Answered step by step

Verified Expert Solution

Question

1 Approved Answer

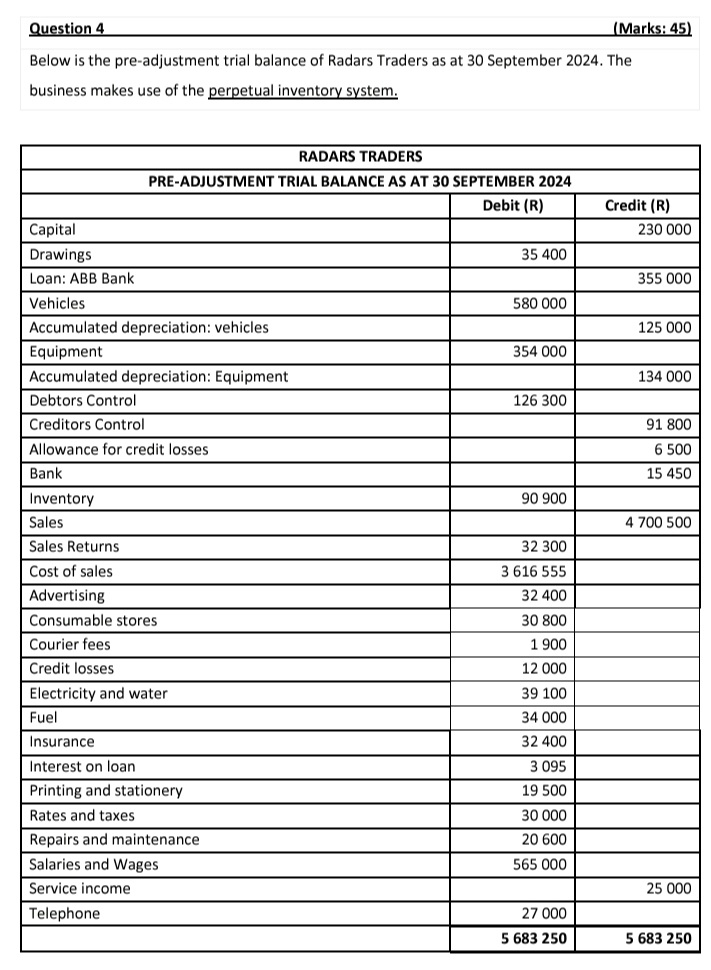

Question 4 ( Marks: 4 5 ) Below is the pre - adjustment trial balance of Radars Traders as at 3 0 September 2 0

Question

Marks:

Below is the preadjustment trial balance of Radars Traders as at September The

business makes use of the perpetual inventory system.

The owner took trading inventory with a cost price of R for his own personal use. This has not been adjusted for yet. According to the physical stock count at year end, the following was on hand: Trading inventory: R Consumable stores: R A new vehicle was purchased on July at a cost of R This has been correctly recorded in the accounting records. There were no other movements in noncurrent assets during the year. Depreciation rates are as follows: Equipment: per annum on the straightline basis. Vehicles: per annum on the diminishing balance method Depreciation on noncurrent assets on hand at yearend must still be accounted for. The September electricity invoice for R was only received on October and must still be accounted for. Management reviewed the Debtors Age Analysis at yearend and has decided the Allowance for credit losses should be R A service income invoice, issued on September was omitted in error from the September Debtors journal. The value of the invoice was R Interest on Loan is calculated at per annum. The loan was negotiated and received on August The first capital repayment of R was made on September Further monthly repayments of R are due from October use days for interest calculations The owner made a capital contribution of R cash on August The sales account was credited in error with this amount and must still be corrected. Ignore VAT

Prepare the general journal entry for adjustment eight above. Journal narrations are not required. Round to the nearest rand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started