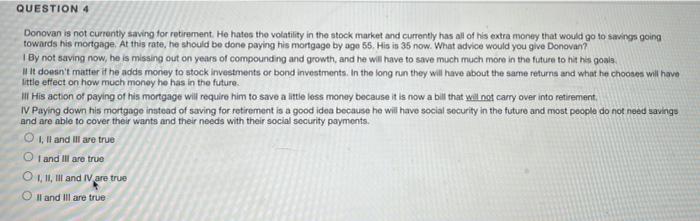

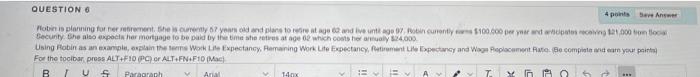

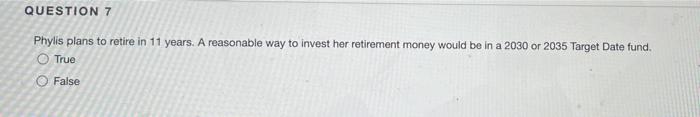

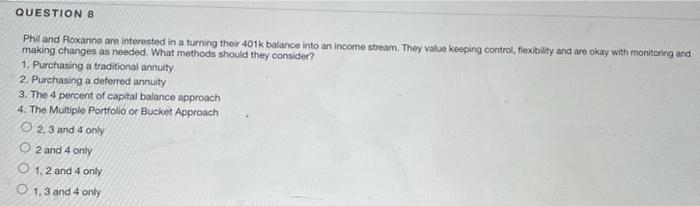

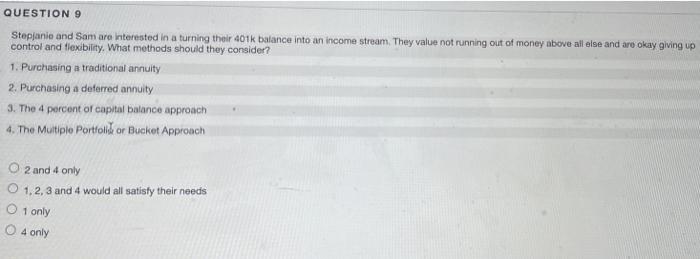

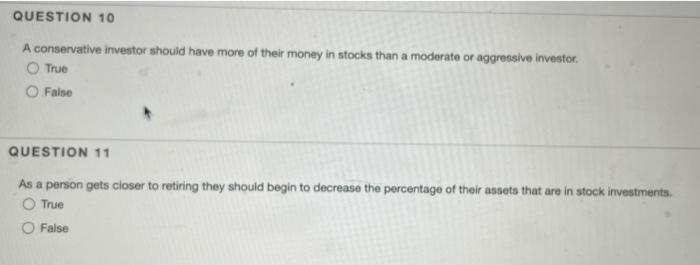

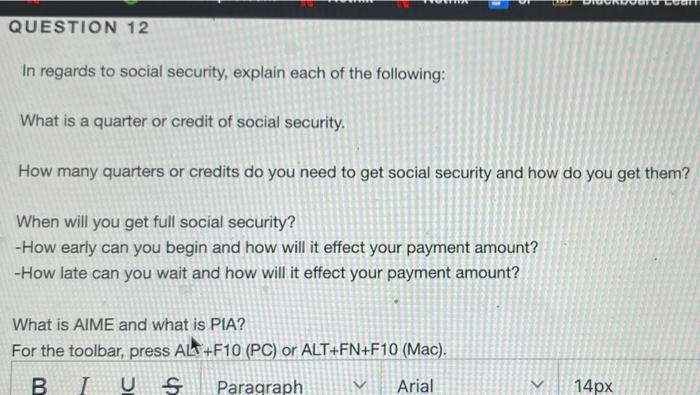

QUESTION 4 Donovan is not currently saving for retirement. He hates the volatility in the stock market and currently has all of his extra money that would go to Savings going towards his mortgage. At this rate, he should be done paying his mortgage by age 55. His is 35 now. What advice would you give Donovan? By not saving now, he is missing out on years of compounding and growth, and he will have to save much much more in the future to hit his goals It doesn't matter if he adds money to stock investments or bond investments. In the long run they will have about the same returns and what he chooses will have little effect on how much money he has in the future all His action of paying of his mortgage will require him to save a little less money because it is now a bill that will not carry over into retirement, IV Paying down his mortgage instead of saving for retirement is a good idea because he will have social security in the future and most people do not need savings and are able to cover their wants and their needs with their social security payments. On and I are true O t and Ill are true 1,1, and I are true Oil and Ill are true QUESTION 6 4 points Beve Answer Mobinis planning for retirement, the years and plans to it age and live unterently a 100.000 din 21.000 tonto Security. She also expect her mortgage to be paid by the time wheretres at age which controly 24,000 Using Robin as an examplain the Work Lite Expectancy, Hamining Work Lite Expectancy, Potret Life Expectancy and Wageplacement to completa eam you paint For the toolbar pros ALT F10 Por ALT FN:F10 (Mac) B. 1 U S Paragraph Ana 14 nx A T x QUESTION 7 Phylis plans to retire in 11 years. A reasonable way to invest her retirement money would be in a 2030 or 2035 Target Date fund. O True O False QUESTIONS Phil and Roxanne are interested in a turning their 401k balance into an income stream. They value keeping control, flexibility and are okay with monitoring and making changes as needed. What methods should they consider? 1. Purchasing a traditional annuity 2. Purchasing a deterred annuity 3. The 4 percent of capital balance approach 4. The Multiple Portfolio or Bucket Approach O 2.3 and 4 only 2 and 4 only 1, 2 and 4 only 1.3 and 4 only QUESTION 9 Stepjanie and Sam are interested in a turning their 401k balance into an income stream. They value not running out of money above all else and are okay giving up control and flexibility. What methods should they consider? 1. Purchasing a traditional annuity 2. Purchasing a deferred annuity 3. The 4 percent of capital balance approach 4. The Multiple Portfolik or Bucket Approach O2 and 4 only 1.2, 3 and 4 would all satisfy their needs O1 only O 4 only QUESTION 10 A conservative investor should have more of their money in stocks than a moderate or aggressive investor True False QUESTION 11 As a person gets closer to retiring they should begin to decrease the percentage of their assets that are in stock investments. True O False QUESTION 12 In regards to social security, explain each of the following: What is a quarter or credit of social security. How many quarters or credits do you need to get social security and how do you get them? When will you get full social security? -How early can you begin and how will it effect your payment amount? -How late can you wait and how will it effect your payment amount? What is AIME and what is PIA? For the toolbar, press Alt+F10 (PC) or ALT+FN+F10 (Mac). B I U S Paragraph Arial 14px QUESTION 13 Explain the different ways to turn a lump sum of money into an income stream. Be sure to explain the 4% approach and the 3 bucket approach. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)