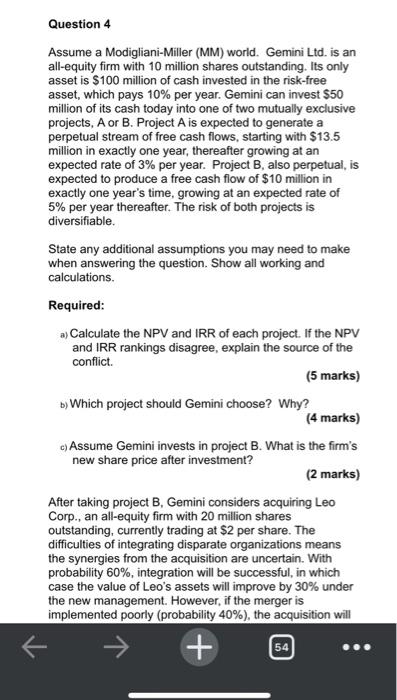

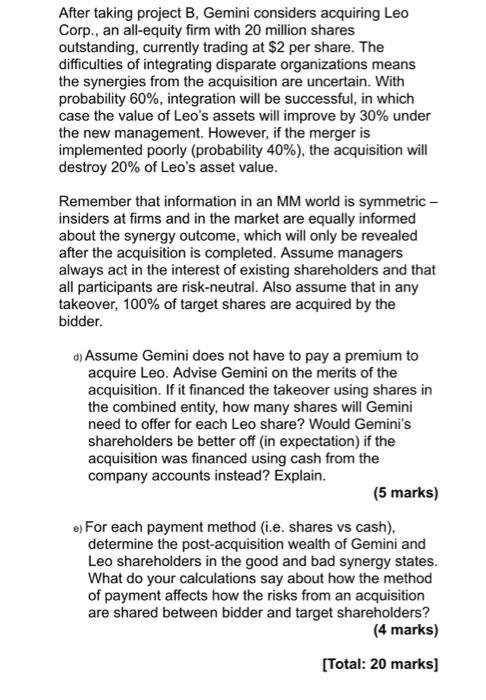

Question 4 Assume a Modigliani-Miller (MM) world. Gemini Ltd. is an all-equity firm with 10 million shares outstanding. Its only asset is $100 million of cash invested in the risk-free asset, which pays 10% per year. Gemini can invest $50 million of its cash today into one of two mutually exclusive projects, A or B. Project A is expected to generate a perpetual stream of free cash flows, starting with $13.5 million in exactly one year, thereafter growing at an expected rate of 3% per year. Project B, also perpetual, is expected to produce a free cash flow of $10 million in exactly one year's time, growing at an expected rate of 5% per year thereafter. The risk of both projects is diversifiable. State any additional assumptions you may need to make when answering the question. Show all working and calculations. Required: a) Calculate the NPV and IRR of each project. If the NPV and IRR rankings disagree, explain the source of the conflict (5 marks) b) Which project should Gemini choose? Why? (4 marks) c) Assume Gemini invests in project B. What is the firm's new share price after investment? (2 marks) After taking project B, Gemini considers acquiring Leo Corp., an all-equity firm with 20 million shares outstanding, currently trading at $2 per share. The difficulties of integrating disparate organizations means the synergies from the acquisition are uncertain. With probability 60%, integration will be successful, in which case the value of Leo's assets will improve by 30% under the new management. However, if the merger is implemented poorly (probability 40%), the acquisition will 54 R + After taking project B, Gemini considers acquiring Leo Corp., an all-equity firm with 20 million shares outstanding, currently trading at $2 per share. The difficulties of integrating disparate organizations means the synergies from the acquisition are uncertain. With probability 60%, integration will be successful, in which case the value of Leo's assets will improve by 30% under the new management. However, if the merger is implemented poorly (probability 40%), the acquisition will destroy 20% of Leo's asset value. Remember that information in an MM world is symmetric - insiders at firms and in the market are equally informed about the synergy outcome, which will only be revealed after the acquisition is completed. Assume managers always act in the interest of existing shareholders and that all participants are risk-neutral. Also assume that in any takeover, 100% of target shares are acquired by the bidder. d) Assume Gemini does not have to pay a premium to acquire Leo. Advise Gemini on the merits of the acquisition. If it financed the takeover using shares in the combined entity, how many shares will Gemini need to offer for each Leo share? Would Gemini's shareholders be better off (in expectation) if the acquisition was financed using cash from the company accounts instead? Explain. (5 marks) a) For each payment method (i.e. shares vs cash), determine the post-acquisition wealth of Gemini and Leo shareholders in the good and bad synergy states. What do your calculations say about how the method of payment affects how the risks from an acquisition are shared between bidder and target shareholders? (4 marks) [Total: 20 marks]