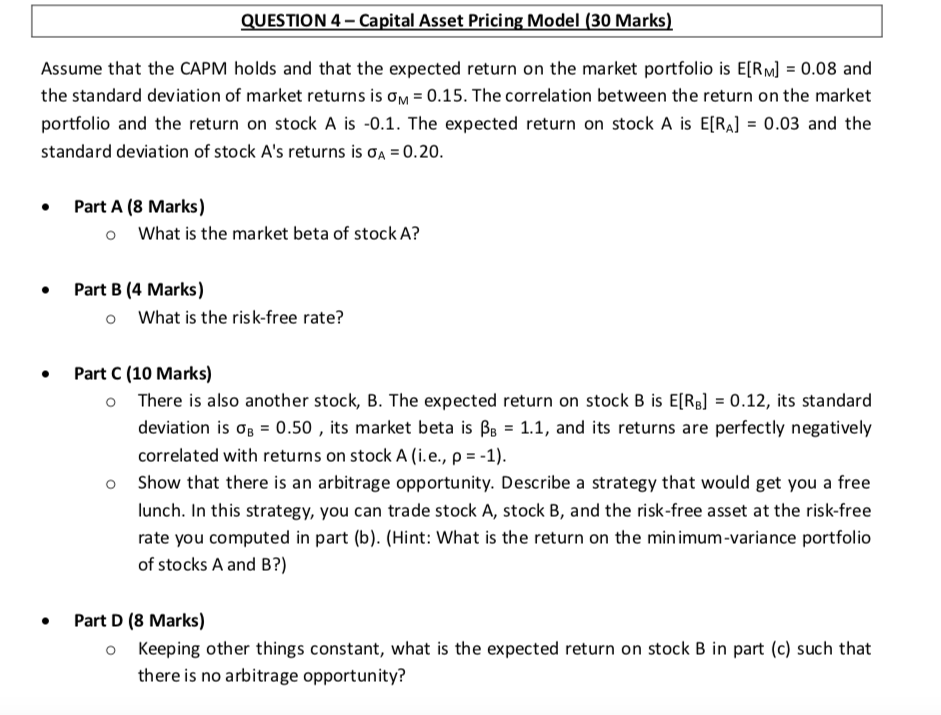

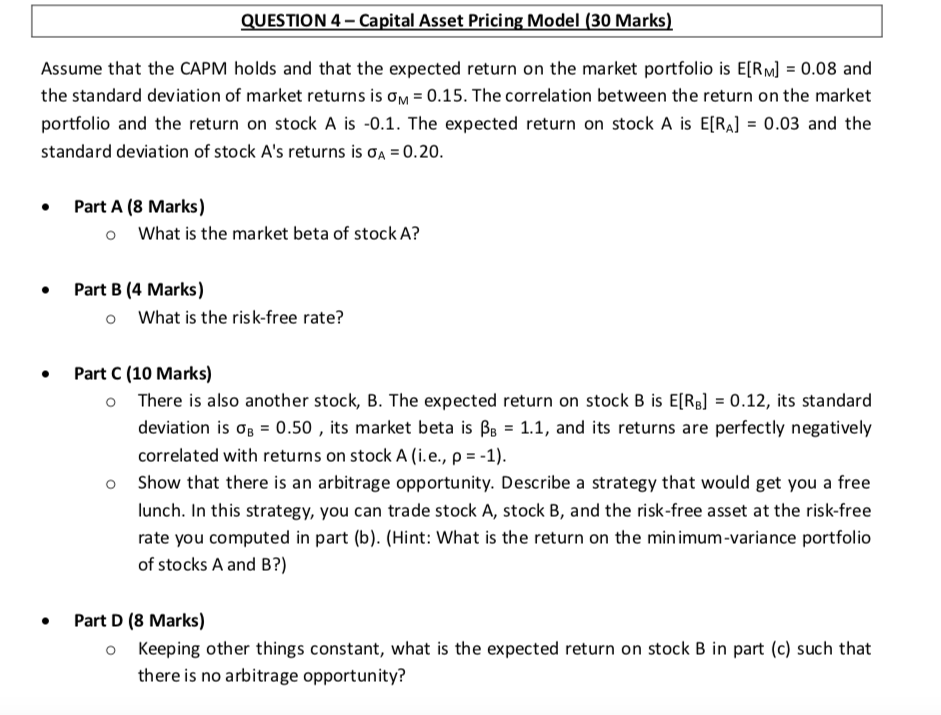

QUESTION 4 - Capital Asset Pricing Model (30 Marks) Assume that the CAPM holds and that the expected return on the market portfolio is E[RM] = 0.08 and the standard deviation of market returns is om = 0.15. The correlation between the return on the market portfolio and the return on stock A is -0.1. The expected return on stock A is E[RA] = 0.03 and the standard deviation of stock A's returns is A = 0.20. Part A (8 Marks) o What is the market beta of stock A? Part B (4 Marks) What is the risk-free rate? Part C (10 Marks) O There is also another stock, B. The expected return on stock B is E[RB] = 0.12, its standard deviation is 0g = 0.50, its market beta is BB = 1.1, and its returns are perfectly negatively correlated with returns on stock A (i.e., p = -1). Show that there is an arbitrage opportunity. Describe a strategy that would get you a free lunch. In this strategy, you can trade stock A, stock B, and the risk-free asset at the risk-free rate you computed in part (b). (Hint: What is the return on the minimum-variance portfolio of stocks A and B?) Part D (8 Marks) o Keeping other things constant, what is the expected return on stock B in part (c) such that there is no arbitrage opportunity? QUESTION 4 - Capital Asset Pricing Model (30 Marks) Assume that the CAPM holds and that the expected return on the market portfolio is E[RM] = 0.08 and the standard deviation of market returns is om = 0.15. The correlation between the return on the market portfolio and the return on stock A is -0.1. The expected return on stock A is E[RA] = 0.03 and the standard deviation of stock A's returns is A = 0.20. Part A (8 Marks) o What is the market beta of stock A? Part B (4 Marks) What is the risk-free rate? Part C (10 Marks) O There is also another stock, B. The expected return on stock B is E[RB] = 0.12, its standard deviation is 0g = 0.50, its market beta is BB = 1.1, and its returns are perfectly negatively correlated with returns on stock A (i.e., p = -1). Show that there is an arbitrage opportunity. Describe a strategy that would get you a free lunch. In this strategy, you can trade stock A, stock B, and the risk-free asset at the risk-free rate you computed in part (b). (Hint: What is the return on the minimum-variance portfolio of stocks A and B?) Part D (8 Marks) o Keeping other things constant, what is the expected return on stock B in part (c) such that there is no arbitrage opportunity