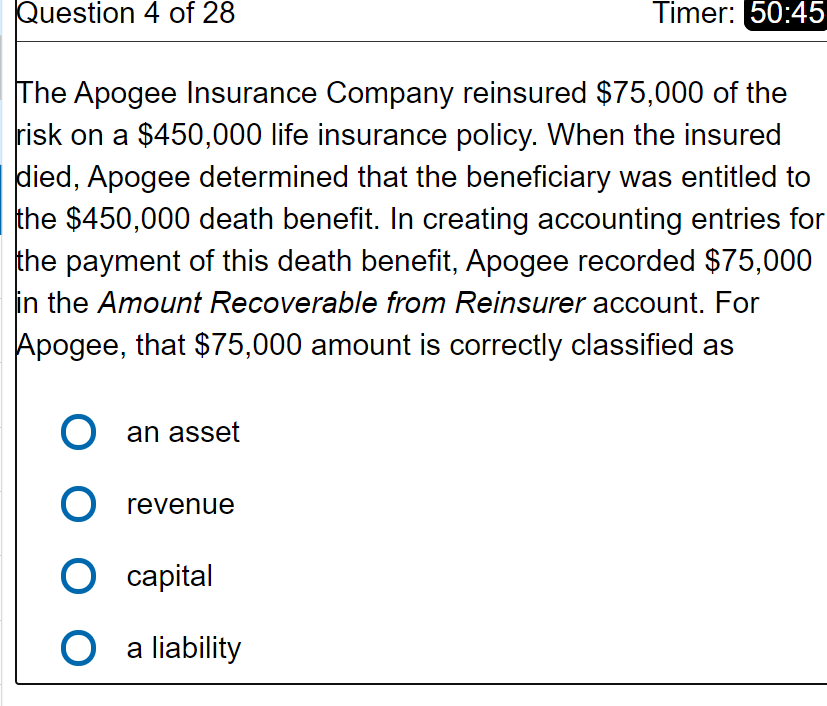

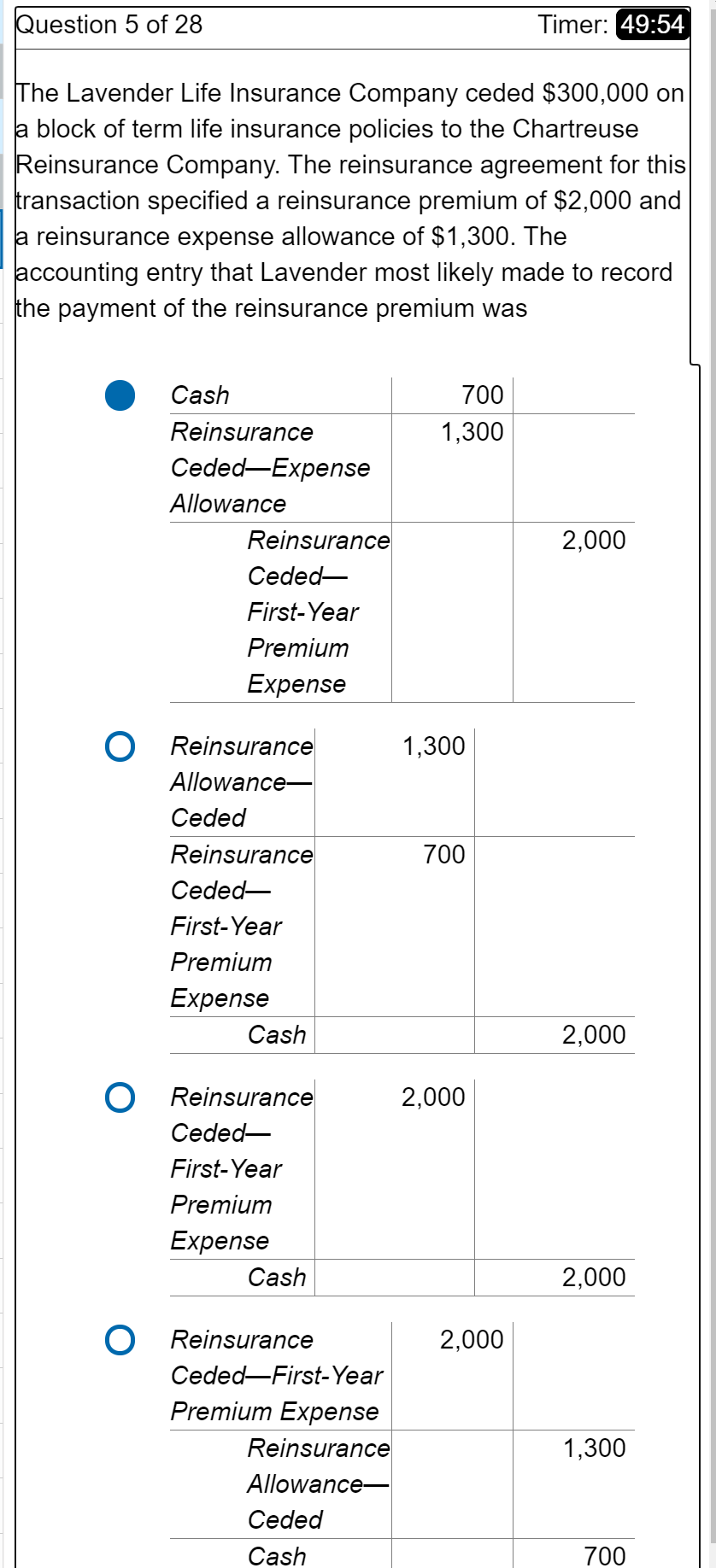

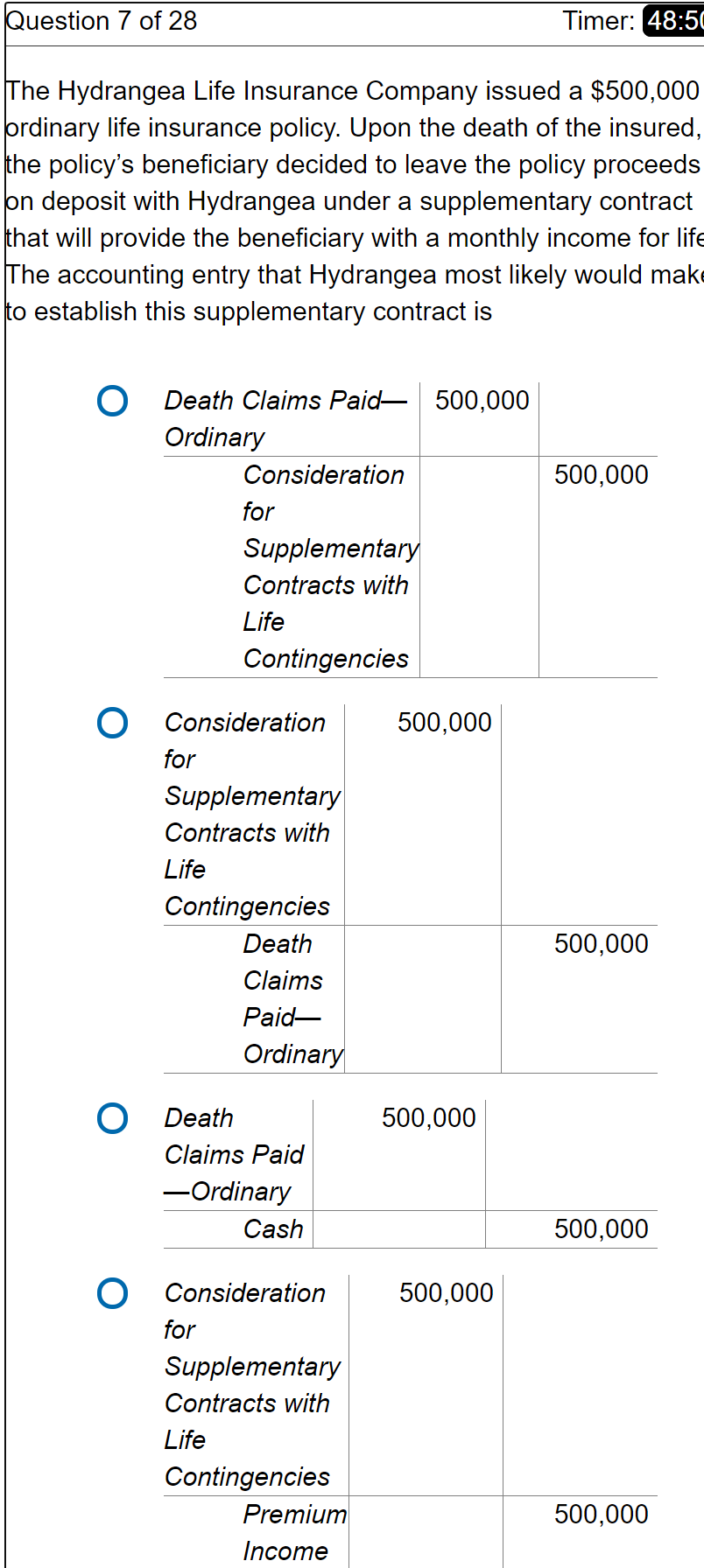

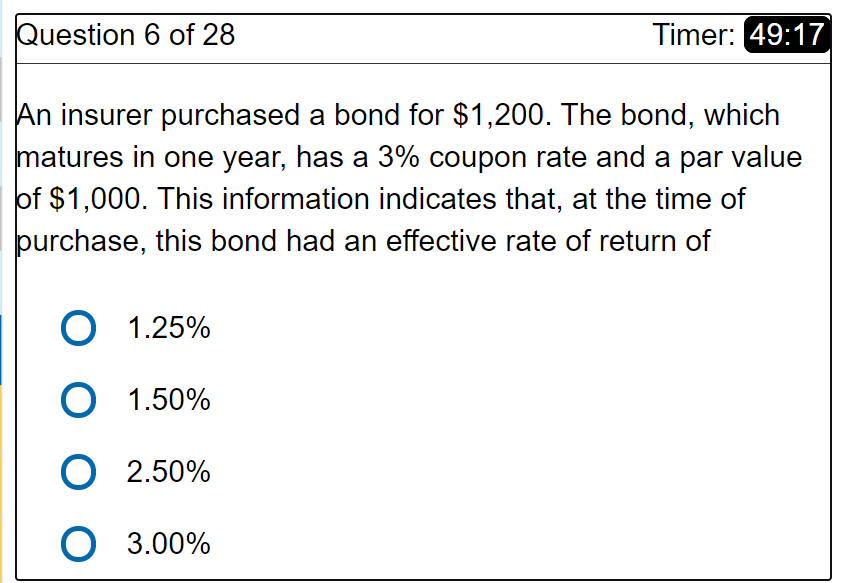

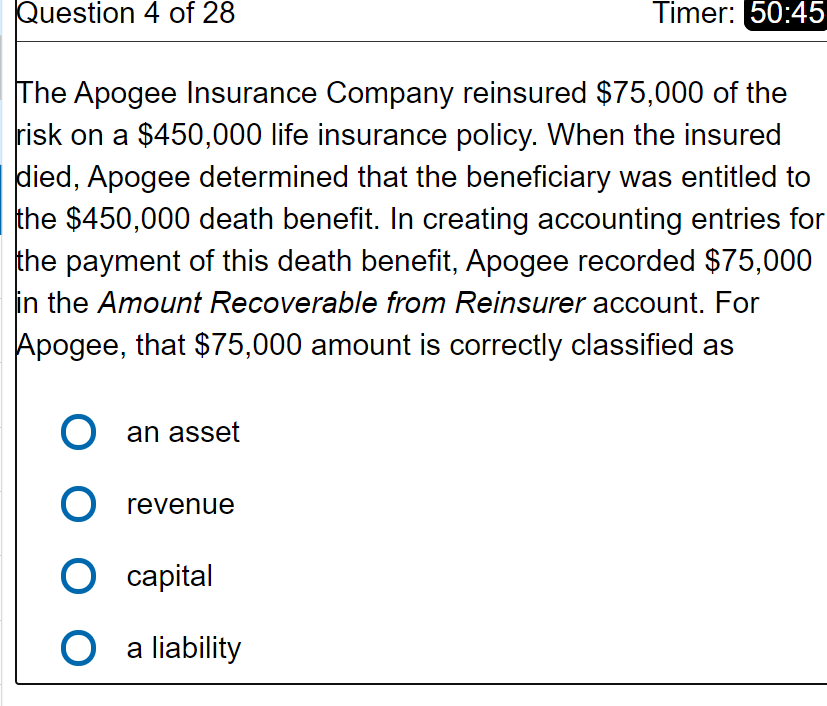

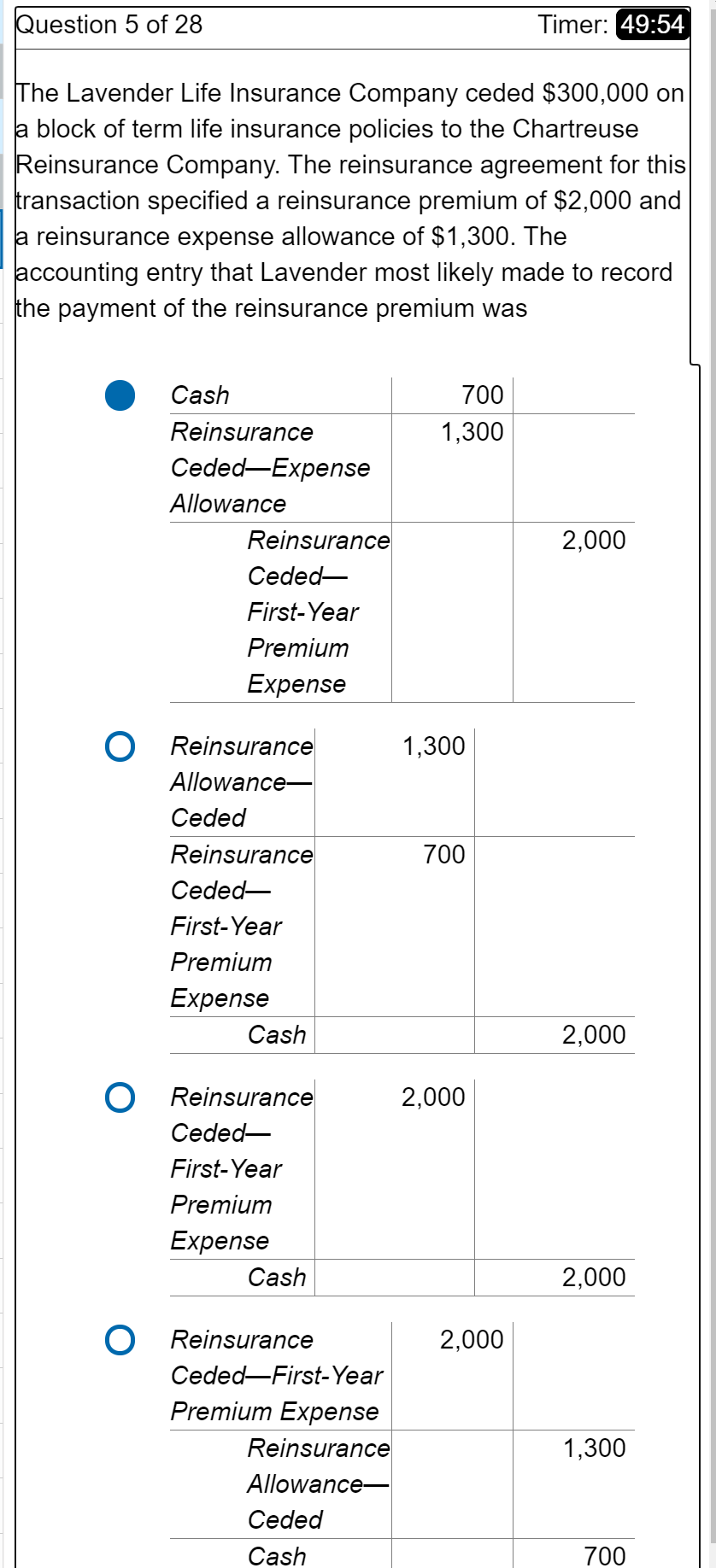

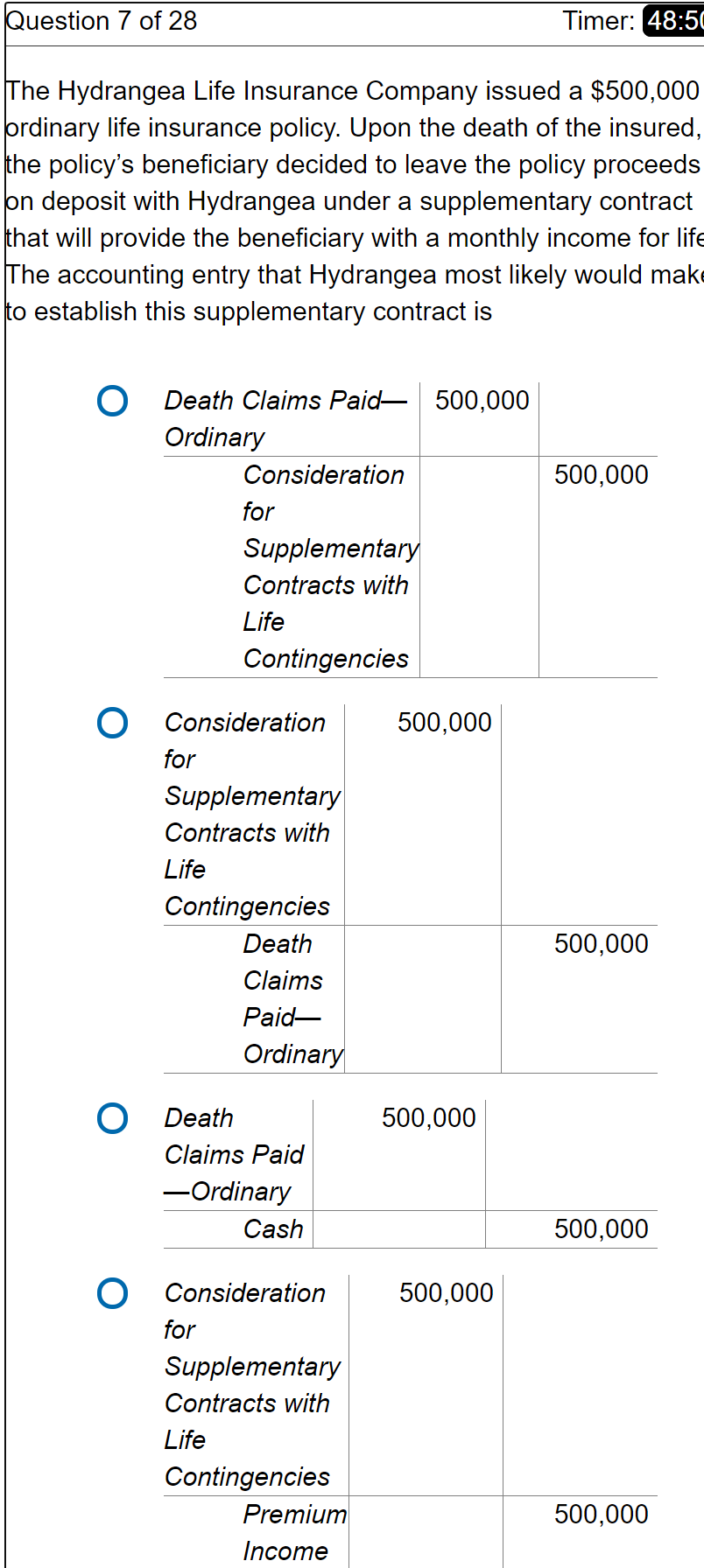

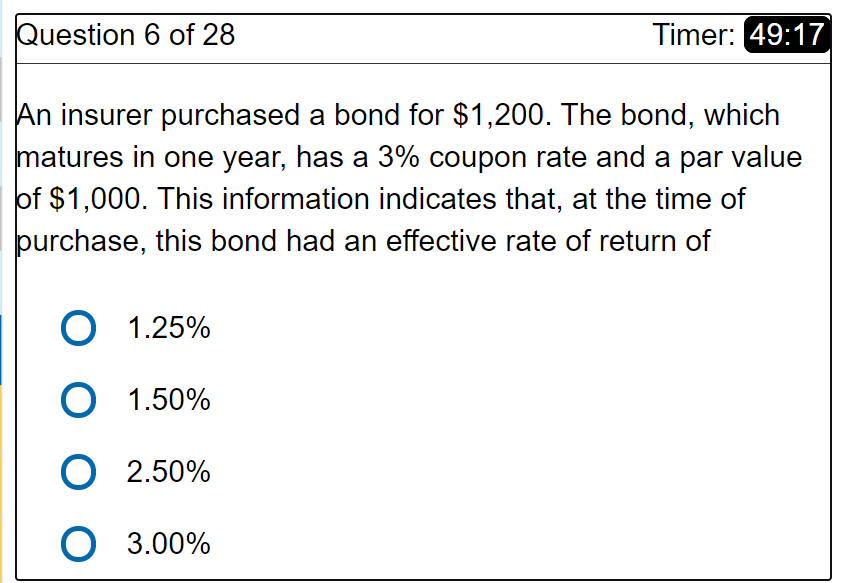

Question 4 of 28 Timer: 50:45 The Apogee Insurance Company reinsured $75,000 of the risk on a $450,000 life insurance policy. When the insured died, Apogee determined that the beneficiary was entitled to the $450,000 death benefit. In creating accounting entries for the payment of this death benefit, Apogee recorded $75,000 in the Amount Recoverable from Reinsurer account. For Apogee, that $75,000 amount is correctly classified as O an asset revenue O capital O a liability Question 5 of 28 Timer: 49:54 The Lavender Life Insurance Company ceded $300,000 on a block of term life insurance policies to the Chartreuse Reinsurance Company. The reinsurance agreement for this transaction specified a reinsurance premium of $2,000 and a reinsurance expense allowance of $1,300. The accounting entry that Lavender most likely made to record the payment of the reinsurance premium was 700 1,300 Cash Reinsurance Ceded-Expense Allowance Reinsurance Ceded- First-Year Premium Expense 2,000 1,300 700 O Reinsurance Allowance- Ceded Reinsurance Ceded- First-Year Premium Expense Cash 2,000 2,000 O Reinsurance Ceded- First-Year Premium Expense Cash 2,000 2,000 O Reinsurance Ceded-First-Year Premium Expense Reinsurance Allowance- Ceded Cash 1,300 700 Question 7 of 28 Timer: 48:51 The Hydrangea Life Insurance Company issued a $500,000 ordinary life insurance policy. Upon the death of the insured, the policy's beneficiary decided to leave the policy proceeds pn deposit with Hydrangea under a supplementary contract that will provide the beneficiary with a monthly income for life The accounting entry that Hydrangea most likely would make to establish this supplementary contract is 500,000 Death Claims Paid- 500,000 Ordinary Consideration for Supplementary Contracts with Life Contingencies O 500,000 Consideration for Supplementary Contracts with Life Contingencies Death Claims Paid- Ordinary 500,000 500,000 O Death Claims Paid - Ordinary Cash 500,000 500,000 O Consideration for Supplementary Contracts with Life Contingencies Premium Income 500,000 Question 6 of 28 Timer: 49:17 An insurer purchased a bond for $1,200. The bond, which matures in one year, has a 3% coupon rate and a par value bf $1,000. This information indicates that, at the time of purchase, this bond had an effective rate of return of O 1.25% O 1.50% O 2.50% O 3.00%