Answered step by step

Verified Expert Solution

Question

1 Approved Answer

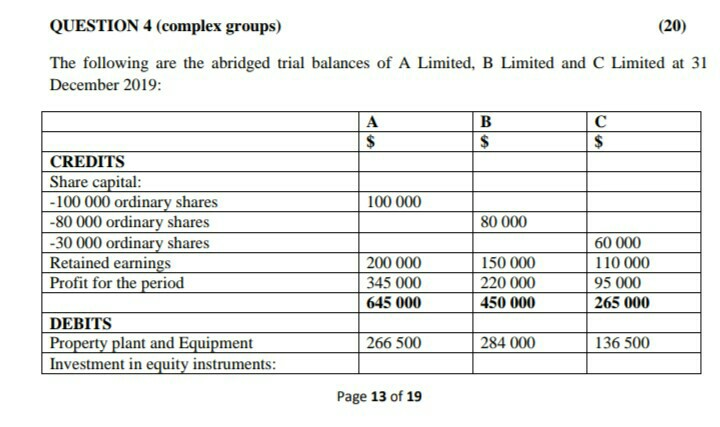

QUESTION 4 (complex groups) (20) The following are the abridged trial balances of A Limited, B Limited and C Limited at 31 December 2019: B

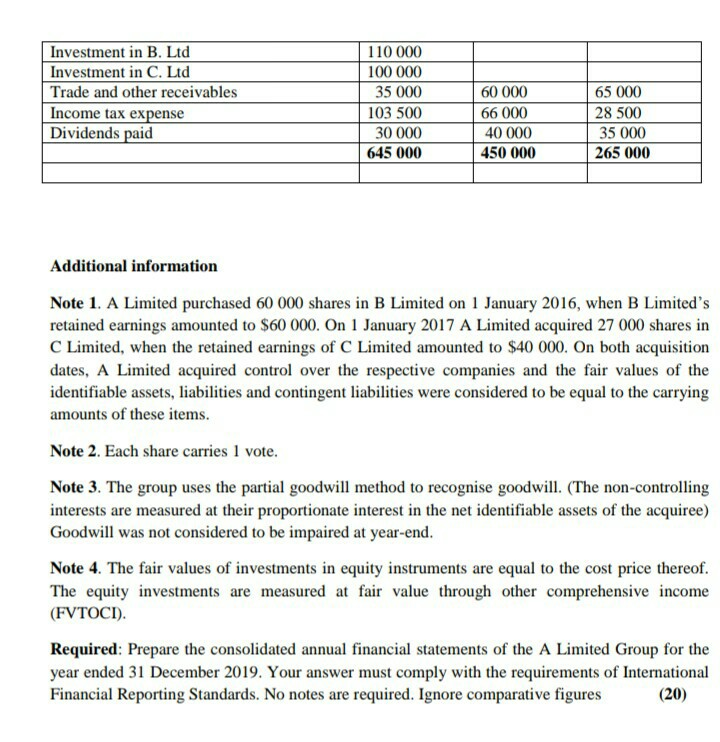

QUESTION 4 (complex groups) (20) The following are the abridged trial balances of A Limited, B Limited and C Limited at 31 December 2019: B 100 000 CREDITS Share capital: - 100 000 ordinary shares -80 000 ordinary shares -30 000 ordinary shares Retained earnings Profit for the period 80 000 200 000 345 000 645 000 150 000 220 000 450 000 60 000 110 000 95 000 265 000 DEBITS Property plant and Equipment Investment in equity instruments: 266 500 284 000 136 500 Page 13 of 19 Investment in B. Ltd Investment in C. Ltd Trade and other receivables Income tax expense Dividends paid 110 000 100 000 35 000 103 500 30 000 645 000 60 000 66 000 40 000 450 000 65 000 28 500 35 000 265 000 Additional information Note 1. A Limited purchased 60 000 shares in B Limited on 1 January 2016, when B Limited's retained earnings amounted to $60 000. On 1 January 2017 A Limited acquired 27 000 shares in C Limited, when the retained earnings of C Limited amounted to $40 000. On both acquisition dates, A Limited acquired control over the respective companies and the fair values of the identifiable assets, liabilities and contingent liabilities were considered to be equal to the carrying amounts of these items. Note 2. Each share carries 1 vote Note 3. The group uses the partial goodwill method to recognise goodwill. (The non-controlling interests are measured at their proportionate interest in the net identifiable assets of the acquiree) Goodwill was not considered to be impaired at year-end Note 4. The fair values of investments in equity instruments are equal to the cost price thereof. The equity investments are measured at fair value through other comprehensive income (FVTOCI). Required: Prepare the consolidated annual financial statements of the A Limited Group for the year ended 31 December 2019. Your answer must comply with the requirements of International Financial Reporting Standards. No notes are required. Ignore comparative figures (20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started