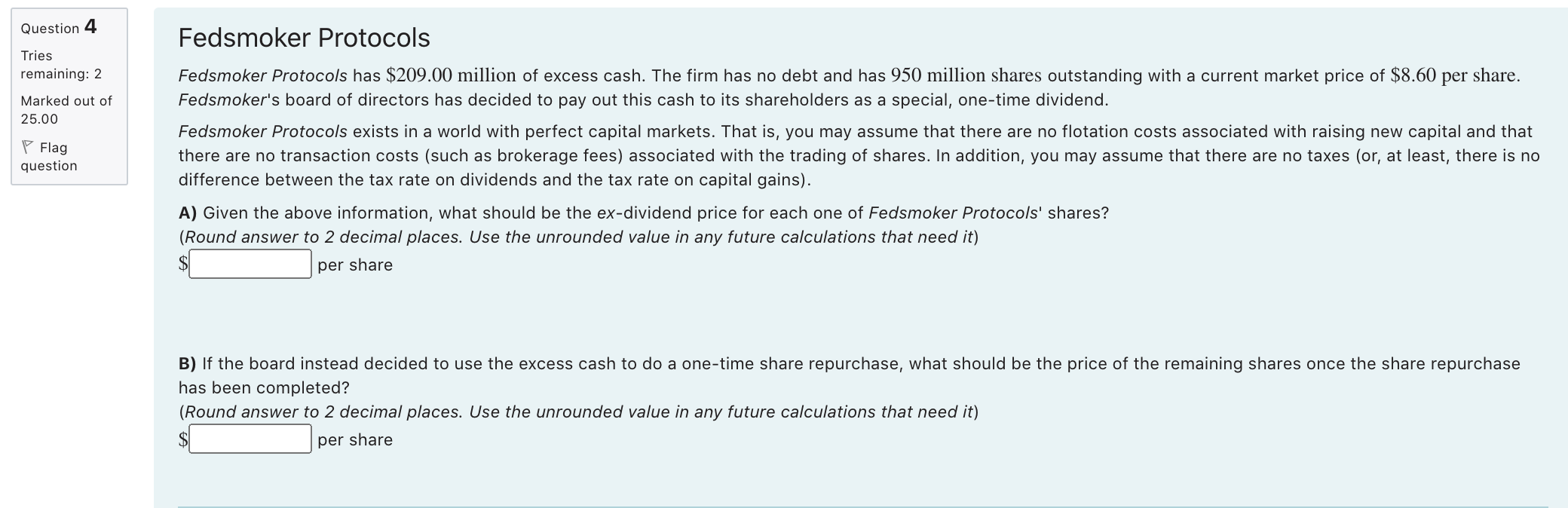

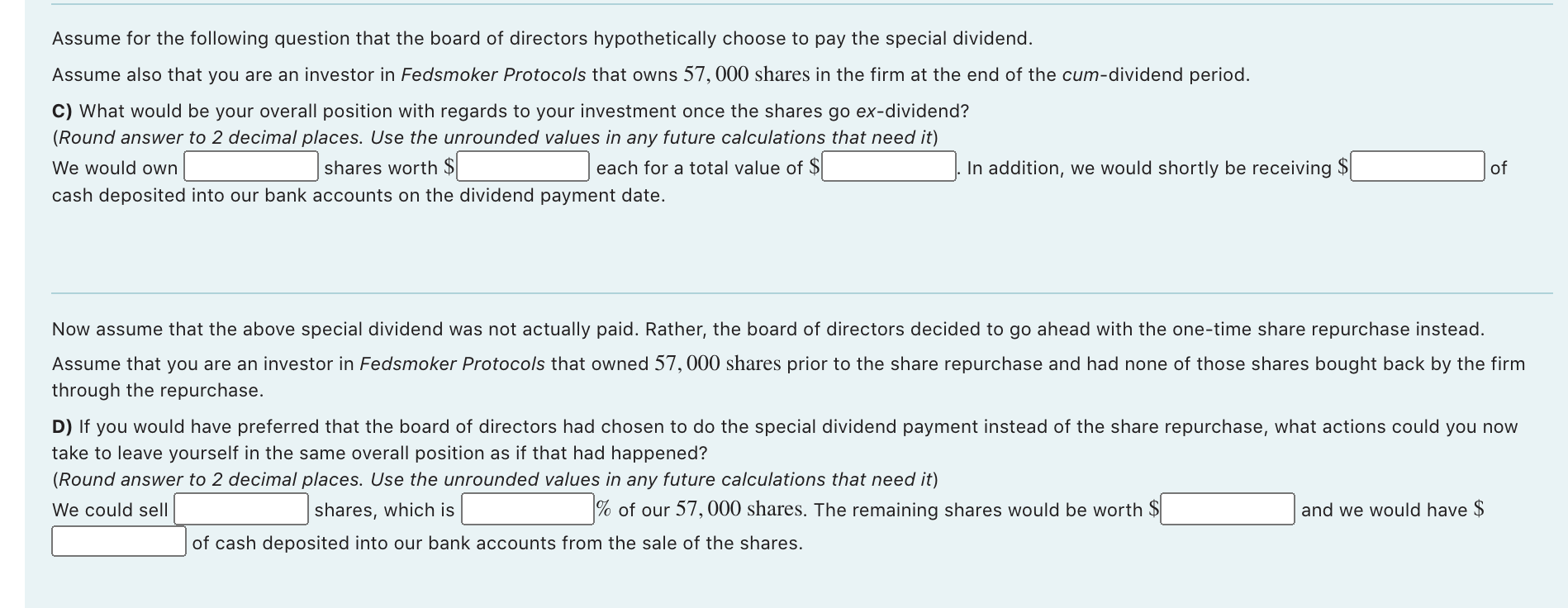

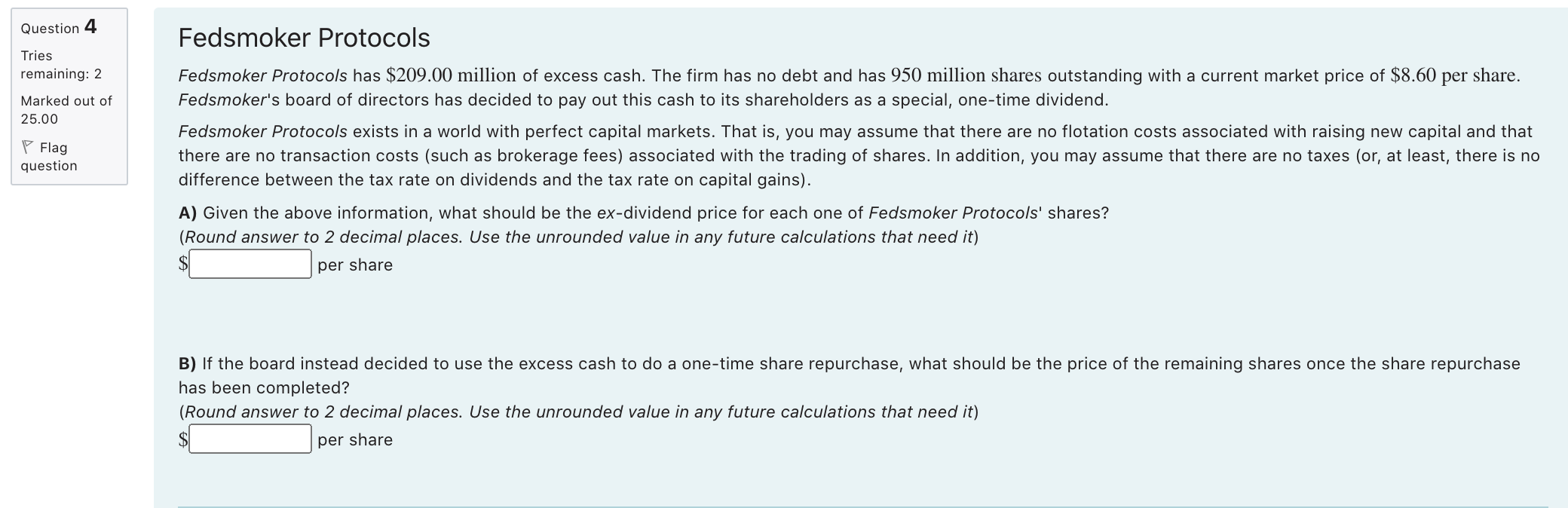

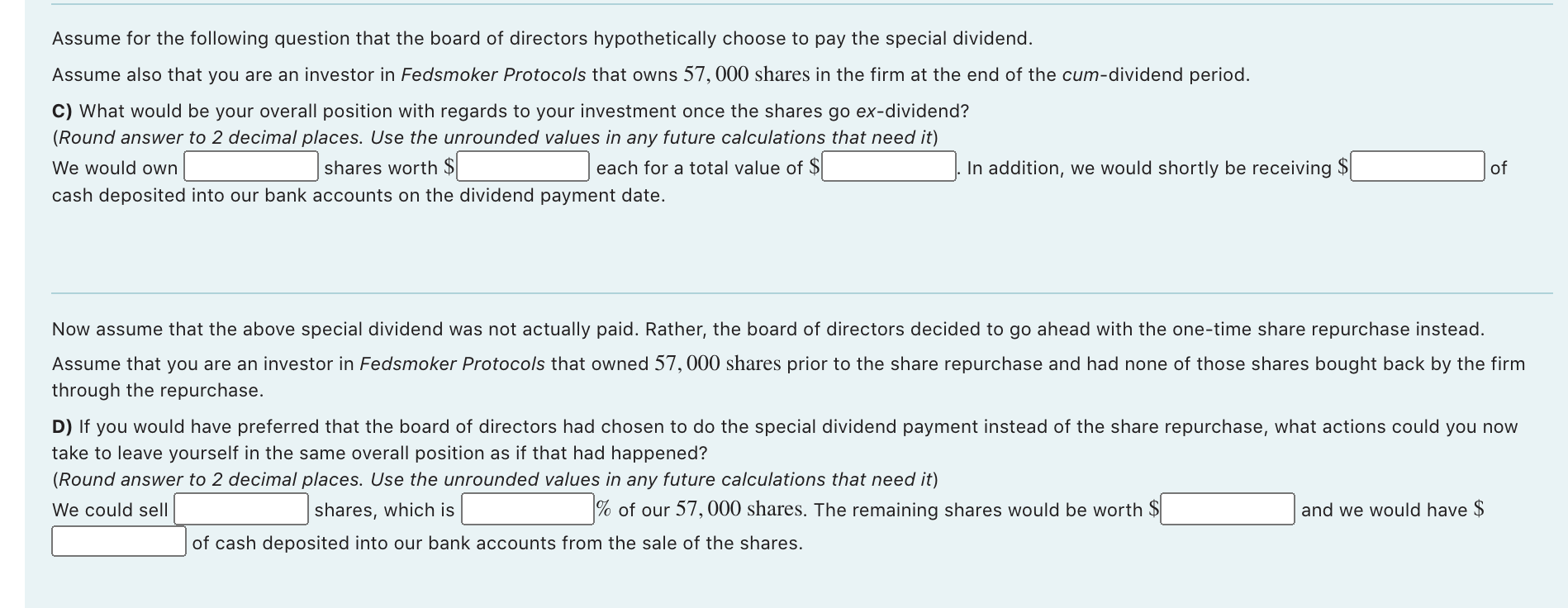

Question 4 Fedsmoker Protocols Tries remaining: 2 Marked out of 25.00 Flag question Fedsmoker Protocols has $209.00 million of excess cash. The firm has no debt and has 950 million shares outstanding with a current market price of $8.60 per share. Fedsmoker's board of directors has decided to pay out this cash to its shareholders as a special, one-time dividend. Fedsmoker Protocols exists in a world with perfect capital markets. That is, you may assume that there are no flotation costs associated with raising new capital and that there are no transaction costs (such as brokerage fees) associated with the trading of shares. In addition, you may assume that there are no taxes (or, at least, there is no difference between the tax rate on dividends and the tax rate on capital gains). A) Given the above information, what should be the ex-dividend price for each one of Fedsmoker Protocols' shares? (Round answer to 2 decimal places. Use the unrounded value in any future calculations that need it) per share B) If the board instead decided to use the excess cash to do a one-time share repurchase, what should be the price of the remaining shares once the share repurchase has been completed? (Round answer to 2 decimal places. Use the unrounded value in any future calculations that need it) per share Assume for the following question that the board of directors hypothetically choose to pay the special dividend. Assume also that you are an investor in Fedsmoker Protocols that owns 57,000 shares in the firm at the end of the cum-dividend period. C) What would be your overall position with regards to your investment once the shares go ex-dividend? (Round answer to 2 decimal places. Use the unrounded values in any future calculations that need it) We would own shares worth $ each for a total value of $ In addition, we would shortly be receiving cash deposited into our bank accounts on the dividend payment date. of Now assume that the above special dividend was not actually paid. Rather, the board of directors decided to go ahead with the one-time share repurchase instead. Assume that you are an investor in Fedsmoker Protocols that owned 57,000 shares prior to the share repurchase and had none of those shares bought back by the firm through the repurchase. D) If you would have preferred that the board of directors had chosen to do the special dividend payment instead of the share repurchase, what actions could you now take to leave yourself in the same overall position as if that had happened? (Round answer to 2 decimal places. Use the unrounded values in any future calculations that need it) We could sell shares, which is % of our 57,000 shares. The remaining shares would be worth $ and we would have $ of cash deposited into our bank accounts from the sale of the shares