Answered step by step

Verified Expert Solution

Question

1 Approved Answer

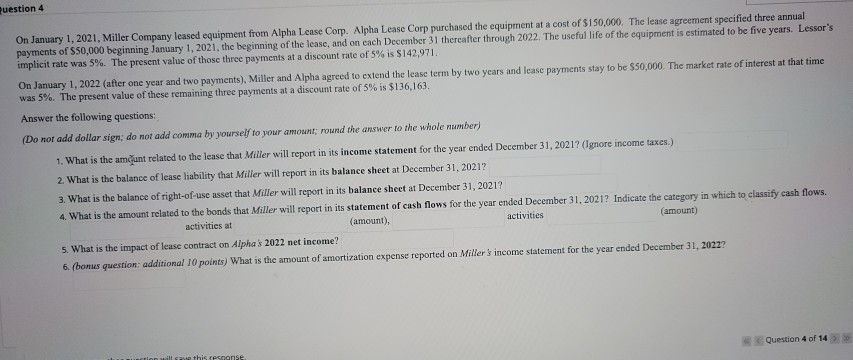

Question 4 On January 1, 2021, Miller Company leased equipment from Alpha Lease Corp. Alpha Lease Corp purchased the equipment at a cost of $150,000.

Question 4 On January 1, 2021, Miller Company leased equipment from Alpha Lease Corp. Alpha Lease Corp purchased the equipment at a cost of $150,000. The lease agreement specified three annual payments of $50,000 beginning January 1, 2021, the beginning of the lease, and on each December 31 thereafter through 2022. The useful life of the equipment is estimated to be five years. Lessor's implicit rate was 5%. The present value of those three payments at a discount rate of 5% is $142,971. On January 1, 2022 (after one year and two payments), Miller and Alpha agreed to extend the lease term by two years and lease payments stay to be $50,000. The market rate of interest at that time was 5%. The present value of these remaining three payments at a discount rate of 5% is $136,163. Answer the following questions: (Do not add dollar sign, do not add comma by yourself to your amount; round the answer to the whole number) 1. What is the amunt related to the lease that Miller will report in its income statement for the year ended December 31, 2021? (Ignore income taxes.) 2. What is the balance of lease liability that Miller will report in its balance sheet at December 31, 2021? 3. What is the balance of right-of-use asset that Miller will report in its balance sheet at December 31, 2021? 4. What is the amount related to the bonds that Miller will report in its statement of cash flows for the year ended December 31, 2021? Indicate the category in which to classify cash flows. activities at (amount), activities (amount) 5. What is the impact of lease contract on Alpha 2022 net income? 6. (bonus question: additional 10 points) What is the amount of amortization expense reported on Miller's income statement for the year ended December 31, 2022? Question 4 of 14 this recognise Question 4 On January 1, 2021, Miller Company leased equipment from Alpha Lease Corp. Alpha Lease Corp purchased the equipment at a cost of $150,000. The lease agreement specified three annual payments of $50,000 beginning January 1, 2021, the beginning of the lease, and on each December 31 thereafter through 2022. The useful life of the equipment is estimated to be five years. Lessor's implicit rate was 5%. The present value of those three payments at a discount rate of 5% is $142,971. On January 1, 2022 (after one year and two payments), Miller and Alpha agreed to extend the lease term by two years and lease payments stay to be $50,000. The market rate of interest at that time was 5%. The present value of these remaining three payments at a discount rate of 5% is $136,163. Answer the following questions: (Do not add dollar sign, do not add comma by yourself to your amount; round the answer to the whole number) 1. What is the amunt related to the lease that Miller will report in its income statement for the year ended December 31, 2021? (Ignore income taxes.) 2. What is the balance of lease liability that Miller will report in its balance sheet at December 31, 2021? 3. What is the balance of right-of-use asset that Miller will report in its balance sheet at December 31, 2021? 4. What is the amount related to the bonds that Miller will report in its statement of cash flows for the year ended December 31, 2021? Indicate the category in which to classify cash flows. activities at (amount), activities (amount) 5. What is the impact of lease contract on Alpha 2022 net income? 6. (bonus question: additional 10 points) What is the amount of amortization expense reported on Miller's income statement for the year ended December 31, 2022? Question 4 of 14 this recognise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started