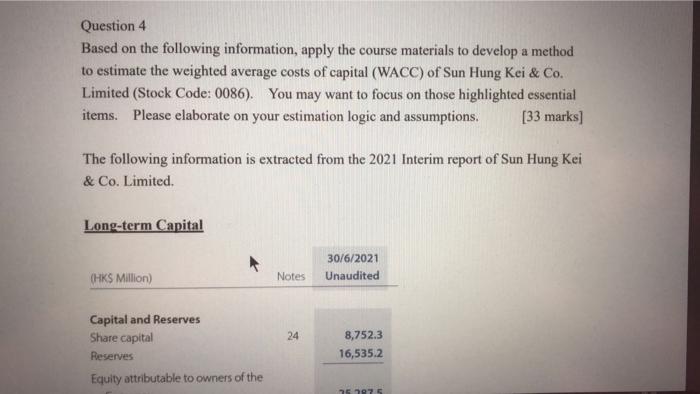

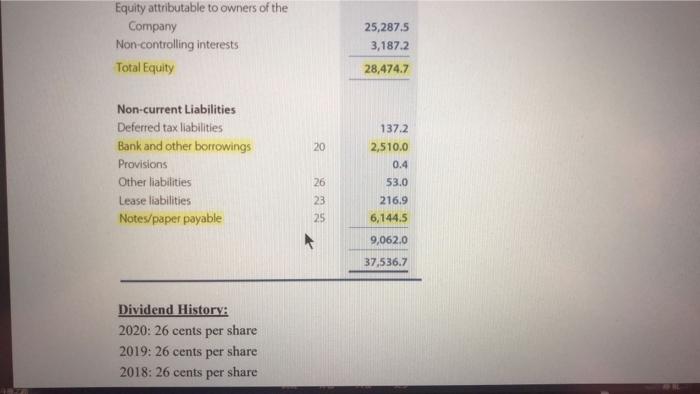

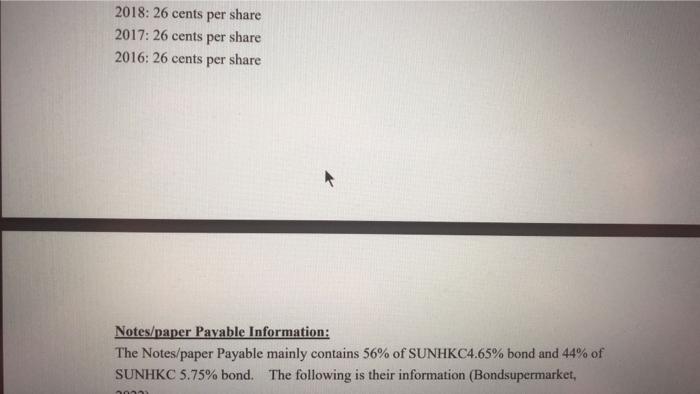

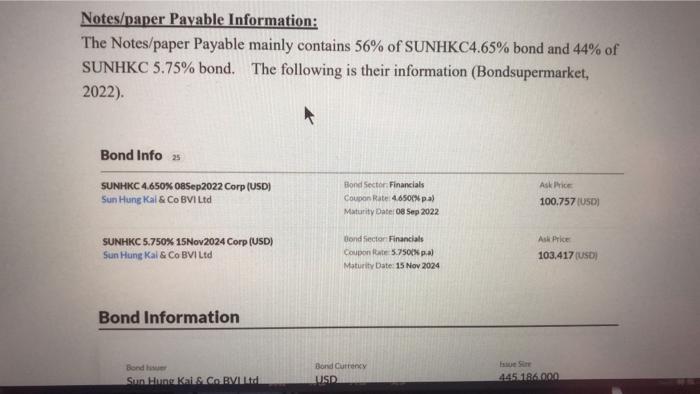

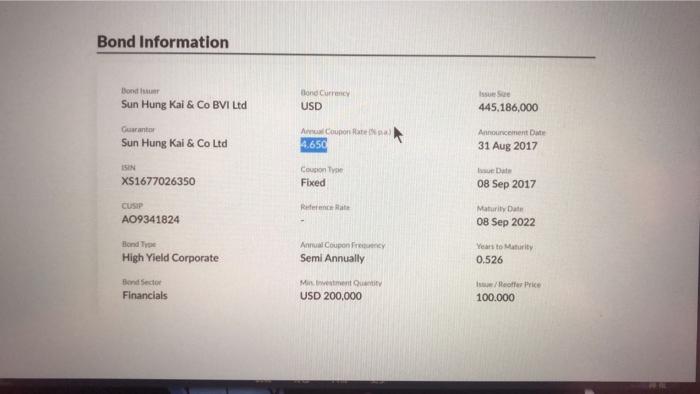

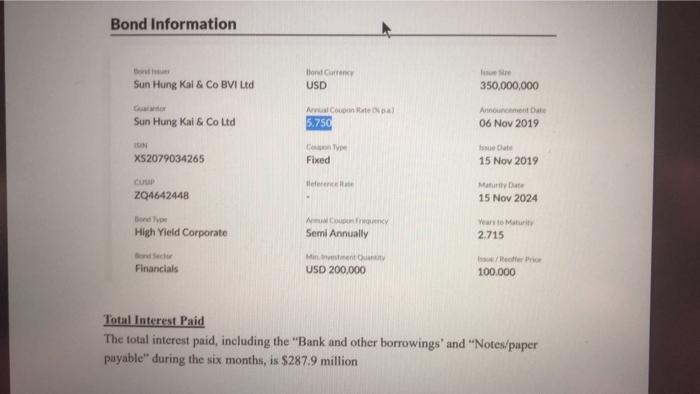

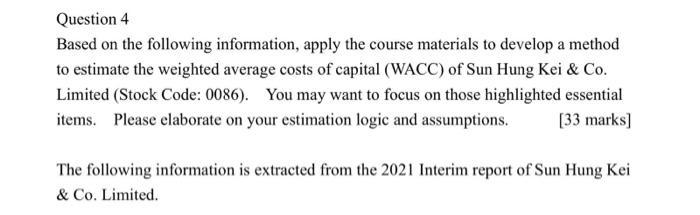

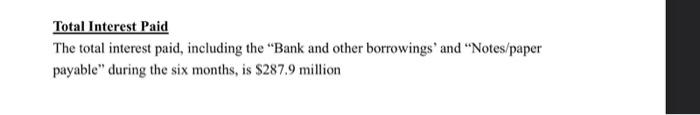

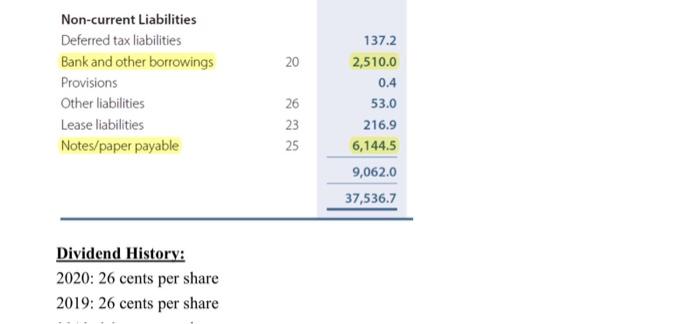

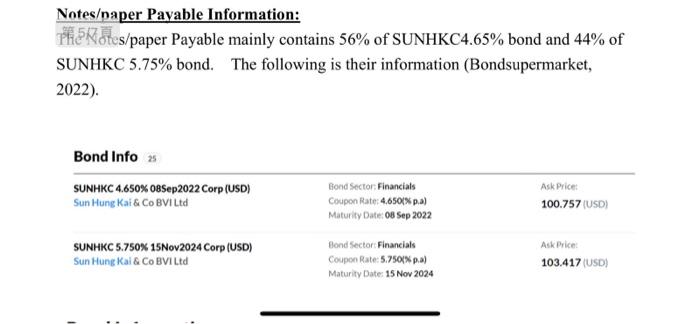

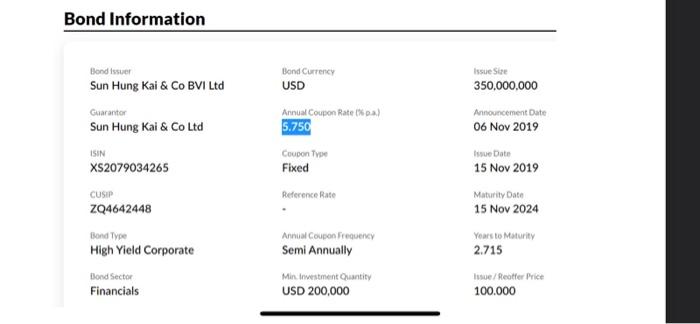

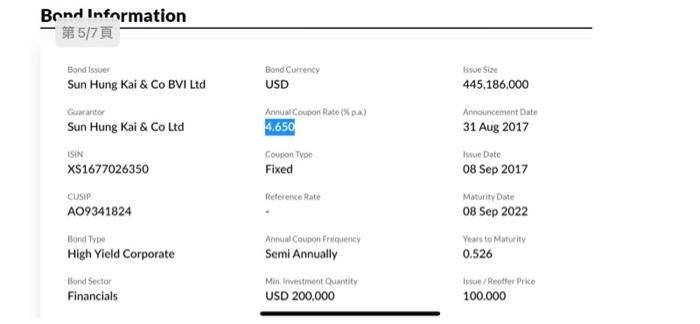

Question 4 Based on the following information, apply the course materials to develop a method to estimate the weighted average costs of capital (WACC) of Sun Hung Kei & Co. Limited (Stock Code: 0086). You may want to focus on those highlighted essential items. Please elaborate on your estimation logic and assumptions. [33 marks] The following information is extracted from the 2021 Interim report of Sun Hung Kei & Co. Limited Long-term Capital 30/6/2021 Unaudited (HKS Million) Notes 24 Capital and Reserves Share capital Reserves Equity attributable to owners of the 8,752.3 16,535.2 075 Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 137.2 2,510.0 0.4 53.0 216.9 6,144.5 26 23 25 9,062.0 37,536.7 Dividend History: 2020: 26 cents per share 2019: 26 cents per share 2018: 26 cents per share 2018: 26 cents per share 2017: 26 cents per share 2016: 26 cents per share Notes/paper Pavable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, Notes/paper Payable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Info SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kal&Co BVI Ltd Bond Sector Financials Coupon Rate 4650CN pa) Maturity Date:08 Sep 2022 Ask Price 100.757 (USD) SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kal & Co BVI Ltd Bond Sector Financials Coupont 5.7500p.a) Maturity Date: 15 Nov 2024 Ask Price 103.417 (USD) Bond Information Bond Sun Wungkal.Co BVLLtd Bond Currency USD 4456186.000 Bond Information Bond Sun Hung Kai & Co BVI Ltd Bond Curre USD Issuu 445.186,000 Guarantee Sun Hung Kal & Co Ltd A Coupon 4.650 Announcement Date 31 Aug 2017 ISIN XS1677026350 Coupon Fixed mue Date 08 Sep 2017 Reference Rate CUSIP AO9341824 Maturity Date 08 Sep 2022 Years to Maturity 0.526 Blonde High Yield Corporate Bend Sector Financials Annual Coupon Frey Semi Annually Mestment Quantity USD 200,000 offer Price 100.000 Bond Information Sun Hung Kal & Co BVI Ltd Blonde USD 350,000,000 Sun Hung Kai & Co Ltd Au Count 5.750 Announce 06 Nov 2019 XS2079034265 CTV Fixed Issue Date 15 Nov 2019 Heren CUP ZQ4642448 Mary Date 15 Nov 2024 Bond High Yield Corporate CV Semi Annually Year to Me 2.715 Financials Minent USD 200,000 Refer Price 100.000 Total Interest Paid The total interest paid, including the "Bank and other borrowings' and "Notes/paper payable" during the six months, is $287.9 million Question 4 Based on the following information, apply the course materials to develop a method to estimate the weighted average costs of capital (WACC) of Sun Hung Kei & Co. Limited (Stock Code: 0086). You may want to focus on those highlighted essential items. Please elaborate on your estimation logic and assumptions. [33 marks) The following information is extracted from the 2021 Interim report of Sun Hung Kei & Co. Limited. Total Interest Paid The total interest paid, including the Bank and other borrowings' and "Notes/paper payable" during the six months, is $287.9 million 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 26 23 25 137.2 2,510.0 0.4 53.0 216.9 6,144.5 9,062.0 37,536.7 Dividend History: 2020: 26 cents per share 2019: 26 cents per share Notes/paper Payable Information: The Rotes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Info > SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kai & Co BVI Ltd Ask Price 100.757 (USD) Gond Sector Financials Coupon Rate: 4.650(%p.a) Maturity Date: 08 Sep 2022 Bond Sector Financials Coupon Rate: 5.750%) Maturity Date: 15 Nov 2024 SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kai & Co BVI Ltd Ask Price 103.417 (USD) Long-term Capital (HK$ Million) 30/6/2021 Notes Unaudited 24 8,752.3 16,535.2 Capital and Reserves Share capital Reserves Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 Non-current Liabilities Bond Information Bond issuer Bond Currency USD Issue Size 350,000,000 Sun Hung Kai & Co BVI Ltd Guarantor Sun Hung Kai & Co Ltd Announcement Date 06 Nov 2019 ISIN Annual Coupon Rate la 5.750 Coupon Type Fixed Reference Rate XS2079034265 CUSIP ZQ4642448 Issue Date 15 Nov 2019 Maturity Date 15 Nov 2024 Bond Type High Yield Corporate Annual Coupon Frequency Semi Annually Years to Maturity 2.715 Min Investment Quantity Bond Sector Financials USD 200,000 Issue/Refer Price 100.000 Bond Information 57 Bond Currency USD Issue Size 445,186,000 Bond issuer Sun Hung Kai & Co BVI Ltd Guarantor Sun Hung Kai & Co Ltd ISIN XS1677026350 Annual Coupon Rate(%) 4.650 Coupon Type Fixed Reference Rate CUSIP A09341824 Announcement Date 31 Aug 2017 Issue Date 08 Sep 2017 Maturity Date 08 Sep 2022 Years to Maturity 0.526 Issue/Reoffer Price 100.000 Bond Type High Yield Corporate Blond Sector Financials Annual Coupon Frequency Semi Annually Min.westment Quantity USD 200,000 Question 4 Based on the following information, apply the course materials to develop a method to estimate the weighted average costs of capital (WACC) of Sun Hung Kei & Co. Limited (Stock Code: 0086). You may want to focus on those highlighted essential items. Please elaborate on your estimation logic and assumptions. [33 marks] The following information is extracted from the 2021 Interim report of Sun Hung Kei & Co. Limited Long-term Capital 30/6/2021 Unaudited (HKS Million) Notes 24 Capital and Reserves Share capital Reserves Equity attributable to owners of the 8,752.3 16,535.2 075 Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 137.2 2,510.0 0.4 53.0 216.9 6,144.5 26 23 25 9,062.0 37,536.7 Dividend History: 2020: 26 cents per share 2019: 26 cents per share 2018: 26 cents per share 2018: 26 cents per share 2017: 26 cents per share 2016: 26 cents per share Notes/paper Pavable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, Notes/paper Payable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Info SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kal&Co BVI Ltd Bond Sector Financials Coupon Rate 4650CN pa) Maturity Date:08 Sep 2022 Ask Price 100.757 (USD) SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kal & Co BVI Ltd Bond Sector Financials Coupont 5.7500p.a) Maturity Date: 15 Nov 2024 Ask Price 103.417 (USD) Bond Information Bond Sun Wungkal.Co BVLLtd Bond Currency USD 4456186.000 Bond Information Bond Sun Hung Kai & Co BVI Ltd Bond Curre USD Issuu 445.186,000 Guarantee Sun Hung Kal & Co Ltd A Coupon 4.650 Announcement Date 31 Aug 2017 ISIN XS1677026350 Coupon Fixed mue Date 08 Sep 2017 Reference Rate CUSIP AO9341824 Maturity Date 08 Sep 2022 Years to Maturity 0.526 Blonde High Yield Corporate Bend Sector Financials Annual Coupon Frey Semi Annually Mestment Quantity USD 200,000 offer Price 100.000 Bond Information Sun Hung Kal & Co BVI Ltd Blonde USD 350,000,000 Sun Hung Kai & Co Ltd Au Count 5.750 Announce 06 Nov 2019 XS2079034265 CTV Fixed Issue Date 15 Nov 2019 Heren CUP ZQ4642448 Mary Date 15 Nov 2024 Bond High Yield Corporate CV Semi Annually Year to Me 2.715 Financials Minent USD 200,000 Refer Price 100.000 Total Interest Paid The total interest paid, including the "Bank and other borrowings' and "Notes/paper payable" during the six months, is $287.9 million Question 4 Based on the following information, apply the course materials to develop a method to estimate the weighted average costs of capital (WACC) of Sun Hung Kei & Co. Limited (Stock Code: 0086). You may want to focus on those highlighted essential items. Please elaborate on your estimation logic and assumptions. [33 marks) The following information is extracted from the 2021 Interim report of Sun Hung Kei & Co. Limited. Total Interest Paid The total interest paid, including the Bank and other borrowings' and "Notes/paper payable" during the six months, is $287.9 million 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 26 23 25 137.2 2,510.0 0.4 53.0 216.9 6,144.5 9,062.0 37,536.7 Dividend History: 2020: 26 cents per share 2019: 26 cents per share Notes/paper Payable Information: The Rotes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Info > SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kai & Co BVI Ltd Ask Price 100.757 (USD) Gond Sector Financials Coupon Rate: 4.650(%p.a) Maturity Date: 08 Sep 2022 Bond Sector Financials Coupon Rate: 5.750%) Maturity Date: 15 Nov 2024 SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kai & Co BVI Ltd Ask Price 103.417 (USD) Long-term Capital (HK$ Million) 30/6/2021 Notes Unaudited 24 8,752.3 16,535.2 Capital and Reserves Share capital Reserves Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 Non-current Liabilities Bond Information Bond issuer Bond Currency USD Issue Size 350,000,000 Sun Hung Kai & Co BVI Ltd Guarantor Sun Hung Kai & Co Ltd Announcement Date 06 Nov 2019 ISIN Annual Coupon Rate la 5.750 Coupon Type Fixed Reference Rate XS2079034265 CUSIP ZQ4642448 Issue Date 15 Nov 2019 Maturity Date 15 Nov 2024 Bond Type High Yield Corporate Annual Coupon Frequency Semi Annually Years to Maturity 2.715 Min Investment Quantity Bond Sector Financials USD 200,000 Issue/Refer Price 100.000 Bond Information 57 Bond Currency USD Issue Size 445,186,000 Bond issuer Sun Hung Kai & Co BVI Ltd Guarantor Sun Hung Kai & Co Ltd ISIN XS1677026350 Annual Coupon Rate(%) 4.650 Coupon Type Fixed Reference Rate CUSIP A09341824 Announcement Date 31 Aug 2017 Issue Date 08 Sep 2017 Maturity Date 08 Sep 2022 Years to Maturity 0.526 Issue/Reoffer Price 100.000 Bond Type High Yield Corporate Blond Sector Financials Annual Coupon Frequency Semi Annually Min.westment Quantity USD 200,000