinery to the value of R81 000 on 01 November 2019. 2.5 In terms of the Close Corporation Accounting policy, the depreciation is calculated as follows: Vehicles are depreciated at 15% according to the straight line method. Plant and machinery are depreciated at 10% according to the straight line method QUESTION 4 Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of Gerlamp CC as at 28 February 2020? 1. R 803 900 2. R1 283 900 3. R 677 900 4. R1 039 400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started