Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Consider an investor with the following utility function; U(W) = 10 + VW 4.1 Plot the utility function, characterise the investor's attitude

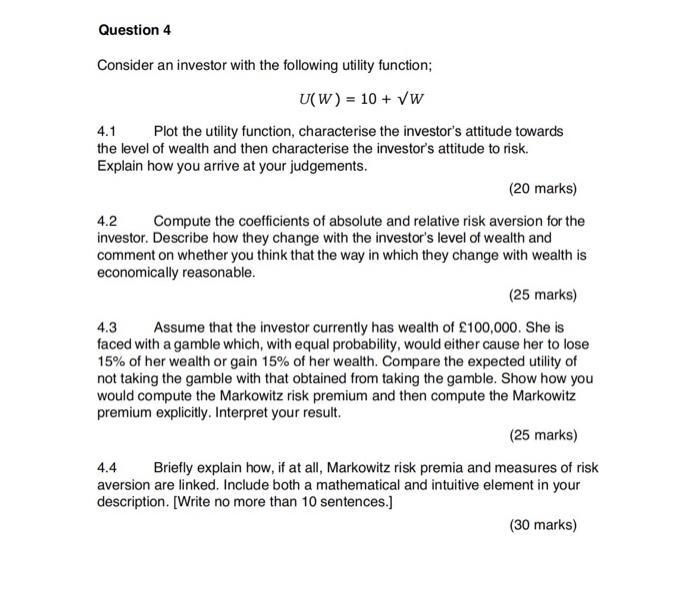

Question 4 Consider an investor with the following utility function; U(W) = 10 + VW 4.1 Plot the utility function, characterise the investor's attitude towards the level of wealth and then characterise the investor's attitude to risk. Explain how you arrive at your judgements. (20 marks) 4.2 Compute the coefficients of absolute and relative risk aversion for the investor. Describe how they change with the investor's level of wealth and comment on whether you think that the way in which they change with wealth is economically reasonable. (25 marks) 4.3 Assume that the investor currently has wealth of 100,000. She is faced with a gamble which, with equal probability, would either cause her to lose 15% of her wealth or gain 15% of her wealth. Compare the expected utility of not taking the gamble with that obtained from taking the gamble. Show how you would compute the Markowitz risk premium and then compute the Markowitz premium explicitly. Interpret your result. (25 marks) 4.4 Briefly explain how, if at all, Markowitz risk premia and measures of risk aversion are linked. Include both a mathematical and intuitive element in your description. [Write no more than 10 sentences.] (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Investors Preferences and Risk Aversion 41 42 41 Plotting the Utility Function and Characterizing Preferences Plot The utility function UW 10 W is plotted as a concave upward curve starting from 0 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started