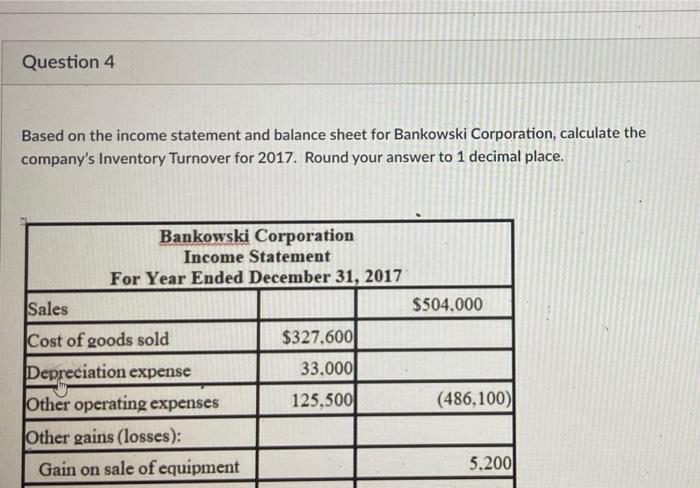

Question: Question 4 Based on the income statement and balance sheet for Bankowski Corporation, calculate the company's Inventory Turnover for 2017. Round your answer to 1

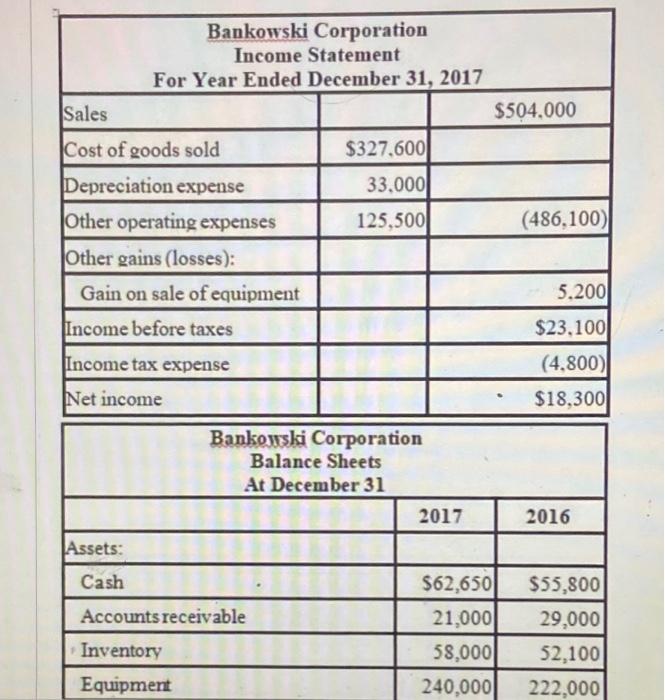

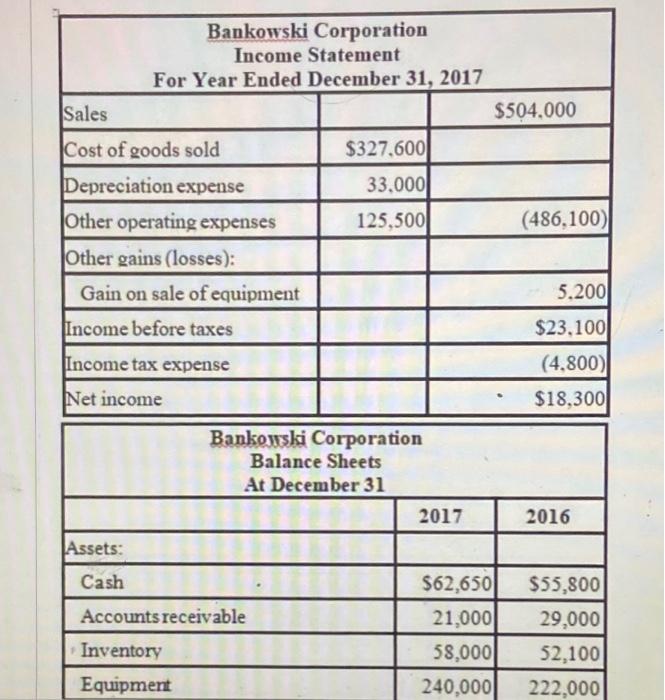

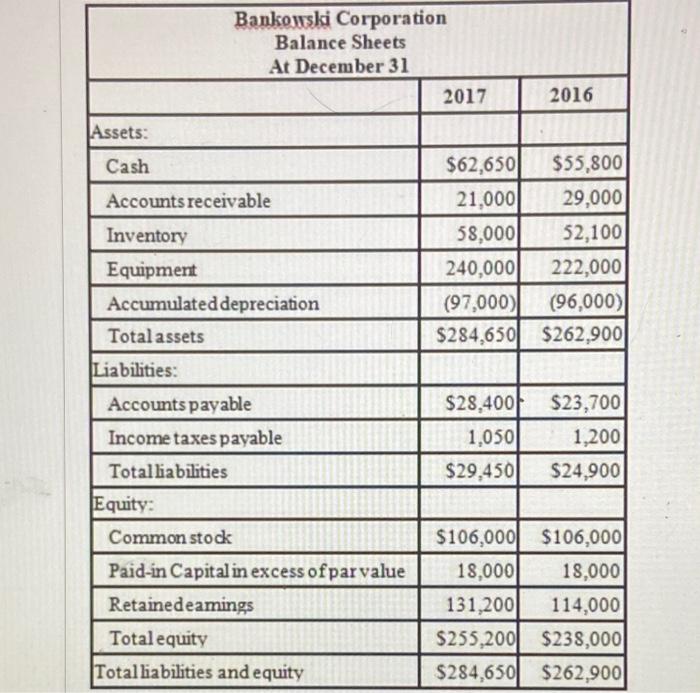

Question 4 Based on the income statement and balance sheet for Bankowski Corporation, calculate the company's Inventory Turnover for 2017. Round your answer to 1 decimal place. $504.000 Bankowski Corporation Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold $327,600 Depreciation expense 33,000 Other operating expenses 125,500 Other gains (losses): Gain on sale of equipment (486,100) 5.200 Bankowski Corporation Income Statement For Year Ended December 31, 2017 Sales $504,000 Cost of goods sold $327.600 33.000 125,500 (486,100) Depreciation expense Other operating expenses Other gains (losses): Gain on sale of equipment Income before taxes 5.200 $23.100 Income tax expense (4.800) Net income $18,300 Bankowski Corporation Balance Sheets At December 31 2017 2016 Assets: Cash Accounts receivable Inventory Equipment $62,650 21,000 58,000 240,000 $55,800 29,000 52,100 222,000 Bankowski Corporation Income Statement For Year Ended December 31, 2017 Sales $504,000 Cost of goods sold $327.600 33.000 125,500 (486,100) Depreciation expense Other operating expenses Other gains (losses): Gain on sale of equipment Income before taxes 5.200 $23.100 Income tax expense (4.800) Net income $18,300 Bankowski Corporation Balance Sheets At December 31 2017 2016 Assets: Cash Accounts receivable Inventory Equipment $62,650 21,000 58,000 240,000 $55,800 29,000 52,100 222,000 Bankowski Corporation Balance Sheets At December 31 2017 2016 Assets: Cash Accounts receivable Inventory $62,650 $55,800 21,0001 29,000 58,000 52,100 240,000 222,000 (97,000) (96,000) $284,650 $262,900 Equipment Accumulated depreciation Total assets Liabilities: $28,400 $23,700 1,0501 1,200 $29,4501 $24,900 Accounts payable Income taxes payable Total liabilities Equity: Common stock Paid-in Capital in excess of par value Retainedeamings Total equity Total liabilities and equity $100,000 $100,000 18.000 18,000 131,200 114,000 $255,200 $238,000 $284,650 $262,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts