Answered step by step

Verified Expert Solution

Question

1 Approved Answer

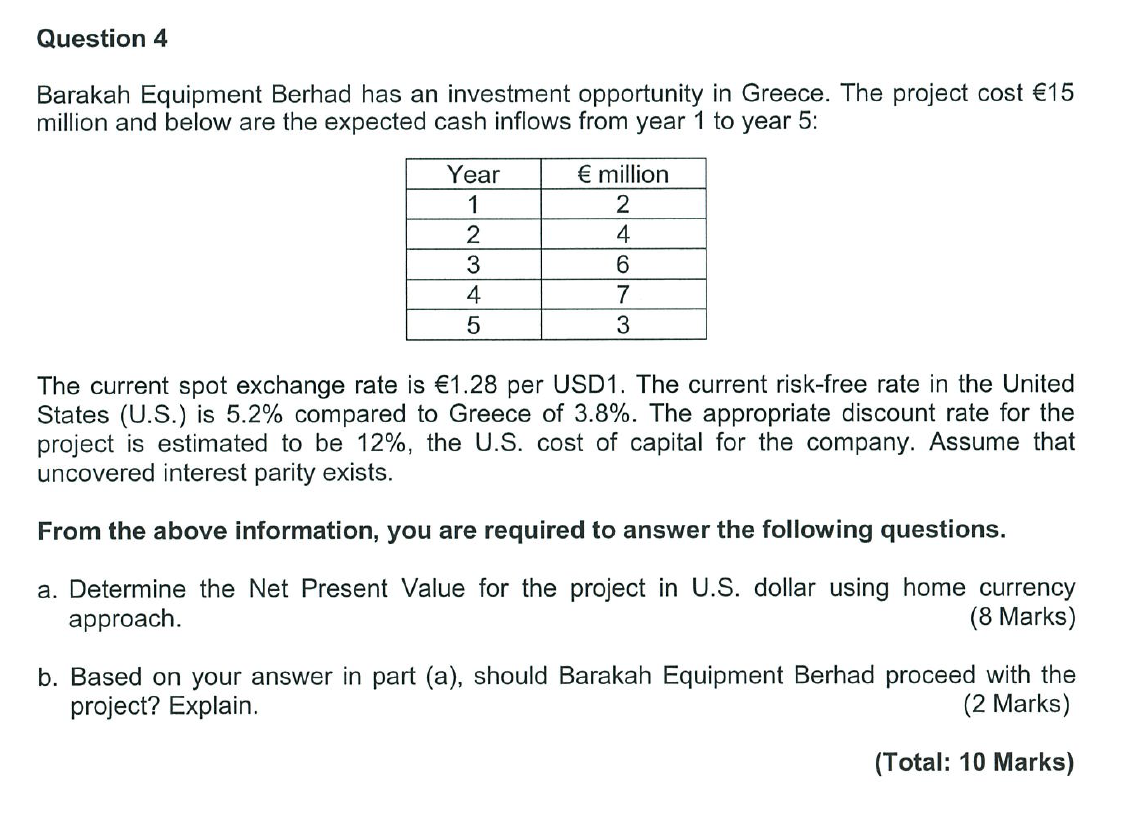

Question 4 Barakah Equipment Berhad has an investment opportunity in Greece. The project cost 1 5 million and below are the expected cash inflows from

Question

Barakah Equipment Berhad has an investment opportunity in Greece. The project cost

million and below are the expected cash inflows from year to year :

The current spot exchange rate is per USD The current riskfree rate in the United

States US is compared to Greece of The appropriate discount rate for the

project is estimated to be the US cost of capital for the company. Assume that

uncovered interest parity exists.

From the above information, you are required to answer the following questions.

a Determine the Net Present Value for the project in US dollar using home currency

approach.

Marks

b Based on your answer in part a should Barakah Equipment Berhad proceed with the

project? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started