Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (max 20 points) - Even though not presently the case, you expect that in the coming years reforesting a farm with trees could

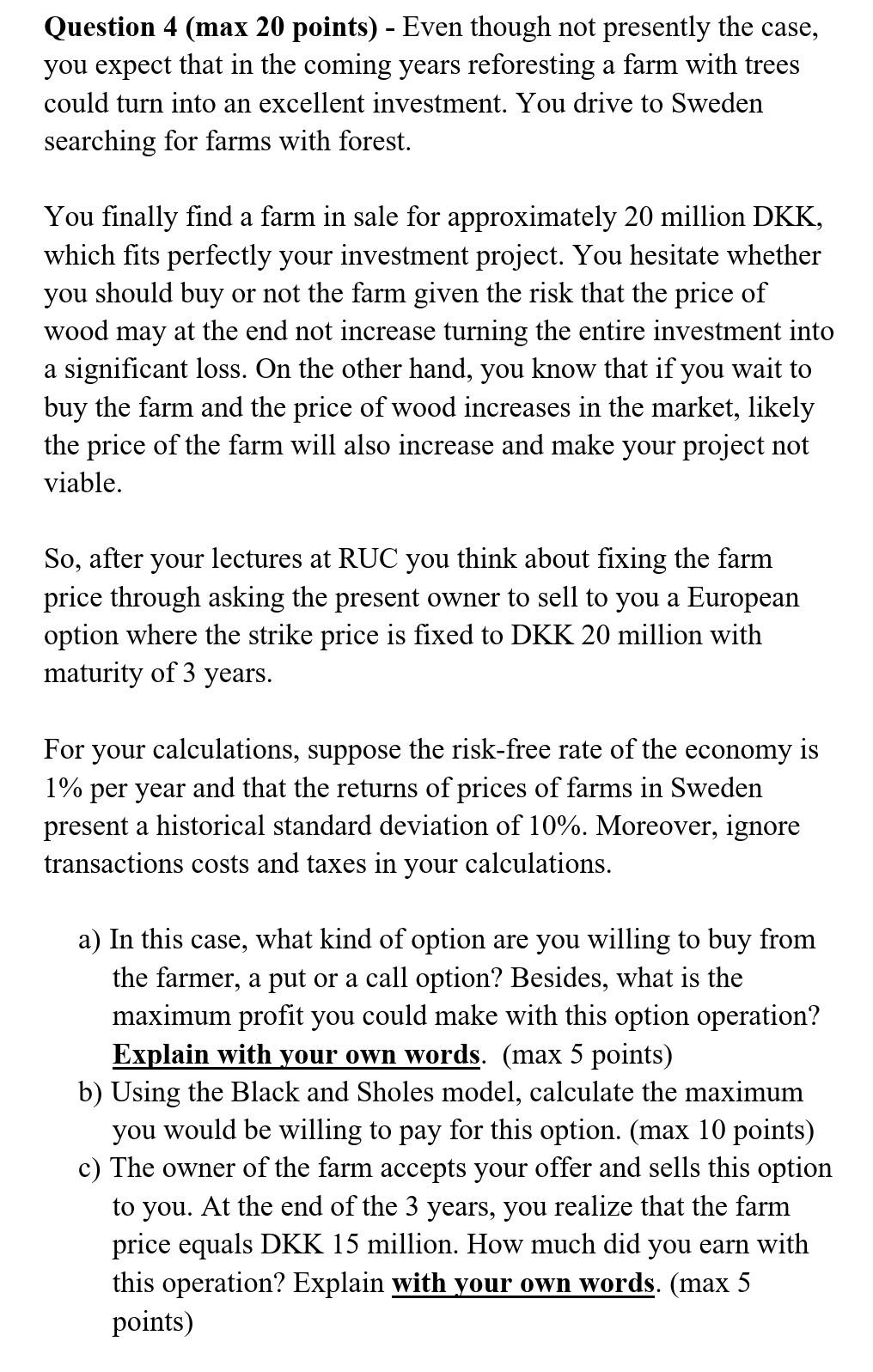

Question 4 (max 20 points) - Even though not presently the case, you expect that in the coming years reforesting a farm with trees could turn into an excellent investment. You drive to Sweden searching for farms with forest. You finally find a farm in sale for approximately 20 million DKK, which fits perfectly your investment project. You hesitate whether you should buy or not the farm given the risk that the price of wood may at the end not increase turning the entire investment into a significant loss. On the other hand, you know that if you wait to buy the farm and the price of wood increases in the market, likely the price of the farm will also increase and make your project not viable. So, after your lectures at RUC you think about fixing the farm price through asking the present owner to sell to you a European option where the strike price is fixed to DKK 20 million with maturity of 3 years. For your calculations, suppose the risk-free rate of the economy is 1% per year and that the returns of prices of farms in Sweden present a historical standard deviation of 10%. Moreover, ignore transactions costs and taxes in your calculations. a) In this case, what kind of option are you willing to buy from the farmer, a put or a call option? Besides, what is the maximum profit you could make with this option operation? Explain with your own words. (max 5 points) b) Using the Black and Sholes model, calculate the maximum you would be willing to pay for this option. (max 10 points) c) The owner of the farm accepts your offer and sells this option to you. At the end of the 3 years, you realize that the farm price equals DKK 15 million. How much did you earn with this operation? Explain with your own words. ( max5 points) Question 4 (max 20 points) - Even though not presently the case, you expect that in the coming years reforesting a farm with trees could turn into an excellent investment. You drive to Sweden searching for farms with forest. You finally find a farm in sale for approximately 20 million DKK, which fits perfectly your investment project. You hesitate whether you should buy or not the farm given the risk that the price of wood may at the end not increase turning the entire investment into a significant loss. On the other hand, you know that if you wait to buy the farm and the price of wood increases in the market, likely the price of the farm will also increase and make your project not viable. So, after your lectures at RUC you think about fixing the farm price through asking the present owner to sell to you a European option where the strike price is fixed to DKK 20 million with maturity of 3 years. For your calculations, suppose the risk-free rate of the economy is 1% per year and that the returns of prices of farms in Sweden present a historical standard deviation of 10%. Moreover, ignore transactions costs and taxes in your calculations. a) In this case, what kind of option are you willing to buy from the farmer, a put or a call option? Besides, what is the maximum profit you could make with this option operation? Explain with your own words. (max 5 points) b) Using the Black and Sholes model, calculate the maximum you would be willing to pay for this option. (max 10 points) c) The owner of the farm accepts your offer and sells this option to you. At the end of the 3 years, you realize that the farm price equals DKK 15 million. How much did you earn with this operation? Explain with your own words. ( max5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started