Question

QUESTION 4 Plateau Pharmaceuticals Limited (Plateau), is a Namibian public listed company in the Health sector. Plateau, manufactures medical drugs for sale to various pharmacies

QUESTION 4

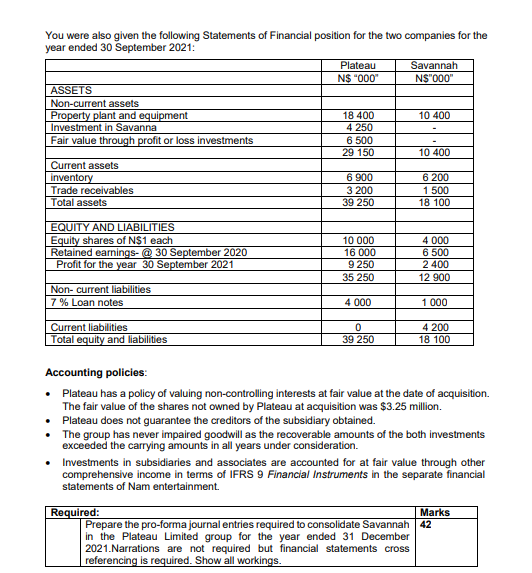

Plateau Pharmaceuticals Limited (Plateau), is a Namibian public listed company in the Health sector. Plateau, manufactures medical drugs for sale to various pharmacies (retail outlets) and to medical institutions. Plateau decided to expand its operations in the health sector in Namibia and the existence of free cash flows at the end of September 2020 encouraged the decision. After a comprehensive market research and financial analysis of the viability of various listed companies in the sector Plateau decided to invest in Savanna Medical Facilities Limited (Savannah). Savannah is a listed on the Namibian Stock Exchange which manufactures the raw material required to produce medical drugs. Plateau gained control of Savanna on 1 October 2020 when all control assessment conditions were satisfied in accordance with IFRS 10: Consolidated Financial Statements. You are an intern at Plateau and you were working closely with the Financial Accountant of the Group Mr Knowitall, who was suddenly attacked by the new Omicron BA12 variant of the corona virus. The Group Finance Director Mrs Nononsense knows you have been working with Mr. Knowitall hence gave you the following information for the group. On 1 October 2020 Plateau acquired 3 million equity shares in Savannah by an exchange of one share in Plateau for every two shares in Savannah plus N$1.25 per acquired Savannah share in cash. The market price of each Plateau share at the date of acquisition was N$6. Savannah also expects Plateau to pay an additional amount of N$1 000 000 at the end of 30 June 2025 as part of consideration transferred. Cost of capital for Plateau is 14% p.a. Only the cash consideration paid of the above investments has been recorded by Plateau. In addition, N$500,000 of professional costs relating to the acquisition of Savannah are also included in the cost of the investment. At the date of acquisition, the fair values of Savannahs assets were equal to their carrying amounts with the exception of Savannahs land which had a fair value of N$500,000 below its carrying amount; it was written down by this amount shortly after acquisition and has not changed in value since then. During the year ended 30 September 2021 Savannah sold goods to Plateau for N$2.7 million. Savannahs profit on sales on these goods is 33 1/3%. Plateau had a third of the goods still in its inventory at 30 September 2021. There were no intragroup payables/receivables at 30 September 2021. The fair value through profit or loss investments are included in Plateaus statement of financial position (above) at their fair value on 1 October 2020, but they have a fair value of N$9 million at 30 September 2021. Plateau sold an asset with a carrying amount of N$ 500 000 to Savanna on 1 May 2021 for an amount of N$600 000. On the date of sale, the assets remaining useful life was 4 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started