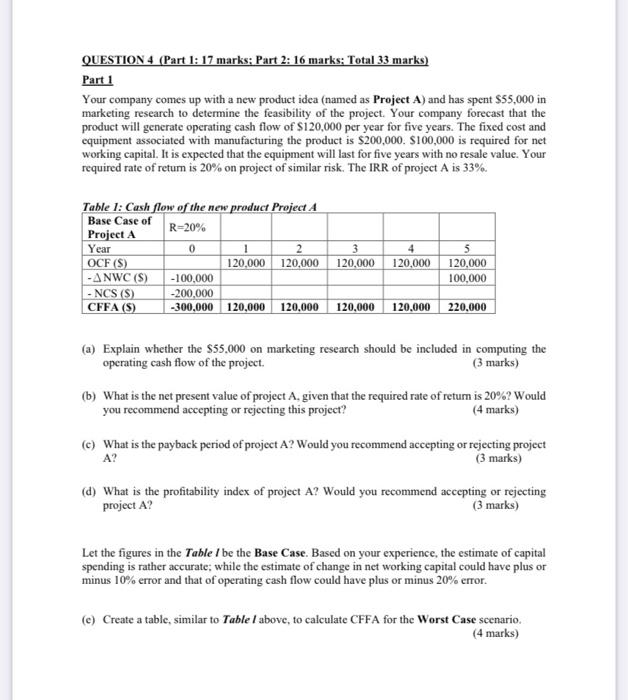

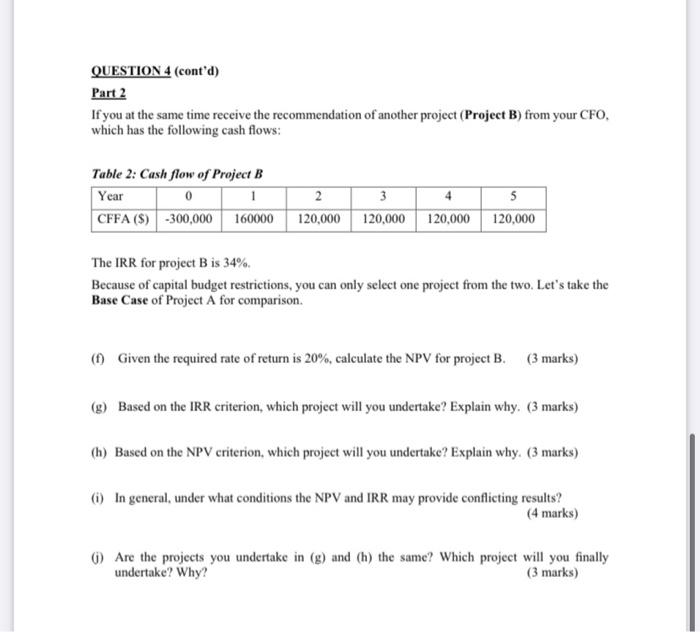

QUESTION 4 (Part 1: 17 marks: Part 2: 16 marks: Total 33 marks) Part 1 Your company comes up with a new product idea (named as Project A) and has spent $55,000 in marketing research to determine the feasibility of the project. Your company forecast that the product will generate operating cash flow of $120,000 per year for five years. The fixed cost and equipment associated with manufacturing the product is $200,000 $100,000 is required for net working capital. It is expected that the equipment will last for five years with no resale value. Your required rate of return is 20% on project of similar risk. The IRR of project A is 33%. Table 1: Cash flow of the new product Project A Base Case of R-20% Project A Year 0 1 2 3 4 5 OCF (S) 120,000 120,000 120,000 120,000 120,000 -ANWC (S) -100,000 100,000 - NCS () -200,000 CFFA (S) -300,000 120,000 120.000 120,000 120.000 220.000 (a) Explain whether the $55.000 on marketing research should be included in computing the operating cash flow of the project. (3 marks) (b) What is the net present value of project A. given that the required rate of retum is 20%? Would you recommend accepting or rejecting this project? (4 marks) (e) What is the payback period of project A? Would you recommend accepting or rejecting project (3 marks) A? (d) What is the profitability index of project A? Would you recommend accepting or rejecting project A? (3 marks) Let the figures in the Table I be the Base Case. Based on your experience, the estimate of capital spending is rather accurate; while the estimate of change in net working capital could have plus or minus 10% error and that of operating cash flow could have plus or minus 20% error. (e) Create a table, similar to Table I above, to calculate CFFA for the Worst Case scenario. (4 marks) QUESTION 4 (cont'd) Part 2 If you at the same time receive the recommendation of another project (Project B) from your CFO. which has the following cash flows: Table 2: Cash flow of Project B Year 0 1 CFFA ($) - 300,000 160000 2 120,000 3 120,000 5 120,000 120,000 The IRR for project Bis 34%. Because of capital budget restrictions, you can only select one project from the two. Let's take the Base Case of Project A for comparison (1) Given the required rate of return is 20%, calculate the NPV for project B. (3 marks) (g) Based on the IRR criterion, which project will you undertake? Explain why. (3 marks) (h) Based on the NPV criterion, which project will you undertake? Explain why. (3 marks) 6) In general, under what conditions the NPV and IRR may provide conflicting results? (4 marks) (1) Are the projects you undertake in (g) and (h) the same? Which project will you finally undertake? Why