Answered step by step

Verified Expert Solution

Question

1 Approved Answer

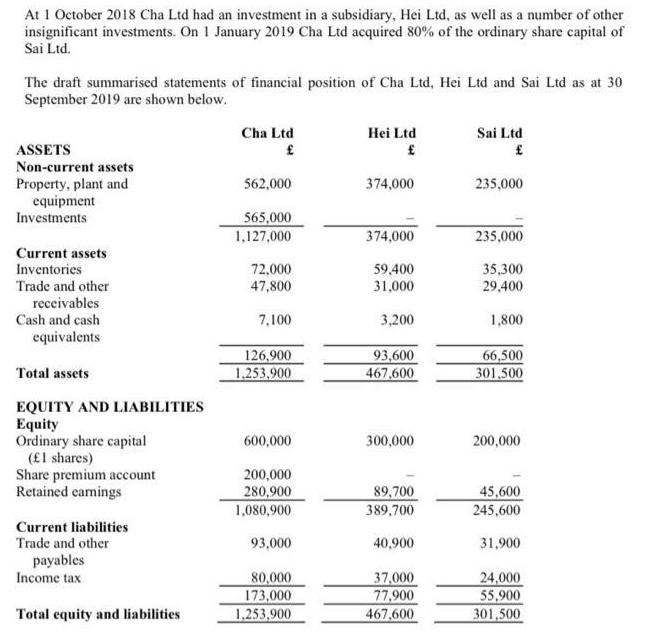

At 1 October 2018 Cha Ltd had an investment in a subsidiary, Hei Ltd, as well as a number of other insignificant investments. On

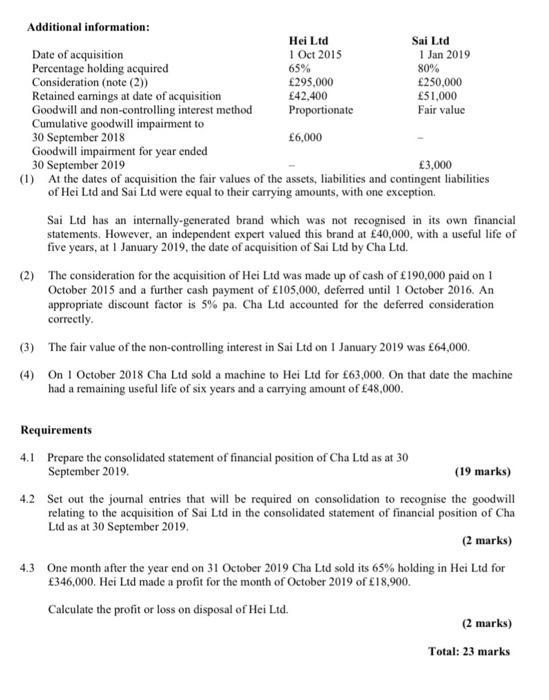

At 1 October 2018 Cha Ltd had an investment in a subsidiary, Hei Ltd, as well as a number of other insignificant investments. On 1 January 2019 Cha Ltd acquired 80% of the ordinary share capital of Sai Ltd. The draft summarised statements of financial position of Cha Ltd, Hei Ltd and Sai Ltd as at 30 September 2019 are shown below. Cha Ltd Hei Ltd Sai Ltd ASSETS Non-current assets Property, plant and equipment Investments 562,000 374,000 235,000 565,000 1,127,000 374,000 235,000 Current assets 35,300 29,400 Inventories 72,000 59,400 Trade and other 47,800 31,000 receivables Cash and cash 7,100 3,200 1,800 equivalents 126,900 1,253,900 93,600 467,600 66,500 Total assets 301,500 EQUITY AND LIABILITIES Equity Ordinary share capital (l shares) Share premium account Retained eamings 600,000 300,000 200,000 200,000 280,900 1,080,900 89,700 45,600 389,700 245,600 Current liabilities Trade and other 93,000 40,900 31,900 payables Income tax 80,000 173,000 1,253,900 37,000 77,900 467,600 24,000 55,900 301,500 Total equity and liabilities Additional information: Hei Ltd 1 Oct 2015 Sai Ltd 1 Jan 2019 80% 250,000 51,000 Fair value Date of acquisition Percentage holding acquired Consideration (note (2) Retained eamings at date of acquisition Goodwill and non-controlling interest method Cumulative goodwill impairment to 30 September 2018 Goodwill impairment for year ended 30 September 2019 (1) At the dates of acquisition the fair values of the assets, liabilities and contingent liabilities of Hei Ltd and Sai Ltd were equal to their carrying amounts, with one exception. 65% 295,000 42,400 Proportionate 6,000 3,000 Sai Ltd has an internally-generated brand which was not recognised in its own financial statements. However, an independent expert valued this brand at 40,000, with a useful life of five years, at 1 January 2019, the date of acquisition of Sai Ltd by Cha Ltd. (2) The consideration for the acquisition of Hei Ltd was made up of cash of 190,000 paid on 1 October 2015 and a further cash payment of 105,000, deferred until 1 October 2016. An appropriate discount factor is 5% pa. Cha Ltd accounted for the deferred consideration correctly. (3) The fair value of the non-controlling interest in Sai Ltd on 1 January 2019 was 64,000. (4) On 1 October 2018 Cha Ltd sold a machine to Hei Ltd for 63,000, On that date the machine had a remaining useful life of six years and a carrying amount of 48,000. Requirements 4.1 Prepare the consolidated statement of financial position of Cha Ltd as at 30 September 2019. (19 marks) 4.2 Set out the joumal entries that will be required on consolidation to recognise the goodwill relating to the acquisition of Sai Ltd in the consolidated statement of financial position of Cha Ltd as at 30 September 2019. (2 marks) 4.3 One month after the year end on 31 October 2019 Cha Ltd sold its 65% holding in Hei Ltd for 346,000. Hei Ltd made a profit for the month of October 2019 of 18,900. Calculate the profit or loss on disposal of Hei Ltd. (2 marks) Total: 23 marks

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ACQUISITION DIFFERENTIAL OF CHA LTD IN HEI LTD AND SAI LTD DATE OF ACQUISITION 01102015 01012019 SHARE OF ACQUISITION 65 80 NAME OF THE ACQUIREE HEI L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635fe790c2521_229448.pdf

180 KBs PDF File

635fe790c2521_229448.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started