Question

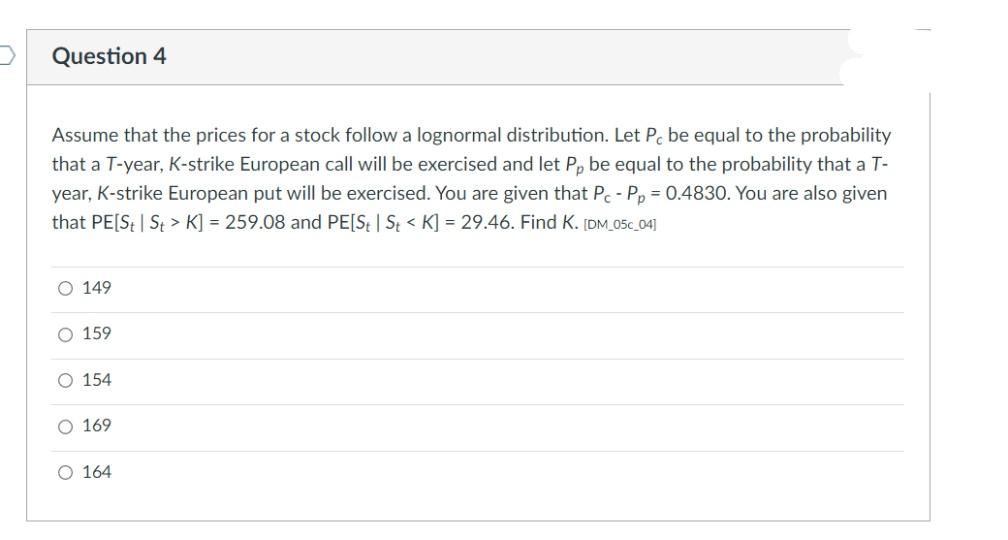

Question 4 Assume that the prices for a stock follow a lognormal distribution. Let P, be equal to the probability that a T-year, K-strike

Question 4 Assume that the prices for a stock follow a lognormal distribution. Let P, be equal to the probability that a T-year, K-strike European call will be exercised and let P, be equal to the probability that a T- year, K-strike European put will be exercised. You are given that Pc - P, = 0.4830. You are also given that PE[S; | St > K] = 259.08 and PE[St | S < K] = 29.46. Find K. [DM_05c_04] 149 O 159 O 154 O 169 O 164

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics Informed Decisions Using Data

Authors: Michael Sullivan III

4th Edition

1269425498, 321757270, 978-0321757272

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App