Answered step by step

Verified Expert Solution

Question

1 Approved Answer

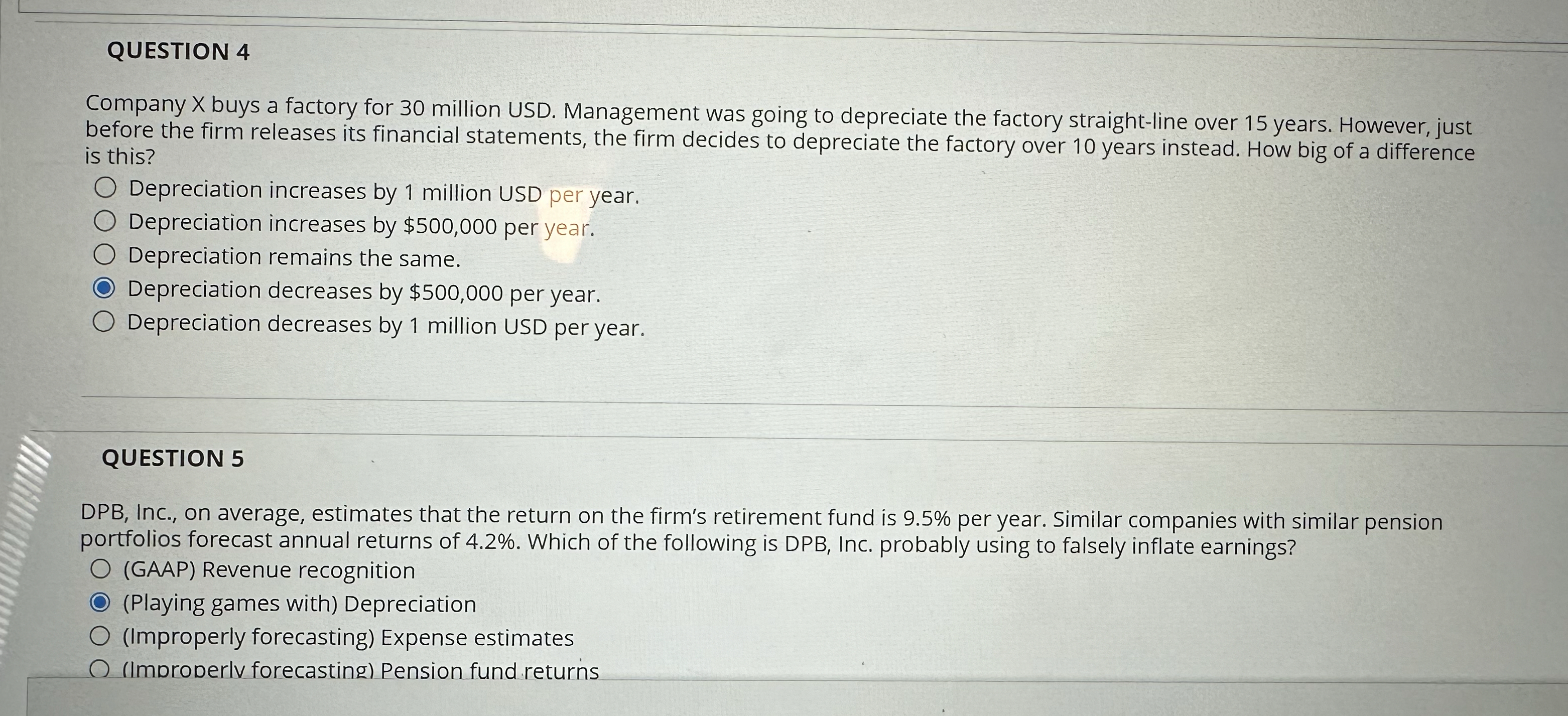

QUESTION 4 Company x buys a factory for 3 0 million USD. Management was going to depreciate the factory straight - line over 1 5

QUESTION

Company buys a factory for million USD. Management was going to depreciate the factory straightline over years. However, just before the firm releases its financial statements, the firm decides to depreciate the factory over years instead. How big of a difference is this?

Depreciation increases by million USD per year.

Depreciation increases by $ per year.

Depreciation remains the same.

Depreciation decreases by $ per year.

Depreciation decreases by million USD per year.

QUESTION

DPB Inc., on average, estimates that the return on the firm's retirement fund is per year. Similar companies with similar pension portfolios forecast annual returns of Which of the following is DPB Inc. probably using to falsely inflate earnings?

GAAP Revenue recognition

Playing games with Depreciation

Improperly forecasting Expense estimates

Imbroderlv forecasting Pension fund returns

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started