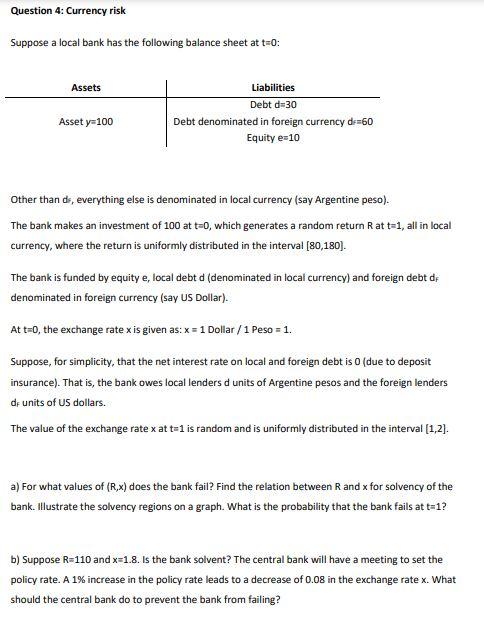

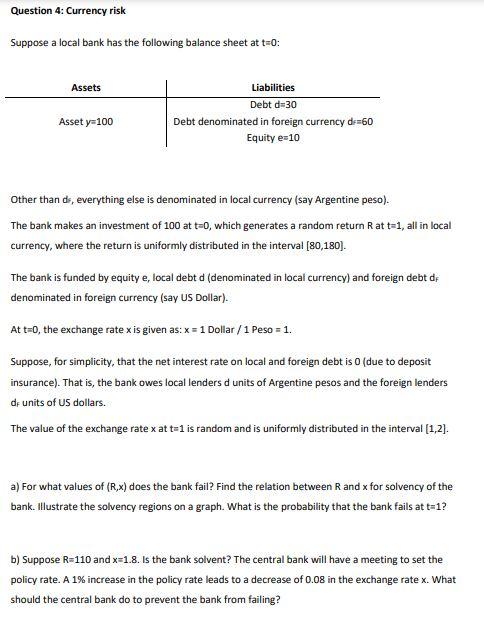

Question 4: Currency risk Suppose a local bank has the following balance sheet at t=0: Assets Liabilities Debt d=30 Debt denominated in foreign currency d=60 Equity e-10 Asset ya 100 Other than ds, everything else is denominated in local currency (say Argentine peso). The bank makes an investment of 100 at t=0, which generates a random return R at t=1, all in local currency, where the return is uniformly distributed in the interval [80,180). The bank is funded by equity e, local debt d (denominated in local currency) and foreign debt de denominated in foreign currency (say US Dollar). At t=0, the exchange rate x is given as: x = 1 Dollar / 1 Peso = 1. Suppose, for simplicity, that the net interest rate on local and foreign debt is o (due to deposit insurance). That is, the bank owes local lenders d units of Argentine pesos and the foreign lenders de units of US dollars. The value of the exchange rate x at t=1 is random and is uniformly distributed in the interval [1,2]. a) For what values of (R,x) does the bank fail? Find the relation between R and x for solvency of the bank. Illustrate the solvency regions on a graph. What is the probability that the bank fails at t=1? b) Suppose R=110 and x=1.8. Is the bank solvent? The central bank will have a meeting to set the policy rate. A 1% increase in the policy rate leads to a decrease of 0.08 in the exchange rate x. What should the central bank do to prevent the bank from failing? Question 4: Currency risk Suppose a local bank has the following balance sheet at t=0: Assets Liabilities Debt d=30 Debt denominated in foreign currency d=60 Equity e-10 Asset ya 100 Other than ds, everything else is denominated in local currency (say Argentine peso). The bank makes an investment of 100 at t=0, which generates a random return R at t=1, all in local currency, where the return is uniformly distributed in the interval [80,180). The bank is funded by equity e, local debt d (denominated in local currency) and foreign debt de denominated in foreign currency (say US Dollar). At t=0, the exchange rate x is given as: x = 1 Dollar / 1 Peso = 1. Suppose, for simplicity, that the net interest rate on local and foreign debt is o (due to deposit insurance). That is, the bank owes local lenders d units of Argentine pesos and the foreign lenders de units of US dollars. The value of the exchange rate x at t=1 is random and is uniformly distributed in the interval [1,2]. a) For what values of (R,x) does the bank fail? Find the relation between R and x for solvency of the bank. Illustrate the solvency regions on a graph. What is the probability that the bank fails at t=1? b) Suppose R=110 and x=1.8. Is the bank solvent? The central bank will have a meeting to set the policy rate. A 1% increase in the policy rate leads to a decrease of 0.08 in the exchange rate x. What should the central bank do to prevent the bank from failing