Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Consider an all-equity firm whose only asset is the option of investing in one of two mutually exclusive projects. Each project requires an

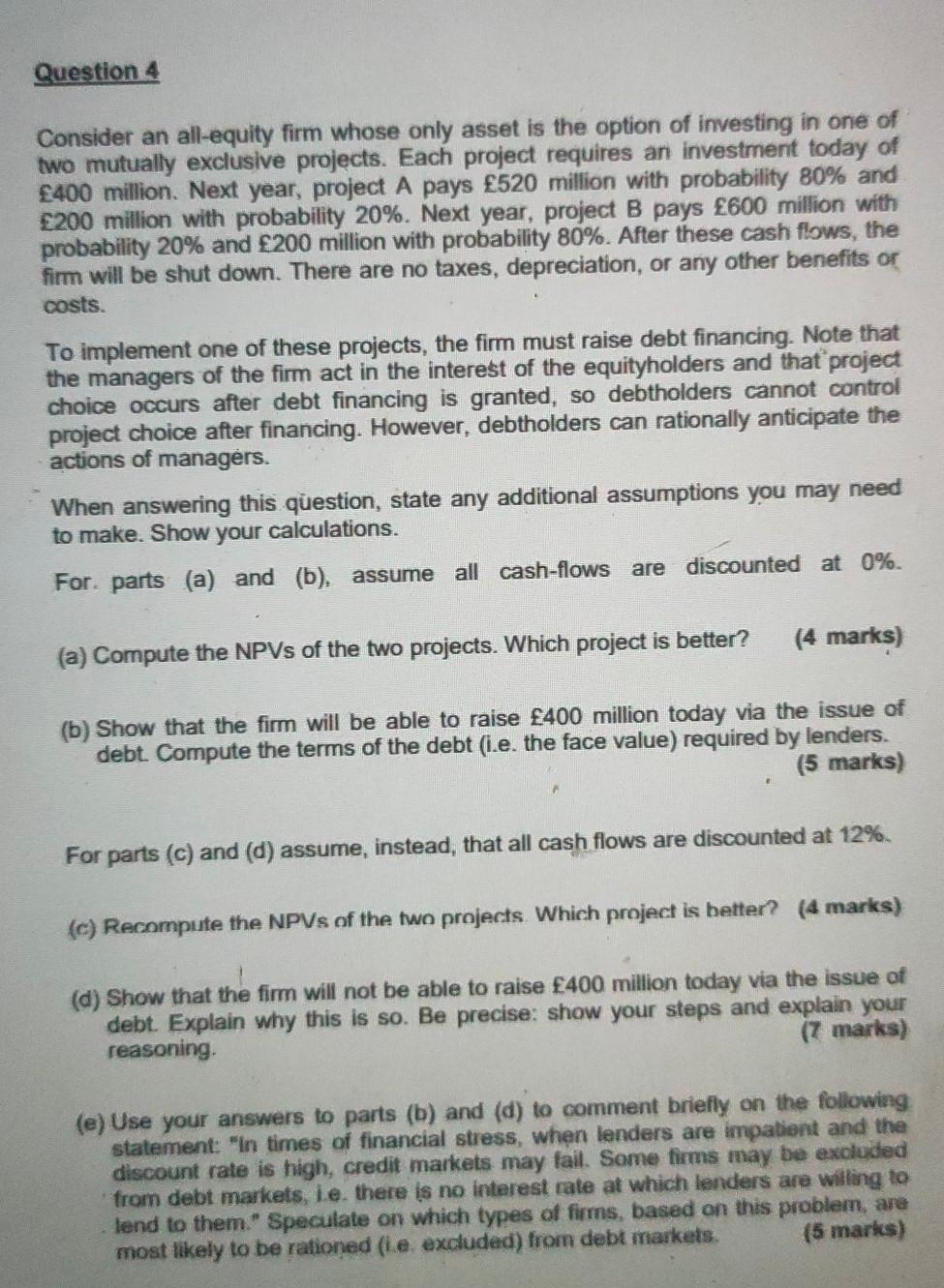

Question 4 Consider an all-equity firm whose only asset is the option of investing in one of two mutually exclusive projects. Each project requires an investment today of 400 million. Next year, project A pays 520 million with probability 80% and 200 million with probability 20%. Next year, project B pays 600 million with probability 20% and 200 million with probability 80%. After these cash flows, the firm will be shut down. There are no taxes, depreciation, or any other benefits or costs. To implement one of these projects, the firm must raise debt financing. Note that the managers of the firm act in the interest of the equityholders and that project choice occurs after debt financing is granted, so debtholders cannot control project choice after financing. However, debtholders can rationally anticipate the actions of managers. When answering this question, state any additional assumptions you may need to make. Show your calculations. For parts (a) and (b), assume all cash-flows are discounted at 0%. (4 marks) (a) Compute the NPVs of the two projects. Which project is better? (b) Show that the firm will be able to raise 400 million today via the issue of debt Compute the terms of the debt (i.e. the face value) required by lenders. (5 marks) For parts (C) and (d) assume, instead, that all cash flows are discounted at 12% (c) Recompute the NPVs of the two projects Which project is better? (4 marks) (d) Show that the firm will not be able to raise 400 million today via the issue of debt. Explain why this is so. Be precise: show your steps and explain your reasoning. (7 marks) (e) Use your answers to parts (b) and (d) to comment briefly on the following statement: "in times of financial stress, when lenders are impatient and the discount rate is high, credit markets may fail. Some firms may be excluded from debt markets, ie, there is no interest rate at which lenders are willing to lend to them." Speculate on which types of firms, based on this problem, are most likely to be rationed (ie excluded) from debt markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started