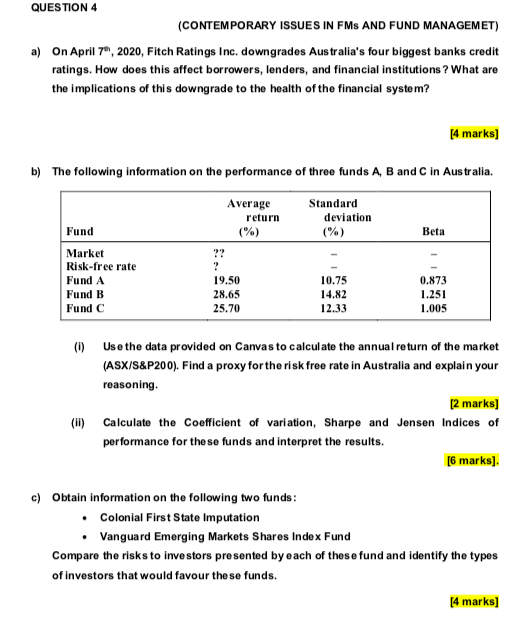

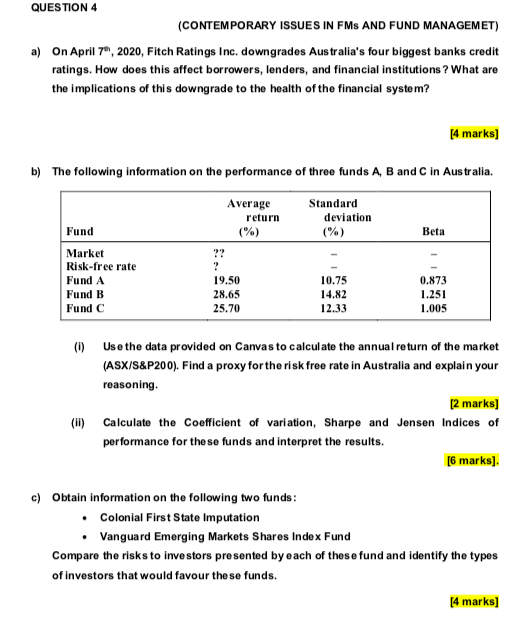

QUESTION 4 (CONTEMPORARY ISSUES IN FMS AND FUND MANAGEMET) a) On April 7, 2020, Fitch Ratings Inc. downgrades Australia's four biggest banks credit ratings. How does this affect borrowers, lenders, and financial institutions ? What are the implications of this downgrade to the health of the financial system? [4 marks] b) The following information on the performance of three funds A, B and C in Australia. Average return (%) Standard deviation (%) Fund Beta ?? ? Market Risk-free rate Fund A Fund B Fund C 19.50 10.75 0.873 1.251 28.65 14.82 25.70 12.33 1.005 (0) Use the data provided on Canvas to calculate the annual return of the market (ASX/S&P200). Find a proxy for the risk free rate in Australia and explain your reasoning. [2 marks] (1) Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. [6 marks]. c) Obtain information on the following two funds: Colonial First State Imputation Vanguard Emerging Markets Shares Index Fund Compare the risks to investors presented by each of these fund and identify the types of investors that would favour these funds. [4 marks) QUESTION 4 (CONTEMPORARY ISSUES IN FMS AND FUND MANAGEMET) a) On April 7, 2020, Fitch Ratings Inc. downgrades Australia's four biggest banks credit ratings. How does this affect borrowers, lenders, and financial institutions ? What are the implications of this downgrade to the health of the financial system? [4 marks] b) The following information on the performance of three funds A, B and C in Australia. Average return (%) Standard deviation (%) Fund Beta ?? ? Market Risk-free rate Fund A Fund B Fund C 19.50 10.75 0.873 1.251 28.65 14.82 25.70 12.33 1.005 (0) Use the data provided on Canvas to calculate the annual return of the market (ASX/S&P200). Find a proxy for the risk free rate in Australia and explain your reasoning. [2 marks] (1) Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. [6 marks]. c) Obtain information on the following two funds: Colonial First State Imputation Vanguard Emerging Markets Shares Index Fund Compare the risks to investors presented by each of these fund and identify the types of investors that would favour these funds. [4 marks)