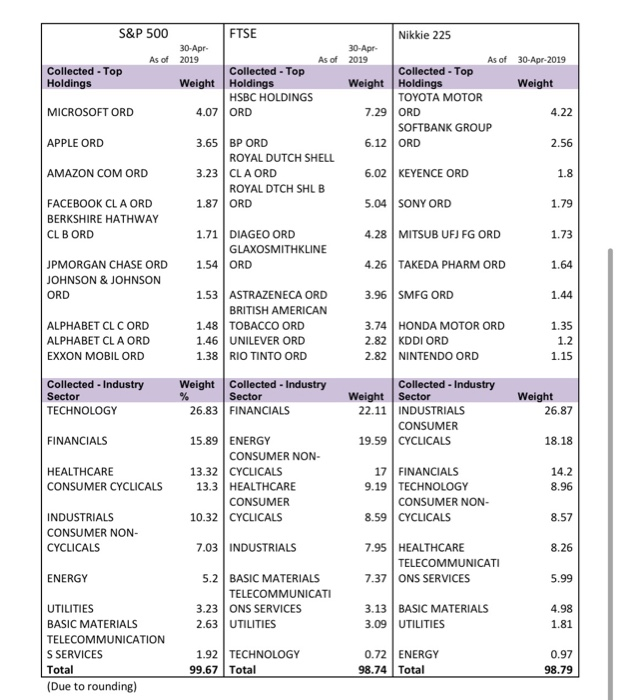

Question 4: Diversification across industry sectors with a single market and across multiple economies should result in higher levels of diversification benefits. a) The table (on the next page) provides the top ten holding and industry weighting for the indexes from three markets - US, UK and Japan. Using the information from this table, explain if investing in a capitalisation-weighted market index fund results in a well-diversified portfolio for that market? b) For a portfolio that allocates a third across each market by investing in the market index fund, explain if this portfolio is now be better diversified, than each single market portfolios? S&P 500 Nikkie 225 30-Apr- 2019 As of Collected - Top Holdings FTSE 30-Apr- 2019 As of Collected - Top Weight Holdings HSBC HOLDINGS 4.07 ORD Weight As of 30-Apr-2019 Collected - Top Holdings Weight TOYOTA MOTOR ORD SOFTBANK GROUP ORD MICROSOFT ORD 7.29 APPLE ORD 6.12 AMAZON COM ORD 3.65 BP ORD ROYAL DUTCH SHELL 3.23 CL A ORD ROYAL DTCH SHLB 1.87 ORD KEYENCE ORD 5.04 SONY ORD FACEBOOK CL A ORD BERKSHIRE HATHWAY CL B ORD 4.28 MITSUB UFJ FG ORD 1.71 DIAGEO ORD GLAXOSMITHKLINE 1.54 ORD 4.26 TAKEDA PHARM ORD JPMORGAN CHASE ORD JOHNSON & JOHNSON ORD 3.96 SMFG ORD ALPHABET CL CORD ALPHABET CL A ORD EXXON MOBIL ORD 1.53 ASTRAZENECA ORD BRITISH AMERICAN 1.48 TOBACCO ORD 1.46 UNILEVER ORD 1.38 RIO TINTO ORD 3.74 HONDA MOTOR ORD 2.82 KDDI ORD 2.82 NINTENDO ORD Weight Collected - Industry Sector TECHNOLOGY Collected - Industry Sector FINANCIALS Weight 26.83 Collected - Industry Weight Sector 22.11 INDUSTRIALS CONSUMER 19.59 CYCLICALS 26.87 FINANCIALS HEALTHCARE CONSUMER CYCLICALS 15.89 ENERGY CONSUMER NON- 13.32 CYCLICALS 13.3 HEALTHCARE CONSUMER 10.32 CYCLICALS 17 9.19 FINANCIALS TECHNOLOGY CONSUMER NON- CYCLICALS 8.59 INDUSTRIALS CONSUMER NON- CYCLICALS 00000000 7.03 INDUSTRIALS 7.95 HEALTHCARE TELECOMMUNICATI 7.37 ONS SERVICES ENERGY 5.2 BASIC MATERIALS TELECOMMUNICATI 3.23 ONS SERVICES 2.63 UTILITIES 3.13 BASIC MATERIALS 3.09 UTILITIES UTILITIES BASIC MATERIALS TELECOMMUNICATION S SERVICES Total (Due to rounding) 1.92 TECHNOLOGY 99.67 Total 0.72 98.74 ENERGY Total 98.79 Question 4: Diversification across industry sectors with a single market and across multiple economies should result in higher levels of diversification benefits. a) The table (on the next page) provides the top ten holding and industry weighting for the indexes from three markets - US, UK and Japan. Using the information from this table, explain if investing in a capitalisation-weighted market index fund results in a well-diversified portfolio for that market? b) For a portfolio that allocates a third across each market by investing in the market index fund, explain if this portfolio is now be better diversified, than each single market portfolios? S&P 500 Nikkie 225 30-Apr- 2019 As of Collected - Top Holdings FTSE 30-Apr- 2019 As of Collected - Top Weight Holdings HSBC HOLDINGS 4.07 ORD Weight As of 30-Apr-2019 Collected - Top Holdings Weight TOYOTA MOTOR ORD SOFTBANK GROUP ORD MICROSOFT ORD 7.29 APPLE ORD 6.12 AMAZON COM ORD 3.65 BP ORD ROYAL DUTCH SHELL 3.23 CL A ORD ROYAL DTCH SHLB 1.87 ORD KEYENCE ORD 5.04 SONY ORD FACEBOOK CL A ORD BERKSHIRE HATHWAY CL B ORD 4.28 MITSUB UFJ FG ORD 1.71 DIAGEO ORD GLAXOSMITHKLINE 1.54 ORD 4.26 TAKEDA PHARM ORD JPMORGAN CHASE ORD JOHNSON & JOHNSON ORD 3.96 SMFG ORD ALPHABET CL CORD ALPHABET CL A ORD EXXON MOBIL ORD 1.53 ASTRAZENECA ORD BRITISH AMERICAN 1.48 TOBACCO ORD 1.46 UNILEVER ORD 1.38 RIO TINTO ORD 3.74 HONDA MOTOR ORD 2.82 KDDI ORD 2.82 NINTENDO ORD Weight Collected - Industry Sector TECHNOLOGY Collected - Industry Sector FINANCIALS Weight 26.83 Collected - Industry Weight Sector 22.11 INDUSTRIALS CONSUMER 19.59 CYCLICALS 26.87 FINANCIALS HEALTHCARE CONSUMER CYCLICALS 15.89 ENERGY CONSUMER NON- 13.32 CYCLICALS 13.3 HEALTHCARE CONSUMER 10.32 CYCLICALS 17 9.19 FINANCIALS TECHNOLOGY CONSUMER NON- CYCLICALS 8.59 INDUSTRIALS CONSUMER NON- CYCLICALS 00000000 7.03 INDUSTRIALS 7.95 HEALTHCARE TELECOMMUNICATI 7.37 ONS SERVICES ENERGY 5.2 BASIC MATERIALS TELECOMMUNICATI 3.23 ONS SERVICES 2.63 UTILITIES 3.13 BASIC MATERIALS 3.09 UTILITIES UTILITIES BASIC MATERIALS TELECOMMUNICATION S SERVICES Total (Due to rounding) 1.92 TECHNOLOGY 99.67 Total 0.72 98.74 ENERGY Total 98.79