Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Austin, your high school friend, has the following expenses in 2023. Austin is not sure how to treat them for his tax purpose in

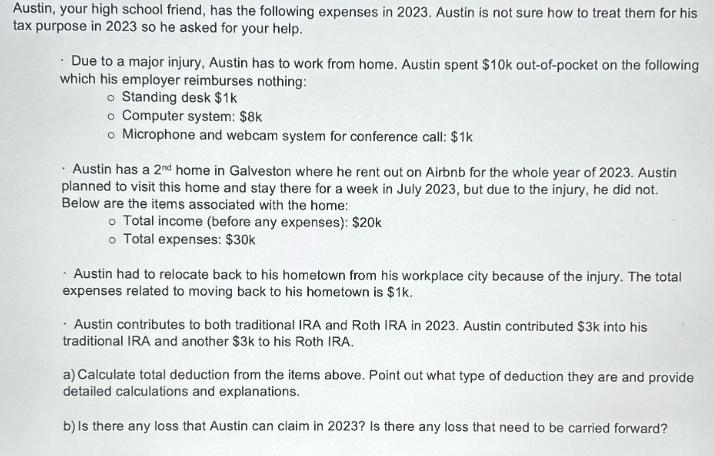

Austin, your high school friend, has the following expenses in 2023. Austin is not sure how to treat them for his tax purpose in 2023 so he asked for your help. Due to a major injury, Austin has to work from home. Austin spent $10k out-of-pocket on the following which his employer reimburses nothing: o Standing desk $1k o Computer system: $8k O Microphone and webcam system for conference call: $1k Austin has a 2nd home in Galveston where he rent out on Airbnb for the whole year of 2023. Austin planned to visit this home and stay there for a week in July 2023, but due to the injury, he did not. Below are the items associated with the home: o Total income (before any expenses): $20k o Total expenses: $30k Austin had to relocate back to his hometown from his workplace city because of the injury. The total expenses related to moving back to his hometown is $1k. . Austin contributes to both traditional IRA and Roth IRA in 2023. Austin contributed $3k into his traditional IRA and another $3k to his Roth IRA. a) Calculate total deduction from the items above. Point out what type of deduction they are and provide detailed calculations and explanations. b) Is there any loss that Austin can claim in 2023? Is there any loss that need to be carried forward?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Lets calculate the total deductions f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started