Answered step by step

Verified Expert Solution

Question

1 Approved Answer

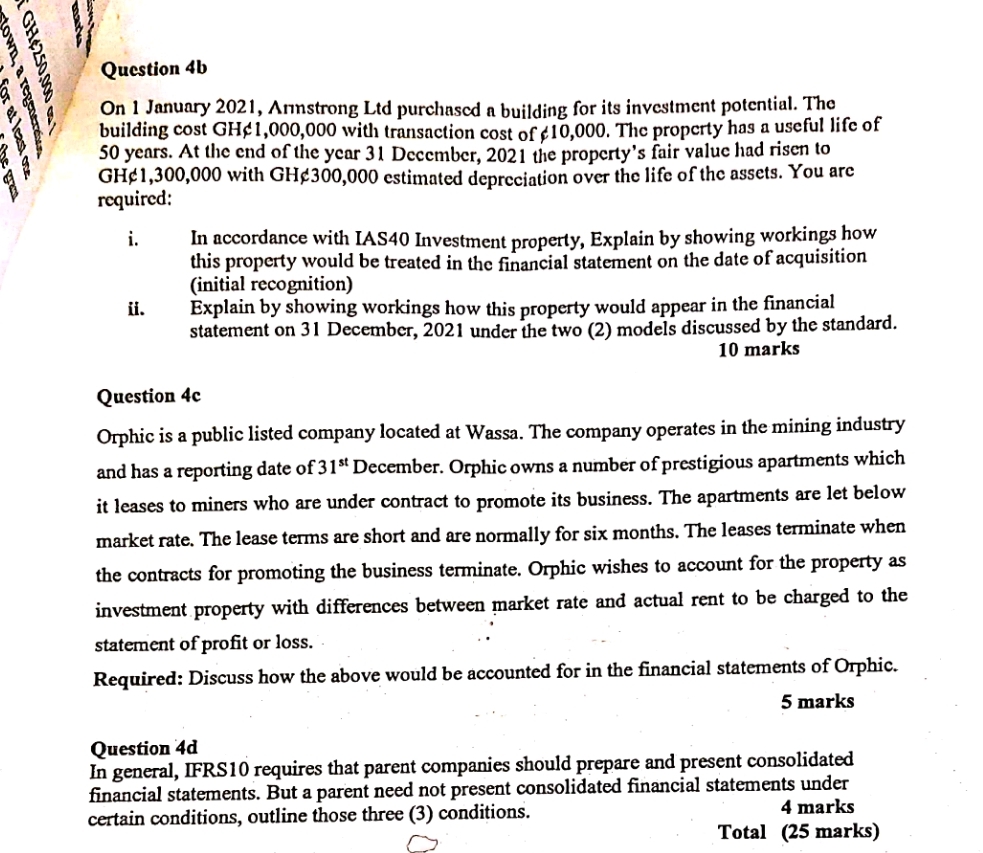

Question 4 b On 1 January 2 0 2 1 , Armstrong Ltd purchased a building for its investment potential. The building cost GH 1

Question b

On January Armstrong Ltd purchased a building for its investment potential. The building cost GH with transaction cost of The property has a useful life of years. At the end of the year December, the property's fair value had risen to GH& with GH& estimated depreciation over the life of the assets. You are required:

i In accordance with IAS Investment property, Explain by showing workings how this property would be treated in the financial statement on the date of acquisition initial recognition

ii Explain by showing workings how this property would appear in the financial statement on December, under the two models discussed by the standard. marks

Question c

Orphic is a public listed company located at Wassa. The company operates in the mining industry and has a reporting date of December. Orphic owns a number of prestigious apartments which it leases to miners who are under contract to promote its business. The apartments are let below market rate. The lease terms are short and are normally for six months. The leases terminate when the contracts for promoting the business terminate. Orphic wishes to account for the property as investment property with differences between market rate and actual rent to be charged to the statement of profit or loss.

Required: Discuss how the above would be accounted for in the financial statements of Orphic.

marks

Question d

In general, IFRS requires that parent companies should prepare and present consolidated financial statements. But a parent need not present consolidated financial statements under certain conditions, outline those three conditions.

marks

Total marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started