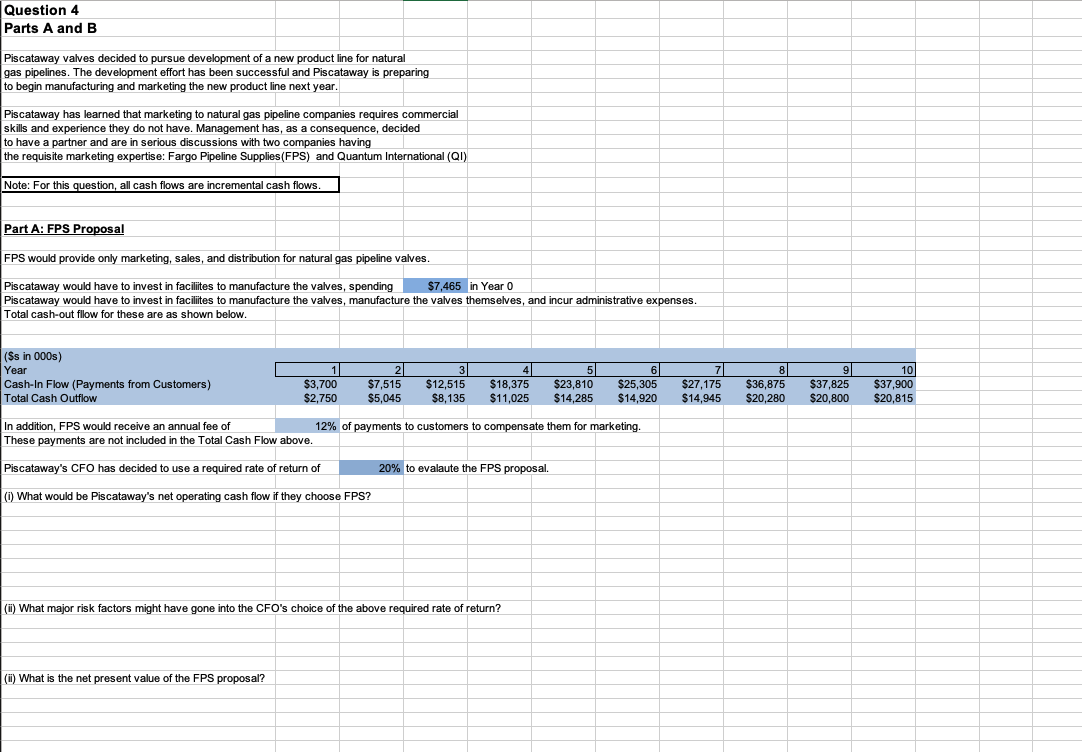

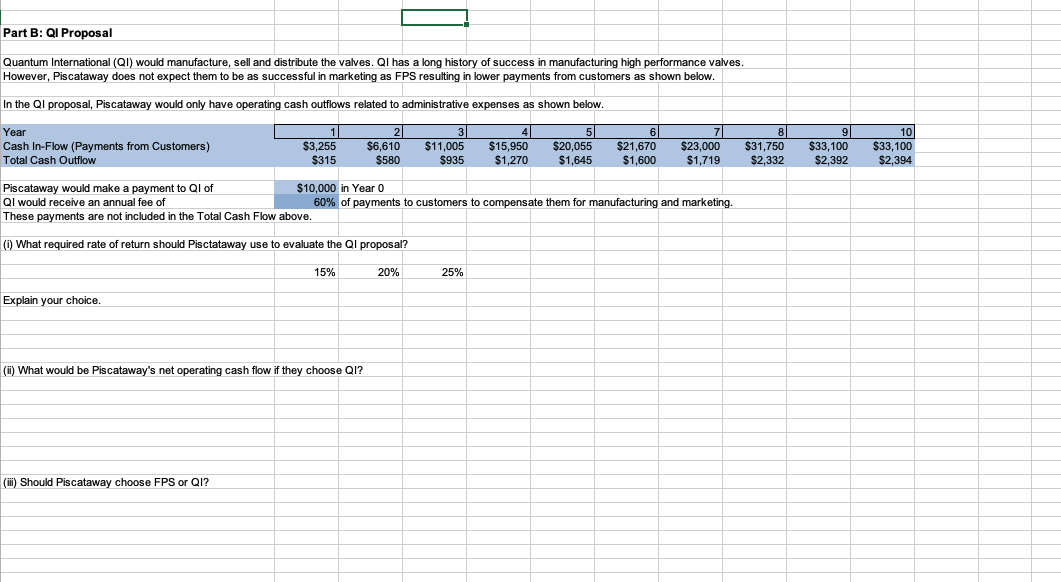

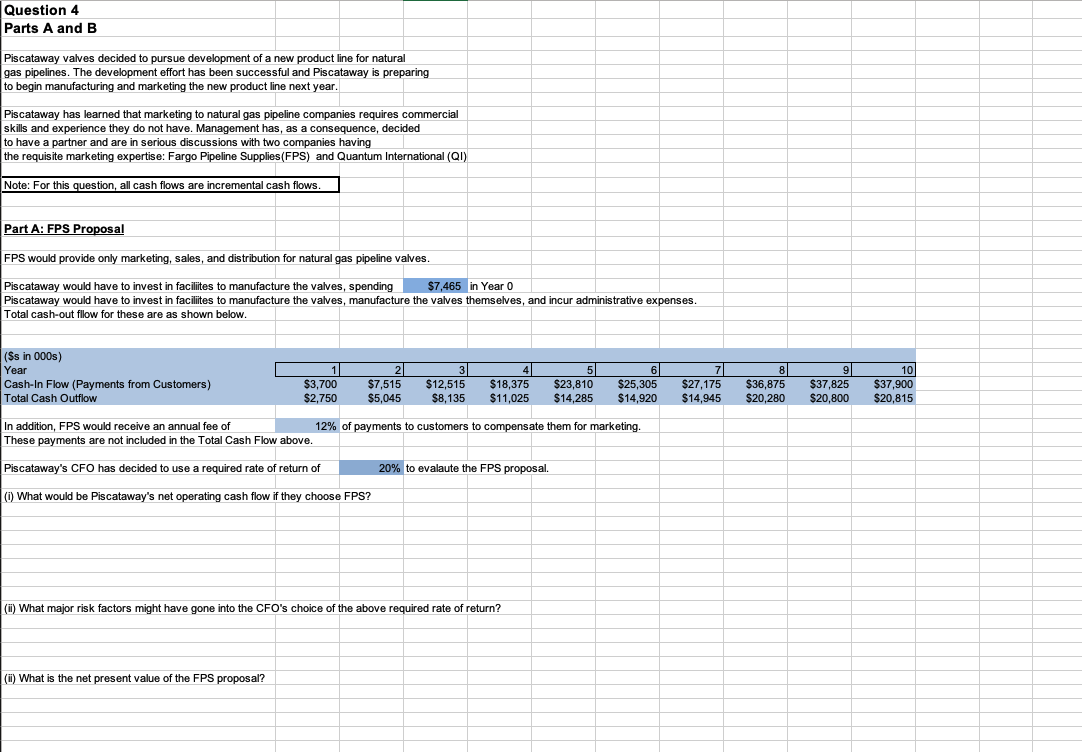

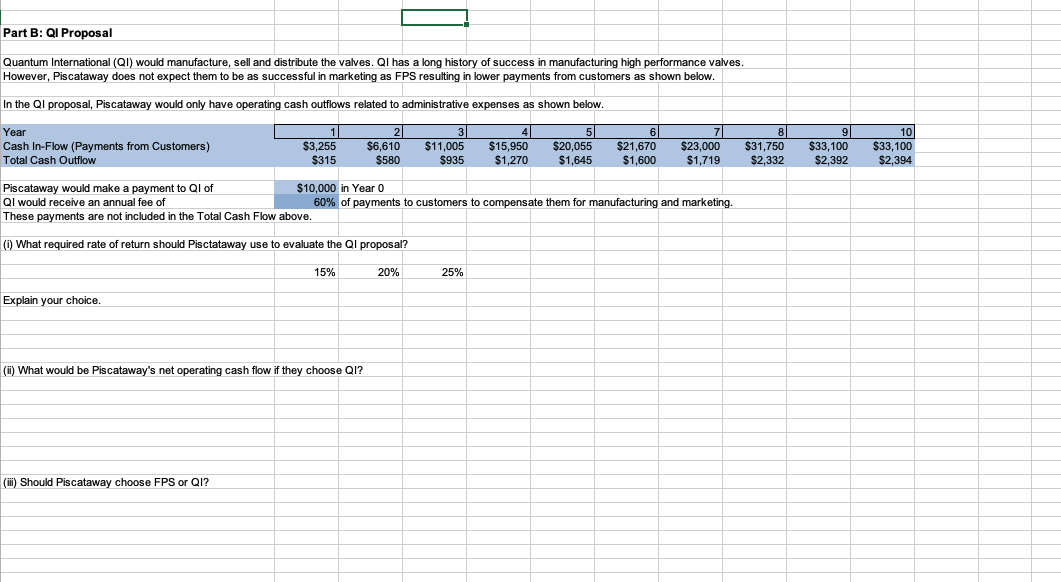

Question 4 Parts A and B Piscataway valves decided to pursue development of a new product line for natural gas pipelines. The development effort has been successful and Piscataway is preparing to begin manufacturing and marketing the new product line next year. Piscataway has learned that marketing to natural gas pipeline companies requires commercial skills and experience they do not have. Management has, as a consequence, decided to have a partner and are in serious discussions with two companies having the requisite marketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) Note: For this question, all cash flows are incremental cash flows. Part A: FPS Proposal FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. Piscataway would have to invest in faciliites to manufacture the valves, spending $7,465 in Year 0 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative expenses. Total cash-out fllow for these are as shown below. (\$s in 000s) Year \begin{tabular}{|r|r|r|rrrrrr|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\ \hline$3,700 & $7,515 & $12,515 & $18,375 & $23,810 & $25,305 & $27,175 & $36,875 & $37,825 & $37,900 \\ $2,750 & $5,045 & $8,135 & $11,025 & $14,285 & $14,920 & $14,945 & $20,280 & $20,800 & $20,815 \\ \hline \end{tabular} In addition, FPS would receive an annual fee of 12% of payments to customers to compensate them for marketing. These payments are not included in the Total Cash Flow above. Piscataway's CFO has decided to use a required rate of return of 20% to evalaute the FPS proposal. (i) What would be Piscataway's net operating cash flow if they choose FPS? (ii) What major risk factors might have gone into the CFO's choice of the above required rate of return? (ii) What is the net present value of the FPS proposal? Part B: QI Proposal Quantum International (QI) would manufacture, sell and distribute the valves. QI has a long history of success in manufacturing high performance valves. However, Piscataway does not expect them to be as successful in marketing as FPS resulting in lower payments from customers as shown below. In the QI proposal, Piscataway would only have operating cash outflows related to administrative expenses as shown below. Year Cash In-Flow (Payments from Customers) Total Cash Outflow \begin{tabular}{l} Piscataway would make a payment to QI of \\ QI would receive an annual fee of \\ \hline These payments are not included in the Total Cash Flow above. \end{tabular} (i) What required rate of return should Pisctataway use to evaluate the QI proposal? Explain your choice. (ii) What would be Piscataway's net operating cash flow if they choose QI? (iii) Should Piscataway choose FPS or QI? Question 4 Parts A and B Piscataway valves decided to pursue development of a new product line for natural gas pipelines. The development effort has been successful and Piscataway is preparing to begin manufacturing and marketing the new product line next year. Piscataway has learned that marketing to natural gas pipeline companies requires commercial skills and experience they do not have. Management has, as a consequence, decided to have a partner and are in serious discussions with two companies having the requisite marketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) Note: For this question, all cash flows are incremental cash flows. Part A: FPS Proposal FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. Piscataway would have to invest in faciliites to manufacture the valves, spending $7,465 in Year 0 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative expenses. Total cash-out fllow for these are as shown below. (\$s in 000s) Year \begin{tabular}{|r|r|r|rrrrrr|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\ \hline$3,700 & $7,515 & $12,515 & $18,375 & $23,810 & $25,305 & $27,175 & $36,875 & $37,825 & $37,900 \\ $2,750 & $5,045 & $8,135 & $11,025 & $14,285 & $14,920 & $14,945 & $20,280 & $20,800 & $20,815 \\ \hline \end{tabular} In addition, FPS would receive an annual fee of 12% of payments to customers to compensate them for marketing. These payments are not included in the Total Cash Flow above. Piscataway's CFO has decided to use a required rate of return of 20% to evalaute the FPS proposal. (i) What would be Piscataway's net operating cash flow if they choose FPS? (ii) What major risk factors might have gone into the CFO's choice of the above required rate of return? (ii) What is the net present value of the FPS proposal? Part B: QI Proposal Quantum International (QI) would manufacture, sell and distribute the valves. QI has a long history of success in manufacturing high performance valves. However, Piscataway does not expect them to be as successful in marketing as FPS resulting in lower payments from customers as shown below. In the QI proposal, Piscataway would only have operating cash outflows related to administrative expenses as shown below. Year Cash In-Flow (Payments from Customers) Total Cash Outflow \begin{tabular}{l} Piscataway would make a payment to QI of \\ QI would receive an annual fee of \\ \hline These payments are not included in the Total Cash Flow above. \end{tabular} (i) What required rate of return should Pisctataway use to evaluate the QI proposal? Explain your choice. (ii) What would be Piscataway's net operating cash flow if they choose QI? (iii) Should Piscataway choose FPS or QI