Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 JJ is the owner of a cleaning company called Squeaky Clean (Pty) Ltd. The company's current financial year end is 31 December

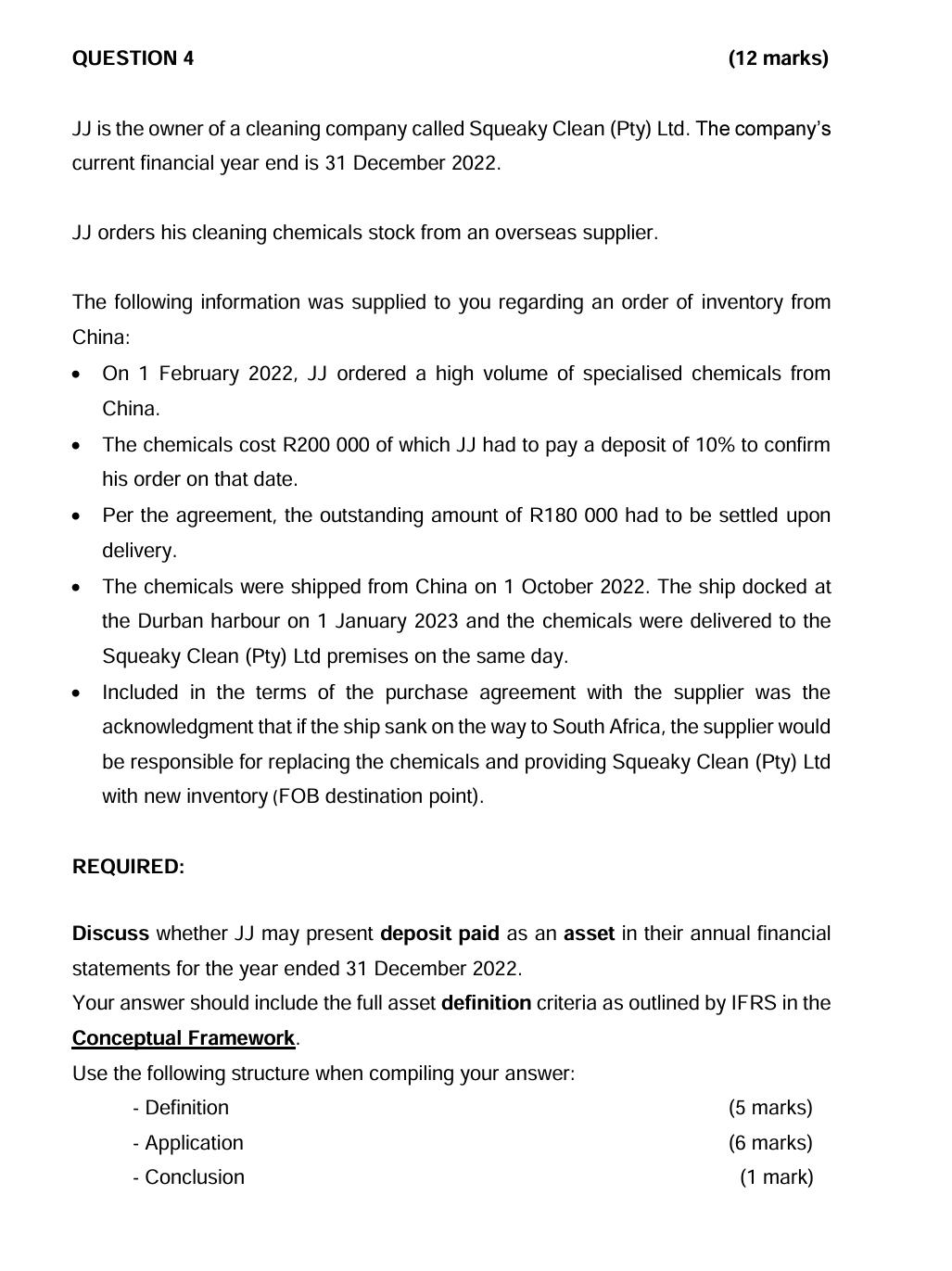

QUESTION 4 JJ is the owner of a cleaning company called Squeaky Clean (Pty) Ltd. The company's current financial year end is 31 December 2022. JJ orders his cleaning chemicals stock from an overseas supplier. The following information was supplied to you regarding an order of inventory from China: (12 marks) On 1 February 2022, JJ ordered a high volume of specialised chemicals from China. The chemicals cost R200 000 of which JJ had to pay a deposit of 10% to confirm his order on that date. Per the agreement, the outstanding amount of R180 000 had to be settled upon delivery. The chemicals were shipped from China on 1 October 2022. The ship docked at the Durban harbour on 1 January 2023 and the chemicals were delivered to the Squeaky Clean (Pty) Ltd premises on the same day. Included in the terms of the purchase agreement with the supplier was the acknowledgment that if the ship sank on the way to South Africa, the supplier would be responsible for replacing the chemicals and providing Squeaky Clean (Pty) Ltd with new inventory (FOB destination point). REQUIRED: Discuss whether JJ may present deposit paid as an asset in their annual financial statements for the year ended 31 December 2022. Your answer should include the full asset definition criteria as outlined by IFRS in the Conceptual Framework. Use the following structure when compiling your answer: - Definition - Application - Conclusion (5 marks) (6 marks) (1 mark)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To address the question of whether JJ may present the deposit paid as an asset in the annual financial statements for the year ended 31 December 2022 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started